Global Fly Ash Industry: Key Statistics and Insights in 2024–2032

Summary:

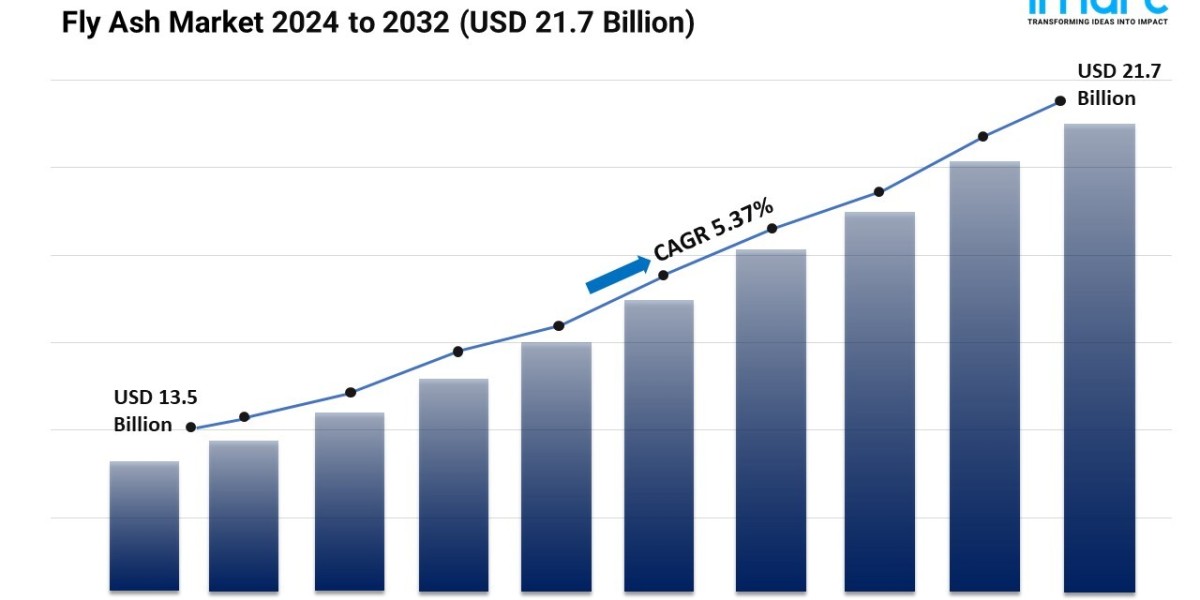

- The global fly ash market size reached USD 13.5 Billion in 2023.

- The market is expected to reach USD 21.7 Billion by 2032, exhibiting a growth rate (CAGR) of 5.37% during 2024–2032.

- Asia-Pacific leads the market, accounting for the largest fly ash market share.

- Class F accounts for the majority of the market share in the type segment due to its effectiveness in reducing the heat of hydration in concrete.

- Construction holds the largest share in the fly ash industry.

- The increasing demand in the construction sector is a primary driver of the fly ash market.

- The growing environmental awareness and regulations, along with innovations in technology in the processing industry, are reshaping the fly ash market.

Industry Trends and Drivers:

● Growing demand in construction industry:

The increasing demand for fly ash due to its strength, durability, and workability in the construction industry is contributing to the market growth. Rapid urbanization and infrastructure projects are driving the demand for sustainable building materials, which is positioning fly ash as a preferred choice among builders. Manufacturers are incorporating fly ash for enhancing the mechanical properties of concrete and improving its resistance to environmental factors like sulfate attack and alkali-silica reaction. Regulatory pressures are also promoting the utilization of recycled materials, encouraging construction firms to integrate fly ash into their projects. Besides this, the green building movement is using fly ash to reduce the carbon footprint associated with concrete production, thereby offering a favorable market outlook.

● Rising environmental awareness and regulations:

Industries are seeking eco-friendly alternatives to traditional cement for minimizing waste and reducing greenhouse gas emissions, which is resulting in growing research and development (R&D) activities in the industry. This shift is aligning with global sustainability goals and initiatives aimed at reducing landfill waste and carbon emissions. As a result, governing agencies of several countries are implementing policies that are promoting the recycling of industrial by-products, including fly ash, thereby encouraging its use in construction and other applications. Public awareness campaigns are also educating stakeholders about the benefits of using fly ash and motivating more construction firms to integrate it into their building materials, thereby supporting the market growth.

● Technological advancements in processing:

Innovations in the processing of fly ash are improving its quality and usability, which is positively influencing the market. Advancements in classification and beneficiation techniques are enhancing the physical and chemical properties of fly ash, making it more suitable for a wider range of applications. These advancements are allowing for better separation of impurities, resulting in higher-grade fly ash that meets industry standards. As manufacturers are developing new methods to optimize fly ash usage, its applications are expanding to include products like lightweight aggregates, soil stabilization materials, and as a component in asphalt mixes. This diversification is increasing the utilization of fly ash in various industries, thereby stimulating the market growth.

Request for a sample copy of this report: https://www.imarcgroup.com/fly-ash-market/requestsample

Fly Ash Market Report Segmentation:

Breakup By Type:

- Class F

- Class C

Class F represents the largest segment due to its superior pozzolanic properties.

Breakup By Application:

- Construction

- Bricks and Blocks

- Road Construction

- Portland Cement and Concrete

- Agriculture

- Mining

- Water Treatment

- Others

Construction accounts for the majority of the market share because it extensively utilizes fly ash as a key ingredient in concrete production.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position in the fly ash market, which can be attributed to rapid urbanization, rising infrastructure development, and increasing awareness about sustainable building practices.

Top Fly Ash Market Leaders:

The fly ash market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Aceton Industries LLP

- Ashtech India Pvt. Ltd.

- Boral Limited

- Cemex S.A.B. de C.V.

- Charah Solutions Inc.

- Holcim Group

- National Minerals Corporation

- Salt River Materials Group

- Suyog Suppliers

- The SEFA Group

- Titan America LLC (Titan Cement International SA)

- Waste Management Inc.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–631–791–1145