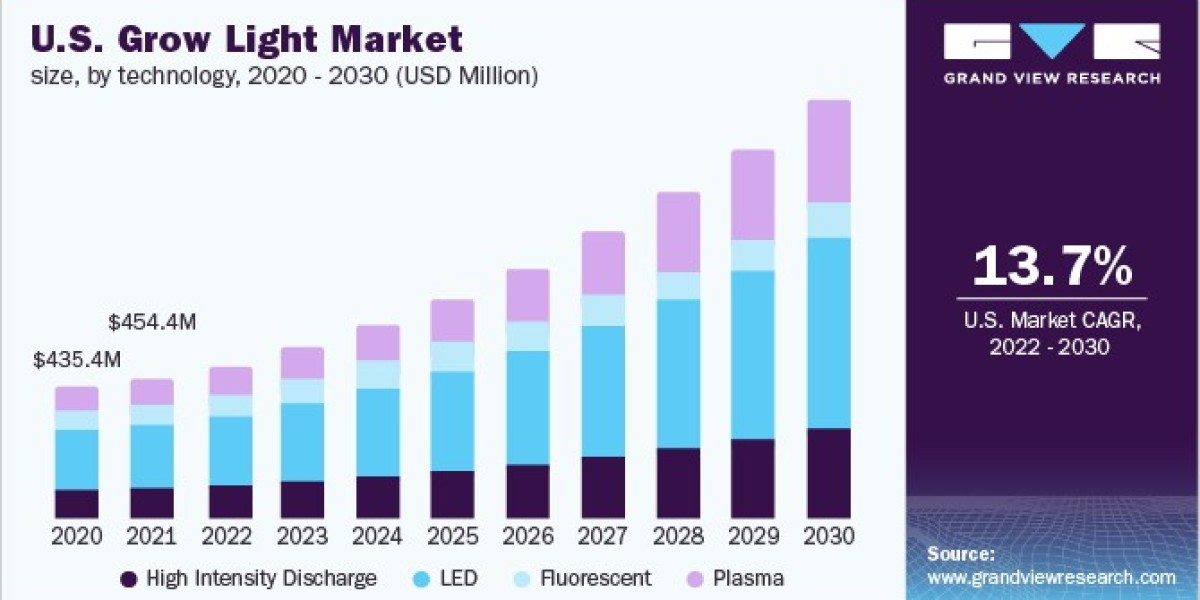

The global grow light market was valued at USD 4.23 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 15.0% from 2022 to 2030. The market growth is primarily driven by the rising popularity of urban cultivation, vertical farming, and the increasing adoption of sustainable methods for producing fruits and vegetables. The surge in the global population has further amplified the demand for urban agriculture. Vertical farming, which involves growing crops in vertically stacked layers within spaces like warehouses, skyscrapers, or shipping containers, has also played a crucial role in market expansion.

Grow lights are instrumental in extending natural daylight hours, which enhances plant health, growth rate, and yield. Artificial lighting solutions, including high-pressure sodium, LED, and plasma lights, enable year-round crop availability by extending growing seasons. The growing awareness of alternative farming methods, driven by the limited availability of fertile land and an increasing population, is expected to be a significant factor in the market's growth.

Unlike traditional farming, indoor farming allows year-round crop production, boosting overall productivity. It also protects crops from extreme weather conditions by employing controlled environment agriculture technology. This technology involves artificial environmental control systems, optimized lighting, and fertigation techniques to maximize efficiency.

Gather more insights about the market drivers, restrains and growth of the Global Grow Light Market

COVID-19 Impact Analysis on the Grow Light Market:

The COVID-19 pandemic initially had a detrimental effect on the grow light market. The emergence of the pandemic led to strict lockdowns and travel restrictions imposed by governments across various countries, which severely disrupted supply chains. These disruptions impacted the availability of raw materials required for manufacturing grow lights, as well as the distribution of the final products to consumers. Consequently, the market witnessed a significant decline in demand for grow lights compared to pre-pandemic levels.

However, as restrictions gradually eased, the market began to recover. During the prolonged periods of staying at home, many individuals, including work-from-home professionals and students, turned to gardening as a productive and stress-relieving activity. Indoor farming and vertical farming techniques, such as hydroponics, gained popularity for home gardening, particularly for growing vegetables. This trend led to a gradual increase in the demand for grow lights.

Once lockdown restrictions were fully lifted, the market experienced stabilization in demand. The normalization of supply chains and the resumption of regular shipments further facilitated the recovery of the grow light market, restoring the availability of grow light products to pre-pandemic levels.

Grow Light Market Regional Insights:

Europe

Europe led the grow light market in 2021, accounting for more than 32% of the revenue share, and is expected to maintain its dominance throughout the forecast period. The region's demand is fueled by the growing awareness of alternative farming solutions, driven by limited fertile agricultural land and increasing population.

Asia Pacific

The Asia Pacific region is expected to experience significant growth due to advancements in genetically modified crop technology and the increasing adoption of energy-efficient LED lights. Many countries in this region are transitioning from traditional incandescent lighting to LEDs to reduce energy consumption, which also contributes to lowering greenhouse gas emissions.

Africa

In Africa, the rising urban population and commercialization of indoor farming are driving market demand. However, challenges such as limited financial resources for building modern vertical farms and restricted access to water and land may hinder growth. To address these issues, the region has adopted innovative models, including vertically stacked wooden crates and sack gardens.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

- Agriculture Analytics Market: The global agriculture analytics market size was estimated at USD 6.49 billion in 2024 and is projected to grow at a CAGR of 14.4% from 2025 to 2030.

- Agricultural Robots Market: The global agricultural robots market size was estimated at USD 14.74 billion in 2024 and is projected to grow at a CAGR of 23.0% from 2025 to 2030.

Key Companies & Market Strategies

Major market players are leveraging strategies such as partnerships, acquisitions, and product innovation to strengthen their market position. For instance:

In December 2021, Signify Holding B.V. announced an agreement to acquire Fluence, the agricultural lighting division of Osram. This acquisition bolstered Signify's agricultural lighting business and expanded its presence in the North American horticulture lighting market.

Some prominent players in the global grow light market include:

- AeroFarms

- EVERLIGHT ELECTRONICS CO., LTD.,

- GAVITA Holland bv

- Heliospectra AB

- Hortilux Schréder

- Illumitex

- LumiGrow Inc

- Osram Licht AG

Order a free sample PDF of the Grow Light Market Intelligence Study, published by Grand View Research.