The global permanent magnets market size is projected to reach approximately USD 39.71 billion by 2030, according to a new report by Grand View Research, Inc., expanding at a CAGR of 8.7% over the forecast period.The rising number of supportive initiatives to promote healthcare infrastructure, especially in developing countries, is projected to aid the market growth over the forecast period. The demand for the product is expected to be driven by the extensive usage in industrial automation amidst the COVID-19 outbreak and rising demand from the healthcare sector. Permanent magnets are used in various medical devices, such as blood separators, surgical devices, dental equipment, patient monitoring systems, drug delivery systems, and Magnetic Resonance Imaging (MRI) scanners, and other essential & non-essential healthcare devices. The COVID-19 outbreak in 2020 played a key role in driving the investments in developing healthcare infrastructure.

For instance, the Government of India laid out the plan to upend its healthcare spending by nearly 3% of its total GDP by 2022. Such initiatives are likely to drive the product demand in the healthcare sector over the predicted timeline. The product is also significantly used in wearable electronic devices. The global economy is currently witnessing drastic developments in technology, which has led to the proliferation of smart electronic devices. The market for wearable electronics devices, smartphones, and other smart technologies in advanced as well as emerging economies is likely to witness significant growth. This is likely to indirectly benefit the product demand over the forecast period. The global market is fragmented and is characterized by regional concentration. On account of the presence of large-scale rare earth metal deposits in China, numerous small, medium, and large-scale manufacturers are located in close vicinity.

Gather more insights about the market drivers, restrains and growth of the Permanent Magnets Market

Detailed Segmentation:

Market Concentration & Characteristics

Market growth stage is high, and pace of the growth is accelerating. The industry is anticipated to witness growth owing to the increasing demand for sustainable energy sources such as wind power, and the exponential growth in the electric vehicle (EV) markets.

Material Insights

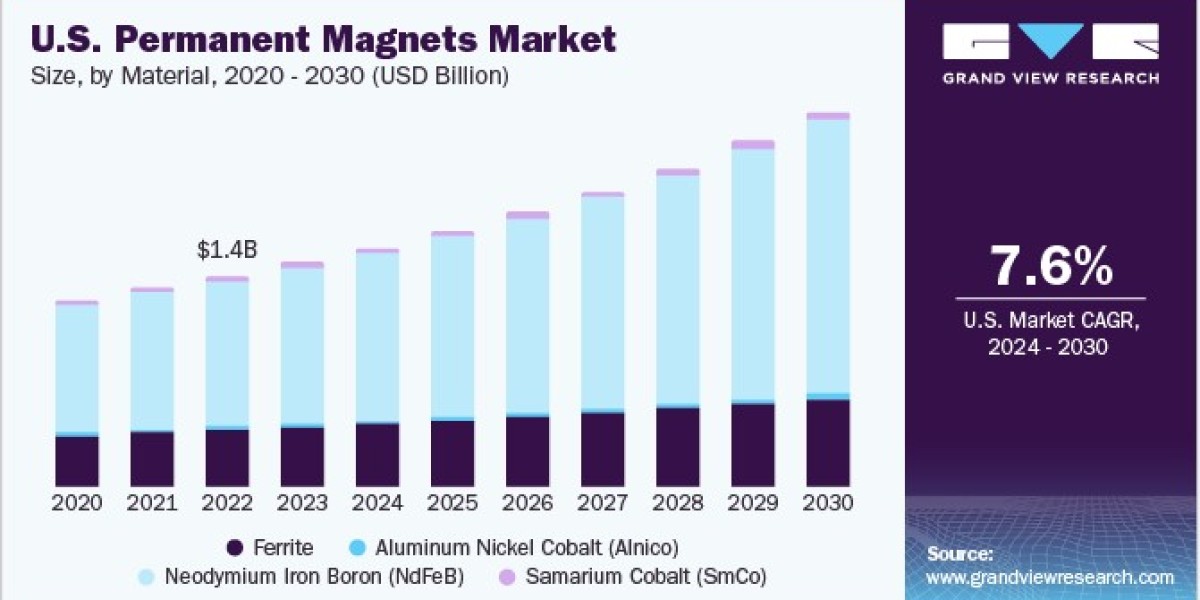

The ferrite material segment dominated the market in 2023 and accounted for the largest revenue share of about 36.0%. Ferrite magnets are primarily used in motor applications. Over 65% of the total volume of ferrite magnets are utilized in motor applications, with consumption in automotive motors, appliance motors, HVAC motors, and industrial & commercial motors estimated roughly at 19%, 14%, 12%, and 11%, respectively, in 2022. Furthermore, they are also utilized in loudspeakers, separation equipment, Magnetic Resonance Imaging (MRI), relays & switches, and holding & lifting applications. Neodymium Iron Boron (NdFeB) is projected to emerge as the second-largest material segment with the fastest CAGR, in terms of volume as well as the revenue over the forecast period.

