The global oleochemicals market, valued at USD 24.42 billion in 2023, is anticipated to grow at a CAGR of 7.0% from 2024 to 2030. This optimistic growth projection is driven by the increasing preference for biodegradable products and regulatory restrictions on petrochemical-based alternatives.

Oleochemicals are derived from fats and oils, sourced from plants, animals, or petrochemicals. Their production involves chemical or enzymatic reactions. A major market shift has occurred due to fluctuating crude oil prices, leading to the adoption of vegetable oils like palm and palm kernel oil as primary feedstocks. The market benefits from abundant raw material availability, low toxicity, and a green image, which are attractive to eco-conscious consumers.

The rising demand for personal care, pharmaceutical, and food products has further bolstered the market. Personal care products, in particular, are experiencing growth due to increased disposable incomes, innovative product launches, and marketing strategies like online promotions and sweepstakes in developed regions. Oleochemicals are commonly found in FMCG products such as soaps, toothpaste, and moisturizing lotions.

Gather more insights about the market drivers, restrains and growth of the Global Oleochemicals Market

Market Opportunities and Challenges

Opportunities

- Growing demand for sustainable products as consumers and industries shift to environmentally friendly alternatives.

- Use in natural and organic personal care products due to their gentle and eco-friendly properties, such as derivatives from coconut oil and palm oil in soaps, shampoos, and skincare items.

Challenges

- One of the industry's significant hurdles is the reliability of raw material suppliers and supply chain optimization. To address this, companies have adopted vertical integration:

- IOI Corp Bhd and Kuala Lumpur Kepong Bhd (KLK) have developed upstream integration (plantations in Indonesia and Malaysia) and downstream integration (refineries and oleochemical production facilities in Europe and China).

Oleochemicals Market Regional Insights:

North America

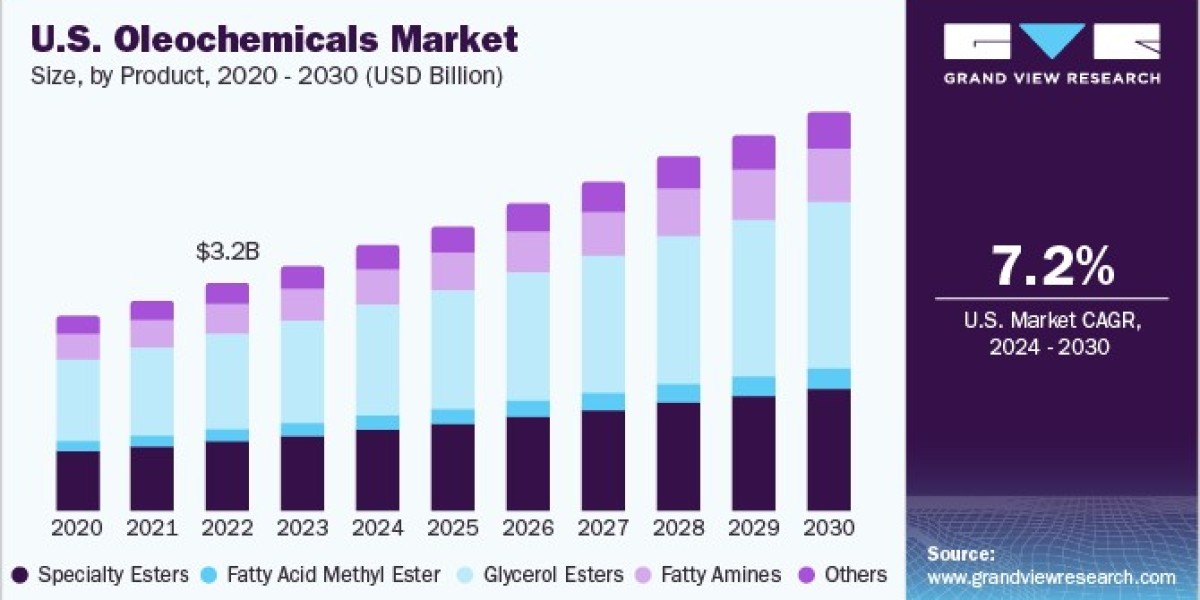

North America's oleochemicals market is driven by stringent environmental regulations on petroleum-based products. Demand is fueled by applications in personal care, healthcare, and food processing industries. In the U.S., the market benefits from:

- Growing demand for cosmetic and personal care products due to rising aesthetic awareness, particularly among women.

