Choosing the right life insurance is one of the most important financial decisions you can make for yourself and your loved ones. While many people understand the value of life insurance, the cost often becomes a major concern. That’s where the cheapest whole life insurance comes in — offering affordable lifelong protection without compromising on peace of mind.

In this comprehensive guide, we’ll explore what whole life insurance is, how it works, why affordability matters, and how you can find cost-effective options to secure financial protection for life. We’ll also highlight how to compare policies and avoid common pitfalls that could increase your premiums unnecessarily.

Understanding Whole Life Insurance

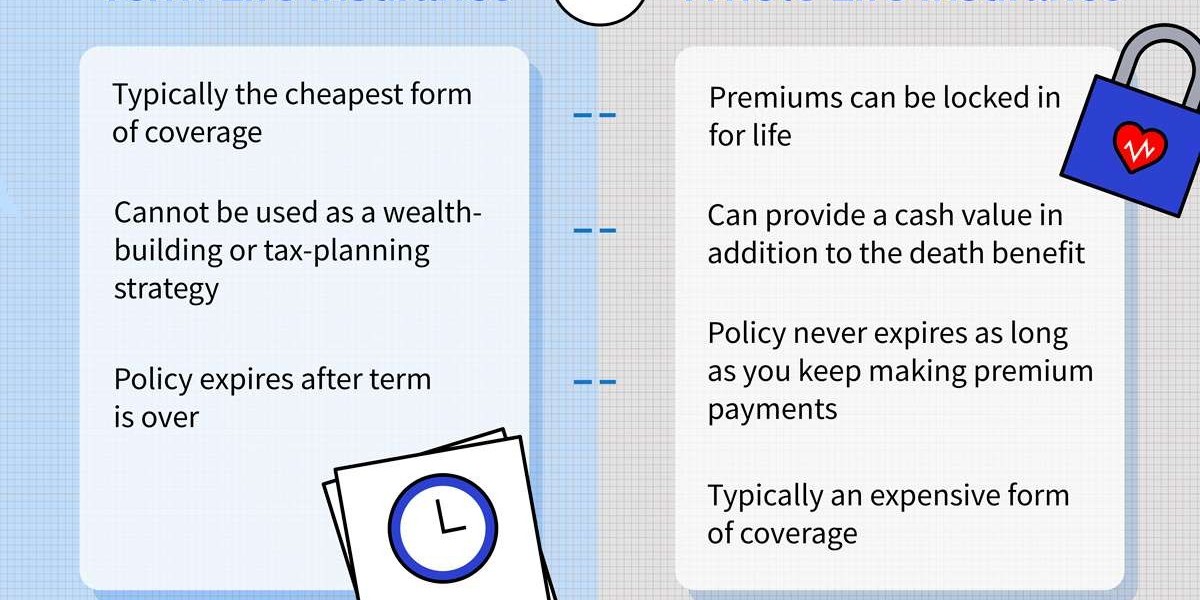

Whole life insurance is a permanent life insurance policy that stays in effect for your entire life as long as premiums are paid. Unlike term life insurance, which covers you for a specific number of years, whole life insurance guarantees a death benefit payout no matter when you pass away. In addition to lifelong coverage, whole life policies also build cash value over time, which you can borrow against or use in retirement.

However, this lifelong protection often comes with higher premiums than term policies. That’s why seeking affordable whole life insurance is crucial for people who want permanent coverage without overextending their budget.

If you’re interested in comparing affordable options, you can find helpful insights into the cheapest whole life insurance available and what to consider before choosing a plan.

Why Affordable Coverage Matters

Life is full of financial commitments — from daily living expenses to long-term goals like buying a home and funding education. Adding life insurance into the mix can feel overwhelming, especially if you’re trying to stick to a budget.

Here’s why finding affordable whole life insurance is vital:

Budget-friendly premiums make it easier to maintain coverage long term

Peace of mind knowing your family is protected without financial strain

Guaranteed coverage regardless of how long you live

Cash value accumulation that adds financial flexibility

Protection against rising life insurance costs in the future

Affordable whole life insurance allows you to secure protection without sacrificing other financial priorities. From young adults planning ahead to retirees seeking to cover final expenses, budget-friendly policies can serve various life stages.

Factors That Affect Whole Life Insurance Costs

Before diving into the cheapest whole life insurance options, it’s important to understand what affects your premiums. These key factors influence how much you’ll pay:

Age

Your age at the time you purchase a policy plays a major role in determining your premium. Younger applicants generally qualify for lower rates.

