Global Check Cashing Market: Trends, Growth, and Future Prospects

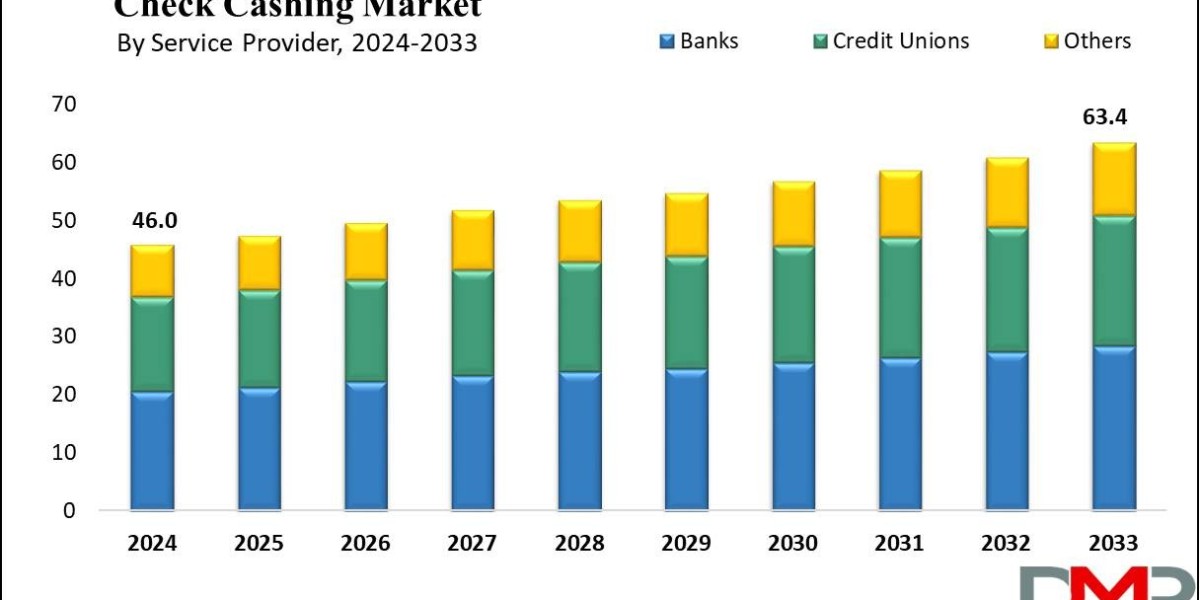

The Global Check Cashing Market is on the rise, driven by changing consumer behavior, the increased need for immediate access to funds, and the growing popularity of non-bank financial services. With a projected market value of USD 44.3 billion in 2023, and a forecast to reach USD 63.4 billion by 2033, growing at a CAGR of 3.6%, the check cashing industry is positioned for significant growth. As more consumers seek accessible, convenient, and fast alternatives to traditional banking services, check cashing has emerged as a viable financial solution, especially in underbanked communities.

Understanding the Global Check Cashing Market

The check cashing market facilitates individuals who need immediate access to the funds written on a check without having to deposit it into a bank account. This process provides an alternative to the traditional banking system, which may have long wait times or strict requirements for check deposit approval. It is particularly attractive to individuals who do not have a bank account, have limited banking access, or require fast cash for urgent needs.

Check cashing services are generally offered by retail stores, independent agencies, and even some specialized kiosks, with consumers paying a fee for the service. The sector’s ability to serve both individuals and businesses has expanded its scope and market share, providing a range of services from check cashing to payday advances, money orders, and wire transfers.

Download a Free PDF Sample@ https://dimensionmarketresearch.com/report/check-cashing-market/request-sample/

Key Drivers of Growth in the Check Cashing Market

Several factors are contributing to the robust growth of the Global Check Cashing Market. These include:

- Increased Unbanked and Underbanked Populations: Many individuals, particularly in emerging economies, do not have access to traditional banking services due to factors such as income instability, lack of credit history, or geographical barriers. The check cashing industry has emerged as an ideal solution for this demographic, offering faster, more flexible financial services compared to banks.

- Rising Demand for Instant Cash: As the world becomes more fast-paced, individuals increasingly desire quicker access to their funds. With check cashing, consumers can convert their checks into cash almost instantly, bypassing the waiting period associated with traditional banking methods.

- Convenience and Accessibility: Check cashing services are often available outside traditional banking hours and in more convenient locations, such as supermarkets, gas stations, and dedicated check-cashing outlets. This 24/7 availability is particularly appealing to consumers who have busy schedules or limited access to financial institutions.

