The global astaxanthin market size is expected to reach USD 7.28 billion by 2030, set to grow at a 17.1% CAGR from 2024 to 2030, according to a new report by Grand View Research, Inc. The increasing demand for nutraceuticals and growing applications of carotenoids in the animal feed industry & aquaculture are the major factors driving the market growth. Moreover, the rapidly aging population and the growing health awareness among consumers are likely to support market expansion.

The market is anticipated to witness growth opportunities owing to growth in the aquaculture and fishing sectors. For instance, Germany is expanding its fish production and according to the federal statistical office of Germany, the country produced around 18,300 tons of fish in 2021. The growth in the aquaculture sector across the globe is likely to propel the demand for astaxanthin as the pigment helps to boost the immunity of animals and enhance the pigmentation of aquatic animals, such as ornamental fish, and rainbow trout.

Moreover, the market growth is also fueled by various research & development activities to increase the adoption of astaxanthin. For instance, in December 2021, AstaReal and the University of Tsukuba announced a new patent and research showing that the astaxanthin molecules modulate the genes of the brain involved in neuron formation, memory, and learning. Moreover, in July 2020, Russian and German university scientists from SPbPU and TUHH announced a collaboration to enhance the production of astaxanthin for its antioxidant application.

Gather more insights about the market drivers, restrains and growth of the Astaxanthin Market

Detailed Segmentation:

Market Concentration & Characteristics

The astaxanthin market showcases a high degree of innovation, with companies developing novel formulations and sustainable production methods. For example Sirio Europe (SIRIO) revealed in August, 2023, its plan to introduce two new softgel products targeting the pharmaceutical sector during the CPHI Barcelona 2023 event.

Market Dynamics

Growing awareness about nutrition for healthy lifestyle and rising preference for dietary supplements due to high cost of hospitalization are factors anticipated to drive demand for nutraceuticals & natural antioxidants. To compete with the increasing demand for nutraceutical products, market players are significantly increasing their production capacity. For instance, in April 2022, Beijing Gingko Group announced a second-time expansion of its pristine region’s astaxanthin farm capacity in last 2 years, which would maximize its production capacity. Algatech Ltd. also increased its production capacity threefold for FucoVital, a product derived from brown algae, to fulfill increasing demand for dietary supplements market.

Source Insights

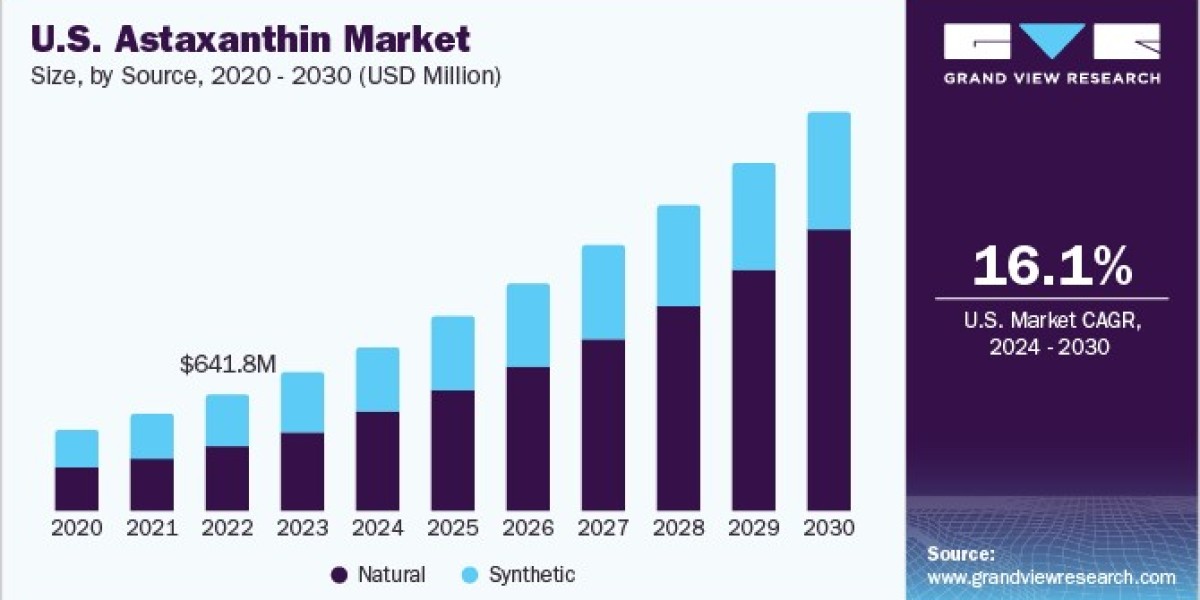

The natural segment held largest revenue share of 56.40% of astaxanthin industry in 2023 and is anticipated to grow at a rapid rate during the forecast period owing to advantages such as high efficacy and sustainability. Currently, it is used to treat hypercholesterolemia, stroke, Parkinson’s disease, Alzheimer’s disease, and cancer. Moreover, natural astaxanthin has very good effects on skin and eye, as many studies reported use of these products in treatment of ophthalmic diseases like cataract, uveitis, & glaucoma and skin photo-aging treatments, as it has 10 times higher free radical inhibitory action than other antioxidants. Moreover, ongoing research activities to enhance the quality and usage of yeast-derived astaxanthin are expected to boost segment growth. For instance, in February 2023, according to research by China Medical University Hospital, National Chung Hsing University, and National Taiwan Ocean University, genetically modified yeast could be a promising source of astaxanthin for shrimp feeds.