Health

Insurance companies assess your health history and may require a medical exam. Better health usually leads to lower premiums.

Gender

Statistically, women tend to pay slightly less for life insurance because they often live longer than men.

Lifestyle

Tobacco use, risky activities, and dangerous hobbies can increase premiums due to higher risk.

Coverage Amount

The amount of coverage you choose will directly impact your cost. Larger death benefits usually mean higher premiums.

By understanding these factors, you can take steps to improve your insurability and find policies that fit your budget.

How to Find the Cheapest Whole Life Insurance

Finding affordable whole life insurance doesn’t have to be complicated. With a strategic approach and a clear understanding of your needs, you can uncover policies that offer lifelong protection without breaking the bank.

Here are practical tips to help you find the best rates:

1. Compare Quotes from Multiple Insurers

Insurance companies use different rating systems, so premiums can vary widely. Obtaining multiple quotes allows you to compare and leverage options.

2. Consider Simplified Issue or Guaranteed Issue Policies

If traditional underwriting seems daunting or expensive, consider simplified issue or guaranteed issue policies. These often require no medical exam, though they may have higher premiums or graded benefits.

3. Work with an Independent Agent

Independent agents can provide unbiased advice and access to multiple carriers, helping you find the best value.

4. Buy Early

As mentioned earlier, age matters. Buying a policy earlier in life can lock in lower rates, potentially saving you thousands over time.

5. Review Your Health and Lifestyle

Addressing modifiable risks like quitting smoking or managing weight can improve your health profile and reduce premiums.

By applying these strategies, you can uncover some of the most competitive and cheapest whole life insurance policies available.

To learn about specific affordable options and what features you should consider when choosing coverage, check out detailed information on cheap whole life insurance.

Benefits of Whole Life Insurance Beyond Cost

While finding a low premium is important, it’s equally crucial to understand the additional benefits that whole life insurance offers:

Guaranteed Death Benefit

No matter when you pass away, your beneficiaries will receive the death benefit as long as the policy is active.

Cash Value Growth

Whole life policies accumulate cash value over time, which grows on a tax-deferred basis. You may borrow against this value or use it for emergencies.

Fixed Premiums

Unlike some other types of coverage, whole life premiums generally remain level throughout the policy’s life.

Financial Security

Whole life insurance provides long-term financial planning tools that can help with estate planning, retirement funding, or long-term goals.

These advantages make it worth considering whole life insurance as part of a comprehensive financial plan — especially when you secure the cheapest whole life insurance that meets your needs.

Common Misconceptions About Whole Life Insurance Costs

Many people have misconceptions about whole life insurance pricing. Let’s clear up a few:

Whole Life Is Too Expensive for Most People

While whole life insurance can be costlier than term insurance, affordable options do exist. With proper research and strategic planning, you can find coverage that fits your budget.

You Don’t Need a Medical Exam

Some policies require a health exam, but others offer no-exam options. While these might have different pricing structures, they still provide valuable coverage.

All Policies Are the Same

Not all policies are created equal. Riders, cash value performance, and company financial strength can vary — which is why comparing policies matters.

Keeping these realities in mind helps you make informed decisions that align with your financial goals.

What to Avoid When Shopping for Cheap Whole Life Insurance

While saving money is a priority, be cautious of the following:

Choosing based solely on price without evaluating value

Not reading policy details carefully

Ignoring company reputation and financial strength

Rushing the decision under pressure

A low premium is attractive, but the policy must still provide the protection and benefits you expect.

Who Should Consider Cheapest Whole Life Insurance

Affordable whole life insurance can make sense for:

Young adults starting financial planning

Parents protecting their family’s future

Individuals looking to cover final expenses

People seeking guaranteed lifelong coverage

Those who want cash value accumulation

If you fall into any of these categories, exploring cheap whole life insurance alternatives could be a smart financial move.

Final Thoughts: Making Coverage Affordable and Meaningful

Securing lifelong protection doesn’t have to be financially overwhelming. By understanding how whole life insurance works, comparing multiple quotes, and considering your personal health and financial situation, you can find the cheapest whole life insurance that still offers vital protection.

Affordable coverage ensures that your family’s financial future is secure — no matter when life’s journey ends. With strategic planning and informed decision-making, you can find value without sacrificing peace of mind.

To dive deeper into finding affordable policy options and tips on choosing the right plan for your needs, explore information on cheap whole life insurance as part of your financial planning strategy.