Application Insights

Consumer goods & electronics accounted for the largest revenue share of about 26.0% and emerged as the leading application segment in 2023. In the electronics industry, the product is used in air conditioning compressors & fans, recorders, computer cables, DVDs, cameras, watches, earbuds, loudspeakers, microphones, mobile phones, voice coil motors, printers, fax stepper motors, printer machine rollers, hard disk drives (HDDs), and portable power tool motors among others. Growth in the production of the aforementioned product categories is estimated to directly support the market growth for permanent magnets.

Regional Insights

Asia Pacific accounted for the largest revenue share of nearly 75.0% in 2023. The region is a manufacturing hub of the world. Automotive and electronic productions are critical components of the region’s manufacturing activities. China, Japan, and South Korea have become hot centers for manufacturing computer hardware devices including hard disks, computer chips, and microprocessors. This has contributed to the rising demand for permanent magnets, which are being extensively consumed by electronics and hardware manufacturers. Europe is anticipated to emerge as the second-largest regional market by 2030, although the region witnessed a sharp decline in 2020. This is because industrial production in Europe has observed slower growth in the past few years due to the overall economic slowdown and due to political uncertainties, such as Brexit.

Browse through Grand View Research's Advanced Interior Materials Industry Research Reports.

• The global chemical mechanical planarization market size was estimated at USD 6.01 billion in 2023 and is anticipated to grow at a CAGR of 7.2% from 2024 to 2030.

• The global aluminum wire market size was estimated at USD 31.95 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030.

Key Companies & Market Share Insights

Some of the key players operating in the market include Hitachi Metals Ltd., Shin-Etsu Chemical Co., Ltd. and Ningbo Yunsheng Co., Ltd.

• Hitachi Metals Ltd. operates through three business segments, namely automotive related products, electronics-related products, and infrastructure related products. It offers a wide range of products including cutting tools, molding materials, chassis, exhaust components, magnets & motor related products, LCD displays & semiconductors, medical equipment, aircraft components, piping equipment, industrial equipment, and rubber.

• Shin-Etsu Chemical Co., Ltd. operates through various business segments, namely PVC, silicones, specialty chemicals, semiconductor silicon, electronics & functional materials, and processing/trading businesses.

• Ningbo Yunsheng Co., Ltd. develops and manufactures sintered and bonded NdFeB, AlNiCo, and SmCo magnets; magnetic assemblies; and electric motor products. The company is engaged in the research and management of servomotors, compact spinning devices, automobile motors, serinette, smart technology products & supplies, and neodymium magnets.

• Earth-Panda Advance Magnetic Material Co., Ltd., and Ninggang Permanent Magnetic Materials Co., Ltd., are some of the emerging market participants.

Key Permanent Magnets Companies:

• Adams Magnetic Products Co.

• Earth-Panda Advance Magnetic Material Co., Ltd.

• Arnold Magnetic Technologies

• Daido Steel Co., Ltd.

• Eclipse Magnetics Ltd.

• Electron Energy Corp.

• Goudsmit Magnetics Group

• Hangzhou Permanent Magnet Group

• Magnequench International, LLC

• Ningbo Yunsheng Co., Ltd.

• Ninggang Permanent Magnetic Materials Co., Ltd.

Permanent Magnets Market Segmentation

Grand View Research has segmented the global permanent magnets market based on material, application, and region:

Permanent Magnets Material Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

• Ferrite

• Neodymium Iron Boron (NdFeB)

• Aluminum Nickel Cobalt (Alnico)

• Samarium Cobalt (SmCo)

Permanent Magnets Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

• Automotive

• Consumer goods & electronics

• Industrial

• Aerospace & Defense

• Energy

• Medical

• Others

Permanent Magnets Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o Russia

o UK

o France

o Italy

• Asia Pacific

o China

o India

o Japan

o South Korea

o Indonesia

• Central & South America

o Brazil

o Argentina

• Middle East & Africa

o KSA

Order a free sample PDF of the Permanent Magnets Market Intelligence Study, published by Grand View Research.

Recent Developments

• In October 2023, Ara Partners, a private equity firm acquired Vacuumschmelze (VAC), a German permanent magnets producer, from its equity investor Apollo. This will strengthen the duo’s rare earths value chain, and help the former to pursue its strategic growth opportunity of supplying permanent magnets to key industries such as electric vehicles (EV).

• In January 2023, VAC signed an agreement with U.S. automaker General Motors to build a permanent magnets manufacturing plant in North America to manufacture, using locally sourced raw materials. The product would be used in the manufacture of electric motors supplied to GM automobiles.