Unlock the World: Discover the Magic of 5G Travel SIM Cards!

In today's hyper-connected world, staying in touch while traveling has become more essential than ever. Enter the 5G travel SIM card—a revolutionary tool that is rapidly gaining popularity among globe-trotters. Unlike traditional SIM cards, 5G travel SIM cards offer unparalleled speed, reliability, and coverage, ensuring that you remain connected no matter where your adventures take you. Imagine sharing your travel experiences on social media in real-time, video calling loved ones, or navigating foreign cities without the fear of losing signal. The benefits of using a 5G SIM card over its predecessors are immense, and as the world embraces this next-generation technology, it's crucial for travelers to understand how these cards can enhance their journeys.

What Are 5G Travel SIM Cards?

5G travel SIM cards are specialized SIM cards designed specifically for international travelers, enabling them to access high-speed mobile data across various countries. Unlike standard SIM cards, which may only provide limited data speeds and coverage depending on the local networks, 5G SIM cards leverage the latest mobile technology to deliver faster internet access and broader network compatibility. Essentially, these cards are engineered to work seamlessly with 5G networks, which are becoming increasingly available around the globe, allowing users to connect to the internet at lightning speeds. This technology is particularly beneficial for those who rely heavily on their smartphones for everything from navigation to entertainment while traveling.

Features of 5G Travel SIM Cards

One of the most notable features of 5G travel SIM cards is their impressive speed. With the capability to deliver data rates several times faster than 4G, users can upload and download content without the frustrating lag often associated with slower networks. Additionally, 5G SIM cards offer extensive coverage, allowing travelers to stay connected in both urban and rural areas across different nations. Many of these cards also come with flexible data limits, catering to different usage needs, whether you're a light user who just needs emails and maps or a heavy user streaming videos and sharing content. Furthermore, 5G travel SIM cards are compatible with a wide range of devices, including smartphones, tablets, and portable Wi-Fi hotspots, making them a versatile choice for travelers.

How 5G Travel SIM Cards Work

Activating and using a 5G travel SIM card is straightforward. Typically, once you purchase the card, you'll need to insert it into your device and follow a few simple activation steps—often just involving a quick online registration process. After activation, your device gains access to local 5G networks, allowing you to enjoy high-speed internet from the moment you land. Many providers also offer a variety of data plans, enabling you to choose the best option based on the duration of your trip and your anticipated data usage. Whether you opt for a pay-as-you-go plan or a fixed data bundle, 5G travel SIM cards usually provide a user-friendly experience that keeps you connected without hassle.

Benefits of Using 5G Travel SIM Cards

The advantages of utilizing 5G travel SIM cards are numerous. For starters, they often prove to be more cost-effective than traditional roaming fees imposed by local carriers. Instead of facing exorbitant charges for data usage, travelers can enjoy predictable costs associated with their chosen data plan. The seamless connectivity provided by 5G networks enhances the overall travel experience; whether you need to book accommodations, navigate unfamiliar terrain, or instantly share your experiences with friends and family, a 5G SIM card makes it all possible. Additionally, the enhanced speed allows for smoother video calls and better streaming quality, ensuring that you never miss a moment of your adventures.

