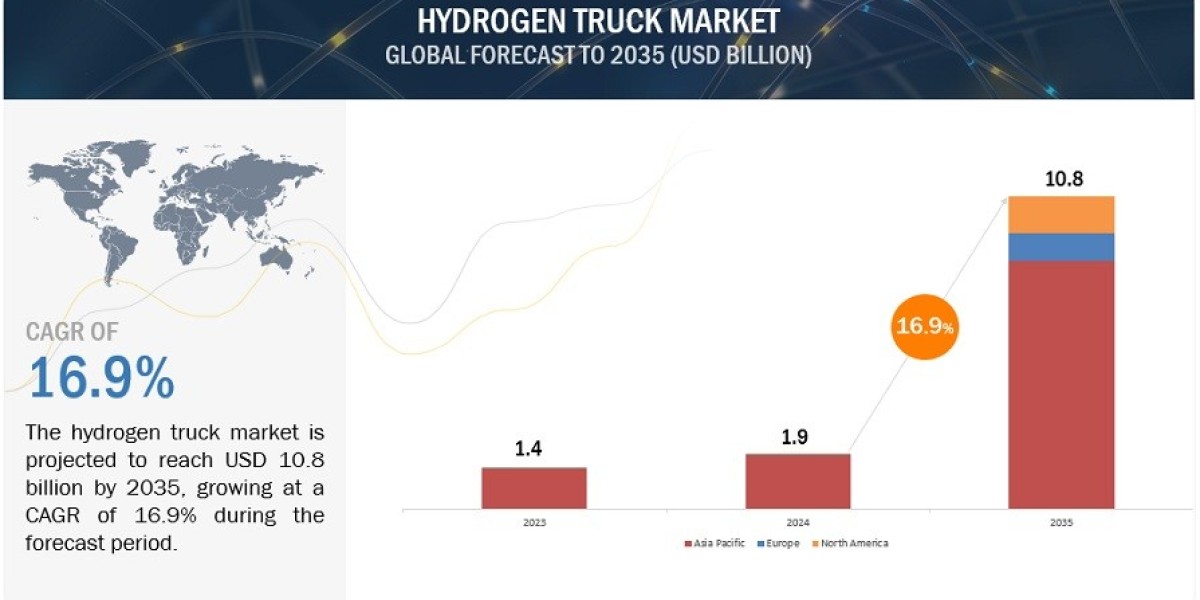

The global hydrogen truck industry size is projected to grow from USD 1.9 billion in 2024 to USD 10.8 billion by 2035 at a CAGR of 16.9% during the forecast period. The hydrogen truck market growth is driven by regulatory backing and government initiatives to develop and deploy hydrogen-powered vehicles. Exapnsion of hydrogen refueling instraucture and green hydrogen hubs is strengthening the market for hydrogen buses & trucks.

The above 400 kW segment includes hydrogen trucks from heavy-duty applications like long-haul trucks and high-performance buses. These vehicles' increased motor power enables them to transport huge loads over long distances while operating efficiently in difficult terrains such as steep slopes. These vehicles are marketed as high-end products prioritizing performance, dependability, and the capacity to withstand difficult operational circumstances. Heavy-duty trucks often need motors rated between 400 and 500 kW. OEMs, such as Nikola and Toyota, provide hydrogen-powered trucks with motors exceeding 400 kW. For example, the Nikola Tre and Toyota Hino trucks are powered by 750 and 450 KW, respectively. Because of its fast refueling time and long-range, hydrogen fuel cell technology is considered a long-haul trucking solution. North American initiatives are aimed at developing hydrogen corridors to adopt these vehicles.

Download Sample Pages @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=228367585

The demand for hydrogen-powered trucks and vehicles with a range of more than 500 miles is increasing as long-haul and heavy-duty transportation demands require longer range and operating efficiency. These hydrogen-powered commercial vehicles are utilized for cross-border freight, and long-distance intercity buses. Due to advancements in hydrogen storage and fuel cells, hydrogen buses and trucks can travel more than 500 miles while remaining highly efficient and durable. High-pressure hydrogen tanks and more efficient fuel cells allow these vehicles to store and use more hydrogen, extending their operational range. Wrightbus (UK) offers hydrogen-powered buses with a range of more than 500 miles. Furthermore, FAW Jiefang Automobile Co., Ltd. (China), Mercedes-Benz (Germany), and Nikola Corporation (United States) provide hydrogen-powered trucks with a range of more than 500 miles. For instance, in March 2024, Nikola Corporation (US) supplied 50 Nikola hydrogen fuel cell trucks to IMC Logistics. These trucks include innovative technology for an 805 km (500 mile) range and quick recharging, strengthening IMC's development into eco-friendly transportation in the US.

Asia Pacific is projected to be the largest market for hydrogen trucks, with China, South Korea, and Japan, leading the sector during the forecast period. Growth can be due to growing hydrogen car uptake and the growth of refueling infrastructure. China has the largest number of hydrogen refueling stations, followed by Japan. Governments in the region are promoting the hydrogen fuel cell technology and assisting key OEMs like as Foton International, Yutong Bus, Xiamen King Long, and Hyundai Motor. These OEMs are investing significantly in hydrogen refueling stations, with China expecting 5,000 fuel cell vehicles and Japan aiming for 900 stations by 2030. Companies are also building new facilities, such as Hyundai Mobis’s USD 1.1 billion investment in hydrogen fuel cell plants. The region's growing demand for green hydrogen and infrastructure developments offer substantial opportunities for companies to innovate and lead in the hydrogen truck market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=228367585