Product Insights

Dried algae meal or biomass accounted highest share of 25.26% of the market in 2023. Major share is attributed to the applications in biomass production of other formulations such as capsules or tablets, minimal downstream processing, convenient bulk production and higher use as animal feed are some key factors driving segment’s growth. Moreover, new product launches, such as AstaPure Arava gummies by Solabia-Algatech Nutrition Ltd, in October 2022, also demonstrated increasing demand for algal astaxanthin . Similarly, in May 2022, Algalif has entered into a partnership with the start-up company Marea, with the aim of creating a biodegradable coating for products using residual algae biomass. These new developments are expected to drive segment growth during study period.

Application Insights

Aquaculture & animal feed segment is accounted the high share of 46.39% of market in 2023. Owing to its extensive use as a feed additive. Natural astaxanthin is used as feed to induce reddish pigmentation in salmon, trout, and shrimp, which is an important factor that drives consumer preference. Astaxanthin oil can also increase feed uptake, which results in faster growth of shrimp. Thus, increasing adoption of these products in aquaculture industry for improving quality of seafood is contributing to segment’s significant share in the market. In addition, key players in market are introducing novel products for animal feed having medical benefits. For instance, in July 2022, AstaReal introduced Novasta, an astaxanthin ingredient designed for use in animal feed. This product launch expands the potential for health-enhancing applications in the field of animal nutrition.

Regional Insights

North America is most developed astaxanthin market and held largest share of 36.53% in 2023. The rising prevalence of nutrition and skin-related diseases in the region is a significant factor driving the demand. Additionally, presence of key manufacturers like Cyanotech, Piveg, Inc., and Beijing Ginko Group (BGG), along with synthetic producers such as Cardax, Inc., in North America, is expected to fuel market during the forecast period. Moreover, market growth in North America is further accelerated by a large number of health-conscious consumers, increased adoption of nutraceuticals, and a well-established cosmeceutical industry. These factors collectively contribute to the increasing demand for market in the region.

Browse through Grand View Research's Pharmaceuticals Industry Research Reports.

• The global antiarrhythmic drugs market size was valued at USD 1.05 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030.

• The global amyloidosis treatment market size was valued at USD 5.39 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.4% from 2024 to 2030.

Key Companies & Market Share Insights

Some of the key players operating in market include Algatech Ltd; Cyanotech Corporation, and ALGAMO. Key players in the market are contributing toward their growth by geographical expansion to gain higher market share. In addition, companies are focusing on gaining market approvals for innovative products to help in management of different health conditions.

Collaborations with research institutes and academic organizations to provide the products & services and engage in new contracts is the major strategy adopted by emerging market players. Additionally, these players may be more flexible and agile than established players in terms of responding and changing to market needs and demand, allowing them to quickly adapt and develop new technologies.

Key Astaxanthin Companies:

• Algatech Ltd

• MicroA

• Cyanotech Corporation

• Algalíf Iceland ehf

• Beijing Gingko Group (BGG)

• PIVEG, Inc.

• Fuji Chemical Industries Co., Ltd

• ENEOS Corporation

• Atacama Bio Natural Products S.A.

• E.I.D. – Parry (India) Limited (Alimtec S.A., Valensa International)

Astaxanthin Market Segmentation

Grand View Research has segmented the global astaxanthin market on the basis of source, product, application, and region

Astaxanthin Source Outlook (Revenue, USD Million, 2018 - 2030) (Volumein Metric Tonnes)

• Natural

o Yeast

o Krill/Shrimp

o Microalgae

o Others

• Synthetic

Astaxanthin Product Outlook (Revenue, USD Million, 2018 - 2030)

• Dried Algae Meal or Biomass

• Oil

• Softgel

• Liquid

• Others

Astaxanthin Application Outlook (Revenue, USD Million, 2018 - 2030)

• Nutraceuticals

• Cosmetics

• Aquaculture And Animal Feed

• Food

o Functional Foods And Beverages

o Other Traditional Food Manufacturing Applications

• Others

Astaxanthin Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o U.K.

o Germany

o France

o Italy

o Spain

o Russia

o Denmark

o Norway

o Sweden

• Asia Pacific

o Japan

o China

o India

o South Korea

o Australia

o Singapore

o Thailand

• Latin America

o Brazil

o Mexico

o Argentina

o Ecuador

• Middle East & Africa

o South Africa

o Saudi Arabia

o UAE

o Israel

o Kuwait

Order a free sample PDF of the Astaxanthin Market Intelligence Study, published by Grand View Research.

Recent Developments

• In October 2023, Algatech Ltd, received National Organic Program (NOP) Certification for the company’s algae-derived astaxanthin.

• In March 2023, AstaReal partnered with raw material distributor C.F.M. Co. Farmaceutica Milanese to offer comprehensive technical, regulatory, scientific, and logistical support to nutraceutical producers in Italy. This collaboration aims to address the increasing market demand for natural astaxanthin, a proven antioxidant with health benefits, positioning AstaReal as the premier natural astaxanthin brand in Italy. Obtained from regrown microalgae Haematococcus pluvialis, AstaReal's astaxanthin is highlighted for its environmentally sustainable sourcing.

• In May 2022, Iceland's Algalif signed an agreement with a start-up company, Marea, to develop a biodegradable good coating from leftover algal biomass.

• In October 2022, Solabia-Algatech launched Astaxanthin Gummies with vitamin C, which contain no preservatives or synthetic colors. Each gummy has 4mg astaxanthin algae complex.

• In April 2022, BGG announced second expansion of pristine region’s astaxanthin farm capacity in last 2 years and expected to maximize its production capacity. Such initiatives are contributing to the market growth.