Many businesses still treat attendance and payroll as separate processes. This disconnect leads to salary errors, payroll disputes, compliance risks, and employee dissatisfaction. In reality, attendance data is the backbone of accurate payroll, especially for growing businesses, remote teams, and multi-location organizations.

This article explains what attendance data is, why it matters for payroll accuracy, how poor attendance tracking hurts businesses, and how integrated attendance and payroll systems solve these challenges.

What Is Attendance Data in Payroll Management?

Attendance data refers to recorded information about employee work hours, including:

- Punch-in and punch-out times

- Total working hours

- Overtime and late arrivals

- Absences and leave records

- Shift-based attendance

In modern businesses, attendance data feeds directly into payroll management systems, ensuring salaries are calculated fairly and accurately.

Without reliable attendance data, payroll becomes guesswork.

Why Attendance Data Is Critical for Accurate Payroll

Payroll accuracy depends on knowing who worked, when they worked, and for how long.

Key Reasons Attendance Data Matters

- Salary calculations are based on actual hours worked

- Overtime and deductions depend on attendance records

- Leave impacts monthly payroll amounts

- Compliance requires verifiable work-hour data

When attendance data is incomplete or inaccurate, payroll errors are unavoidable.

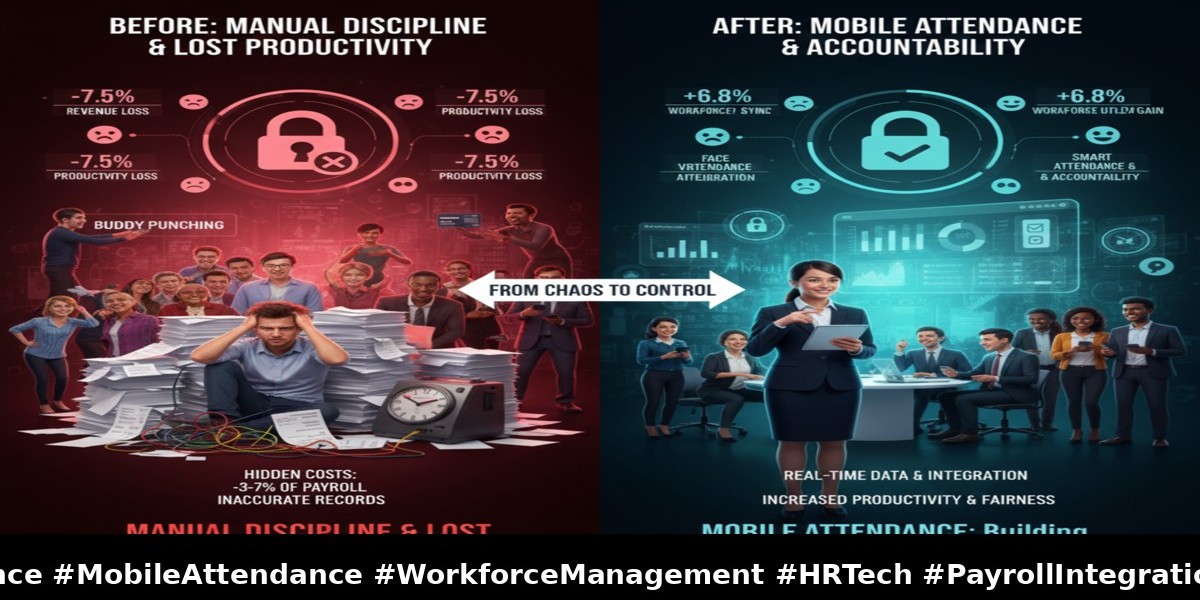

The Problem with Manual Attendance Tracking

Many organizations still rely on outdated attendance methods such as registers, spreadsheets, or unverified punch systems.

Limitations of Manual Attendance Systems

- Human errors in data entry

- Proxy attendance and buddy punching

- Delayed updates to payroll teams

- No real-time visibility

- Difficult audit trails

These issues directly impact payroll accuracy and increase the risk of disputes.

How Inaccurate Attendance Data Affects Payroll

Poor attendance data creates a chain reaction across payroll operations.

Common Payroll Issues Caused by Bad Attendance Data

- Overpayment or underpayment of salaries

- Incorrect overtime calculations

- Wrong leave deductions

- Employee complaints and mistrust

- Compliance penalties during audits

Once employees lose confidence in payroll, trust in management erodes quickly.

Attendance and Payroll: A Direct Relationship

Attendance and payroll are not separate HR functions—they are deeply connected.

