Lab-grown meat, also referred to as cultured meat or cell-based meat, represents a groundbreaking innovation aimed at addressing the increasing global demand for animal protein while simultaneously mitigating the environmental challenges associated with traditional livestock farming. As consumers grow more aware of the ethical concerns and environmental ramifications tied to conventional meat production—such as deforestation, greenhouse gas emissions, and animal welfare issues—lab-grown meat is emerging as a compelling alternative.

The production of lab-grown meat involves a sophisticated process that begins with obtaining a small biopsy of animal cells, typically from a cow, chicken, or pig. These cells are then placed in a controlled laboratory environment where they are provided with a nutrient-rich culture medium that supplies essential growth factors, vitamins, and minerals. This environment mimics the conditions found in the animal's body, allowing the cells to proliferate and differentiate.

Over time, these cells develop into muscle tissue that closely resembles traditional meat in terms of texture and nutritional profile. The ability to produce meat without raising and slaughtering animals not only reduces animal suffering but also significantly lowers land usage and water consumption compared to conventional meat production. Furthermore, lab-grown meat holds the potential to decrease the release of harmful pollutants and greenhouse gases into the atmosphere, making it a more sustainable choice for the planet.

The report begins with an outline of the business environment and then explains the commercial summary of the chain structure.

The report also includes data on the overview of the competitive situation among different companies, including an analysis of the current market situation and prospects for growth. This report provides insights on the general market's profit through graphs, an in-depth SWOT analysis of the trends in this business space alongside regional proliferation.

Full Report @ https://futuremarketanalytics.com/report/lab-grown-meat-market/

Lab Grown Meat Market Segmentation:

By Type

- Beef

- Pork

- Poultry

- Seafood

By Application

- Food Retail

- Food service Channels

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Competitive Landscape in the Lab Grown Meat Market:

Major market players enclosed within this market are

- Aleph Farms

- Mosa Meat

- Just Inc.

- Meatable

- Memphis Meats

- SuperMeat

- Finless Foods

(Note: The lists of the key players are going to be updated with the most recent market scenario and trends)

Future Market Analytics Focus Points:

- SWOT Analysis

- Key Market Trends

- Key Data -Points Affecting Market Growth

- Revenue and Forecast Analysis

- Growth Opportunities for New Entrants and Emerging Players

- Key Player and Market Growth Matrix

Objectives of the Study:

- To provide a comprehensive analysis on the Lab Grown Meat Market By Type,By Application and By Region

- To cater extensive insights on factors influencing the market growth (drivers, restraints, industry-specific restraints, business expansion opportunities)

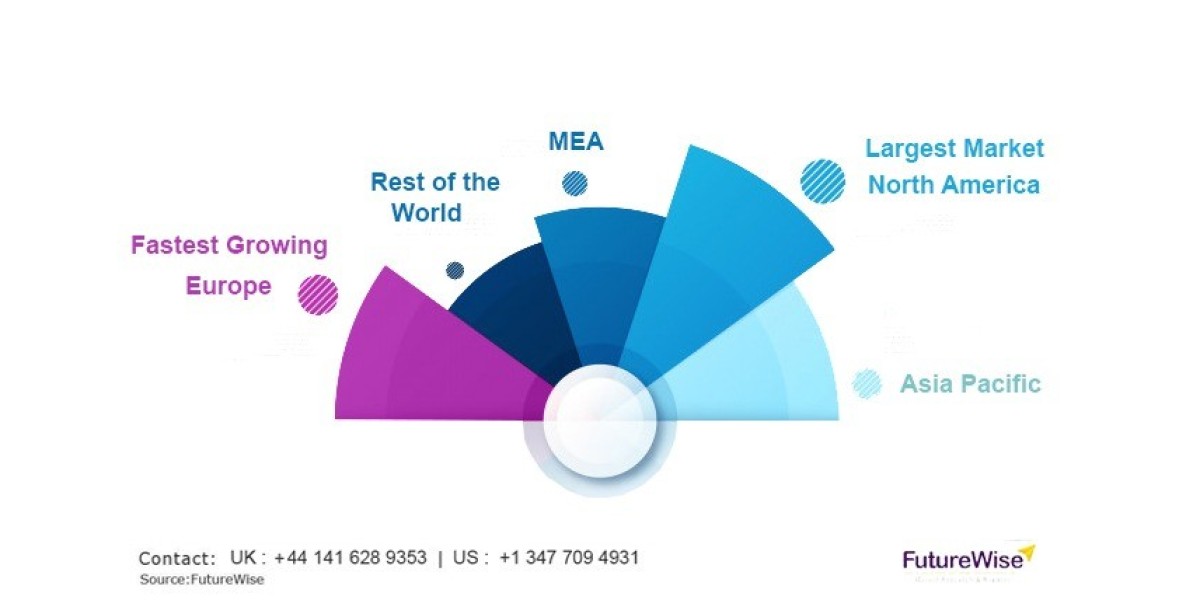

- To anticipate and analyse the market size expansion in key regions- North America, Europe, Asia Pacific, Latin America and Middle East and Africa

- To record and evaluate competitive landscape mapping- strategic alliances and mergers, technological advancements and product launches, revenue and financial analysis of key market players

Flexible Delivery Model:

- We have a flexible delivery model and you can suggest changes in the scope/table of content as per your requirement

- The customization services offered are free of charge with purchase of any license of the report.

- You can directly share your requirements/changes to the current table of content to: [email protected]

About Future Market Analytics:

We at Future Market Analytics are capable of understanding consumer and market mindsets. Based on a precise current and forecast data analysis, we offer the most pertinent insights to organizations by implementing the latest market research methodologies. Studying high-growth niche markets like shipping and transportation, blockchain, energy, and sustainability, providing customized solutions to our clients, assuring agility, and flexibility in report delivery are parts of our business model which makes us stand out within our competition.