- Use of oleochemicals like alkoxylates, fatty amines, and glycerol esters in cosmetics formulation

Asia Pacific

In 2023, the Asia Pacific region accounted for 41.38% of global revenue. It leads in production and consumption due to:

- Abundant raw materials (e.g., palm oil) in Malaysia and Indonesia.

- Strong demand from China for specialty oleochemicals in household cleaners, cosmetics, and pharmaceuticals.

- Growing biodiesel demand in India and the use of oleochemical derivatives like fatty amines in agrochemical production.

Europe: The European market focuses on biodiesel as an alternative to petroleum diesel, driving demand for oleochemicals like glycerin and methyl ester sulfonate. However, economic challenges may hinder growth. Germany sees demand from the cleaning and cosmetics industries, with companies like Procter & Gamble relying on imported oleochemicals.

Central & South America: This market is growing due to concerns over petroleum reserve depletion, prompting industries to explore oleochemicals. Brazil leads due to its abundant palm oil resources and rising captive consumption.

Middle East & Africa: Market growth is spurred by industrialization in countries like Saudi Arabia and South Africa. Positive demographics, economic conditions, and increasing tourism promote oleochemicals demand in food, beverage, and pharmaceutical sectors.

Browse through Grand View Research's Renewable Chemicals Industry Research Reports.

- Caprylic Acid Market: The global caprylic acid market size was valued at USD 4.69 million in 2023 and is projected to grow at a CAGR of 10.4% from 2024 to 2030.

- 9-Decanoic Acid Methyl Ester Market: The global 9-decanoic acid methyl ester market size was valued at USD 204.2 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.0% from 2024 to 2030.

Key Oleochemicals Company Insights:

Some of the key players operating in the market include Vantage Specialty Chemicals, Inc., Emery Oleochemicals, Evonik Industries AG, Wilmar International Ltd., and Kao Chemicals, among others.

- Vantage Specialty Chemicals, Inc. is a specialty chemicals company that manufactures and distributes specialty derivatives, fatty acids, naturally derived specialty chemicals, and intermediates. The company is a vertically integrated provider and caters to four diverse markets, including personal care and beauty, food, life science and consumer care, and industrial specialties.

- Evonik Industries AG is a key player in the oleochemical sector, and it manufactures and distributes specialty chemicals globally. The company operates through five business units, which include Specialty Additives, Nutrition & Care, Smart Materials, Performance Materials, And Technology & Infrastructure.

- JNJ Oleochemicals, Incorporated. is engaged in the manufacturing and distribution of biodiesel and oleo chemical products worldwide. The products are mainly derived from coconut oil. The company’s product portfolio includes methyl ester derivatives and glycerin, and it is vertically integrated along its value chain. The company has its manufacturing plant in Lucena City, Philippines.

- Stepan Company manufactures and distributes intermediate chemicals including specialty products, surfactants, germicidal & fabric softening quaternaries, phthalic anhydride (P.A.), polyurethane polyols, and special ingredients for supplements, food, and pharmaceutical industries. The company provides a wide range of oleo chemical-based surfactants for the formulation of both home and industrial laundry detergents. It has 18 manufacturing units located in 11 countries in North America, South America, Europe, and Asia.

Key Oleochemicals Companies:

- Vantage Specialty Chemicals, Inc.

- Emery Oleochemicals

- Evonik Industries AG

- Wilmar International Ltd.

- Kao Chemicals Global

- Ecogreen Oleochemicals

- Corbion N.V

- Cargill, Incorporated

- Oleon NV

- Godrej Industries

- IOI Corporation Berhad

- KLK OLEO

- Evyap

- JNJ Oleochemicals, Incorporated

- Sakamoto Yakuhin Kogyo Co., Ltd.

- Stepan Company

- Pepmaco Manufacturing Corporation

- Philippine International Dev.

Order a free sample PDF of the Oleochemicals Market Intelligence Study, published by Grand View Research.