- Growing Online Check Cashing Services: The rise of digital check cashing platforms is revolutionizing the market. Online platforms allow individuals to upload their checks electronically, facilitating easy and quick processing from the comfort of their homes. This innovation has expanded the market's reach and attractiveness to a broader audience.

Market Size and Forecast

The Global Check Cashing Market was valued at USD 44.3 billion in 2023 and is projected to grow at a CAGR of 3.6%, reaching USD 63.4 billion by 2033. This growth is underpinned by the factors mentioned above, as well as the increasing number of small businesses and freelancers who rely on check cashing services for quick cash flow.

Talk to our Experts Team@ https://dimensionmarketresearch.com/enquiry/check-cashing-market/

Regional Analysis: North America Leads the Way

North America holds a significant share of the Global Check Cashing Market, accounting for around 34.8% of the total revenue in 2024. The region’s dominance is primarily due to the well-established check cashing infrastructure, high demand for non-bank financial services, and the large underbanked population. In addition, the adoption of digital financial solutions has expanded the market in this region, allowing for convenient, online check-cashing services.

The U.S. is the largest market for check cashing, driven by the presence of a vast number of service providers and the high demand from individuals who prefer immediate access to their funds. Despite the increasing use of digital banking, check cashing remains a key solution for a significant portion of the population in the U.S. and Canada.

While North America leads the market, Europe and Asia-Pacific are also growing rapidly, driven by the demand for alternative financial services and greater financial inclusion. As the market becomes more globalized, opportunities in these regions are expected to increase substantially.

Market Trends and Opportunities

The Global Check Cashing Market is witnessing several key trends that are reshaping the industry. These trends include:

- Expansion of Digital Platforms: Digital transformation is taking the check cashing industry by storm. More companies are introducing mobile apps and online platforms that allow consumers to deposit and cash checks using their smartphones. These services eliminate the need for consumers to visit physical outlets, providing added convenience.

- Partnerships with Retailers: Many check-cashing businesses are forming partnerships with major retail chains to expand their reach. These collaborations make it easier for customers to access check cashing services at locations they already frequent.

- Adoption of Prepaid Debit Cards: Some check cashing businesses offer prepaid debit cards as an alternative payment method for customers. This option allows individuals to access their funds instantly while avoiding high fees typically associated with check cashing.

- Increased Regulatory Oversight: As the check cashing industry grows, governments worldwide are increasing regulatory oversight to ensure consumer protection and reduce fraud. New compliance measures are expected to emerge, creating both challenges and opportunities for businesses in the market.

Key Players in the Global Check Cashing Market

The Global Check Cashing Market is competitive, with several prominent players offering a variety of check-cashing services to consumers. Some of the leading companies in the industry include:

- ACE Cash Express

- Check Into Cash

- The Check Cashing Store

- Money Mart

- Western Union

These companies offer a wide range of services, including check cashing, payday loans, money transfers, and bill payment. The market is also becoming more fragmented as new startups and fintech companies enter the scene with innovative solutions to meet the needs of modern consumers.

FAQs

1. What is check cashing?

Check cashing is the process of exchanging a written check for its cash value, usually with a service fee. It provides an alternative to traditional banking, especially for individuals without access to bank accounts.

2. How much is the Global Check Cashing Market worth in 2023?

The Global Check Cashing Market is valued at USD 44.3 billion in 2023 and is expected to reach USD 63.4 billion by 2033.

3. What are the key drivers of growth in the check cashing market?

The key drivers include increased demand for instant access to cash, a growing underbanked population, and the rise of digital check-cashing platforms.

4. Which region is leading the global check cashing market?

North America is expected to lead the market, accounting for approximately 34.8% of the global market revenue in 2024.

5. What are the market trends in the check cashing industry?

Key trends include the expansion of digital check-cashing platforms, partnerships with retail chains, adoption of prepaid debit cards, and increased regulatory oversight.

Conclusion

The Global Check Cashing Market is poised for continued growth as demand for accessible, immediate financial services rises. With a projected market value of USD 63.4 billion by 2033, opportunities are abundant for businesses to capitalize on the increasing need for convenient and flexible solutions. While North America currently leads the market, emerging regions such as Asia-Pacific and Europe present significant potential for expansion. The future of check cashing looks promising, with digital solutions, new partnerships, and regulatory developments shaping the next phase of market growth.