How Attendance Drives Payroll Calculations

Attendance data determines:

- Payable working days

- Hourly wage calculations

- Overtime eligibility

- Leave-based deductions

- Shift allowances

If attendance data is wrong, payroll output will be wrong—no matter how advanced the payroll software is.

Why Real-Time Attendance Data Improves Payroll Accuracy

Modern businesses are moving toward real-time attendance tracking using digital systems.

Benefits of Real-Time Attendance for Payroll

- Instant data syncing with payroll systems

- Reduced dependency on manual reconciliation

- Faster payroll processing cycles

- Higher accuracy in salary computation

Real-time attendance eliminates last-minute surprises during payroll runs.

The Role of Automated Attendance Systems

Automated attendance systems use technology such as:

- Selfie-based attendance

- Geo-location attendance

- Mobile attendance apps

- Shift-based tracking

These systems ensure attendance data is verified, consistent, and tamper-proof.

Why Automation Matters

- Removes human bias

- Prevents proxy attendance

- Creates reliable payroll inputs

- Saves HR time

Automation turns attendance from a weak link into a payroll strength.

Integrated Attendance and Payroll Systems: The Smart Approach

The most effective payroll setups integrate attendance tracking directly into payroll software.

Advantages of Integration

- Attendance data flows automatically into payroll

- No duplicate data entry

- Fewer payroll errors

- Faster payroll processing

- Easy audit readiness

This integration creates a single source of truth for workforce data.

? Internal linking opportunity:

Link to Attendance & Payroll Management service page

Link to Staff Attendance App feature page

Attendance Data and Compliance Requirements

Compliance laws require accurate records of:

- Working hours

- Overtime

- Leave

- Salary calculations

During audits, attendance data acts as proof that payroll calculations are fair and legal.

Compliance Risks Without Accurate Attendance

- Incomplete audit trails

- Incorrect statutory deductions

- Legal disputes with employees

- Financial penalties

Reliable attendance data protects businesses from compliance risks.

Attendance Accuracy Builds Employee Trust

Employees closely watch payroll accuracy.

When attendance and payroll are aligned:

- Salaries are credited correctly

- Payslips are transparent

- Disputes reduce significantly

This builds long-term trust between employees and management.

Accurate payroll is not just a finance function—it’s an employee experience issue.

Cost Impact of Poor Attendance Data

Many businesses underestimate the cost of inaccurate attendance.

Hidden Costs Include:

- Payroll corrections and reprocessing

- HR time spent resolving disputes

- Employee disengagement

- Attrition due to mistrust

Investing in accurate attendance systems reduces these recurring costs.

Why Modern Businesses Rely on Attendance-Driven Payroll

With remote work, flexible shifts, and field teams, attendance tracking has become more complex.

Modern payroll systems rely on:

- Digital attendance capture

- Location-based verification

- Automated data syncing

Platforms like Waggex help businesses connect attendance and payroll seamlessly, ensuring accuracy without manual effort.

How to Improve Payroll Accuracy with Better Attendance Data

Practical Steps Businesses Can Take

- Replace manual attendance with digital systems

- Use real-time attendance tracking

- Integrate attendance with payroll software

- Automate leave and overtime calculations

- Educate employees on attendance transparency

These steps significantly improve payroll reliability.

Conclusion: Attendance Data Is the Foundation of Payroll Accuracy

Payroll accuracy starts long before salary calculation—it starts with attendance data.

When attendance is unreliable, payroll becomes error-prone. When attendance is accurate, payroll becomes predictable, fair, and compliant.

By adopting modern attendance systems and integrating them with payroll software, businesses can:

- Reduce payroll errors

- Improve employee trust

- Ensure compliance

- Save time and operational costs

Attendance data is not just a record—it’s the foundation of accurate payroll.

? Want error-free payroll?

Start by fixing attendance accuracy with a modern attendance and payroll system.

FAQs – Attendance Data and Payroll Accuracy

1. Why is attendance data important for payroll?

Attendance data determines working hours, overtime, leave deductions, and final salary calculations.

2. Can payroll be accurate without automated attendance?

It’s difficult. Manual attendance increases the risk of errors and disputes.

3. How does real-time attendance improve payroll?

It syncs accurate work-hour data instantly with payroll systems, reducing manual corrections.

4. What attendance system is best for accurate payroll?

Digital systems like selfie-based or geo-location attendance provide verified and reliable data.

5. Does attendance integration reduce payroll disputes?

Yes. Transparent attendance records significantly reduce salary-related conflicts.