Things to Consider When Choosing a 5G Travel SIM Card

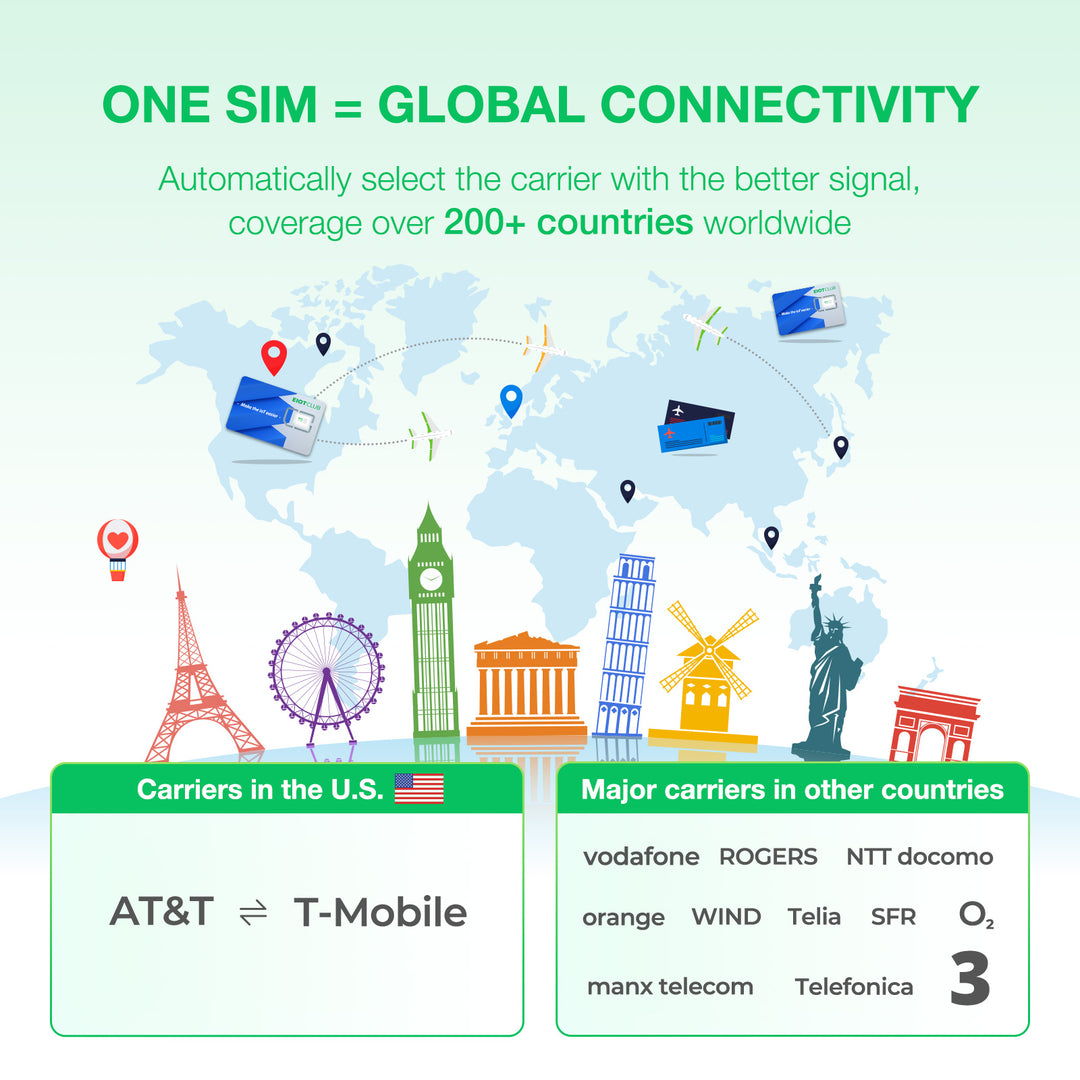

When selecting a 5G travel SIM card, several important factors should be taken into account. First and foremost, consider the coverage areas—ensure that the card supports the countries you plan to visit. It's also crucial to evaluate the data allowances offered; some plans may be more suited for light browsing, while others cater to heavy data users. Customer support is another key consideration; reputable providers often offer 24/7 assistance to help travelers resolve any connectivity issues that may arise. Lastly, look for cards that offer the flexibility to adjust data plans as your needs change throughout your trip to maximize convenience.

Final Thoughts on 5G Travel Connectivity

In summary, 5G travel SIM cards represent a significant leap forward in mobile connectivity for travelers. With their remarkable speed, extensive coverage, and user-friendly features, these cards ensure that you can stay connected during your adventures without breaking the bank. As more travelers opt for this innovative solution, it’s worth exploring the various options available to keep you linked to the world while you explore it. Embrace the magic of 5G travel SIM cards and elevate your travel experience to new heights!