Introduction to Accounts Receivable Outsourcing

Accounts receivable (AR) represents a critical financial component for businesses, forming the counterpart to accounts payable. Without efficient AR management, businesses struggle to maintain cash flow, even when they produce top-quality products or sell numerous units. Simply put, unless payments are collected on time, the business cannot sustain itself. Conversely, accounts payable focuses on what the business owes to suppliers for goods and services purchased, highlighting the need to balance both for financial stability. Learn more about managing AR effectively through accounts receivable outsourcing.

In the United Kingdom, managing accounts receivable has grown increasingly complex due to advancements in technology and evolving regulations from HMRC. The era of manual bookkeeping is long gone, replaced by sophisticated digital tools and automated systems. These changes, while beneficial, also bring challenges, particularly for accounting practices striving to stay ahead of compliance requirements and technological trends. Among the various solutions available, such as bookkeeping outsourcing and AI-driven analytics, outsourcing accounts receivable has emerged as a highly effective strategy. This service, often offered as part of outsourced bookkeeping, is gaining traction for its efficiency and cost-effectiveness.

Explaining the Concept of Accounts Receivable

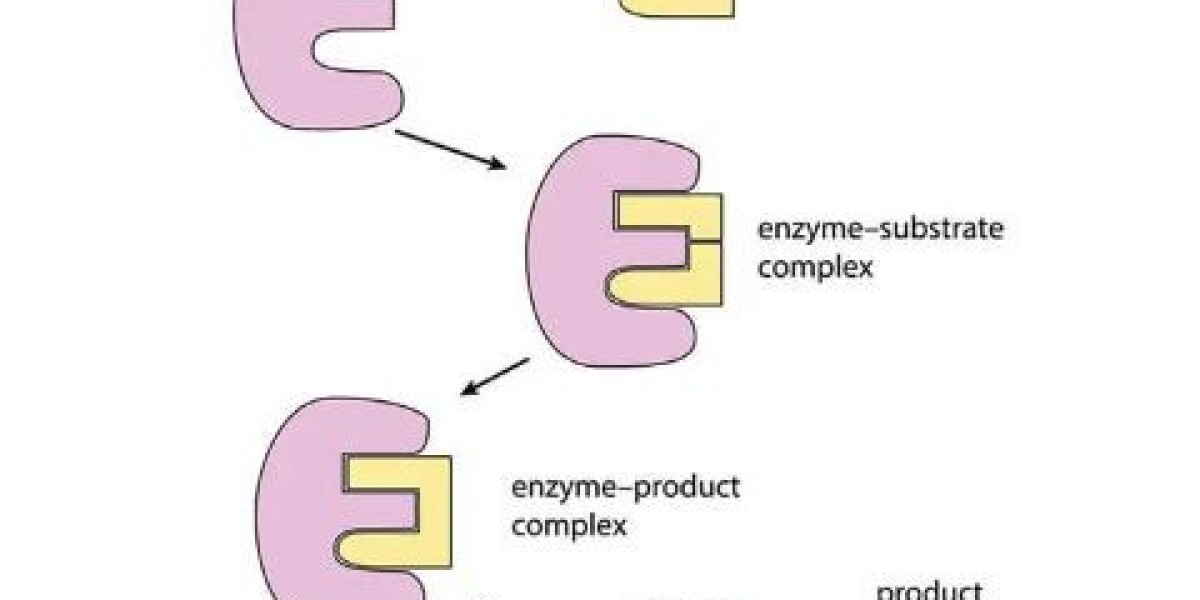

Accounts receivable is a vital financial metric, recorded as a current asset in accrual accounting. It reflects the money owed to a business by its customers for products or services delivered but not yet paid for. This metric provides a clear snapshot of a client’s financial standing, representing potential cash flow.

When both parties involved in a transaction adhere to agreed terms, AR is eventually converted into bankable cash. However, delays in customer payments can reduce the value of AR, negatively impacting cash flow. Traditionally, accounting practices have managed AR on behalf of businesses, but increasing complexities necessitate additional support. This is where accounts receivable outsourcing steps in, offering streamlined solutions for accounting practices and their clients. Explore other related solutions with our accounting outsourcing services.

The Importance of Managing Accounts Receivable Outsourcing

Outsourcing accounts receivable can unlock numerous benefits for both accounting practices and their clients. However, it’s crucial to approach the process thoughtfully to maximize these advantages and maintain client trust.

Before opting for outsourcing, conduct a thorough analysis of your client’s business cycle, including cycle timing, customer locations, total sales, and associated risks. Additionally, evaluate the supply chain and vendor relationships to ensure a smooth transition. Open communication with vendors and clients is essential to establish a foundation of trust and clarity.

Benefits of Accounts Receivable Outsourcing

Lowering Costs

One of the primary reasons businesses outsource AR is to reduce operational costs. By delegating AR management to specialized service providers, you eliminate the need to hire and train in-house staff for this function. This leads to significant cost savings while ensuring your clients receive expert support.Service providers bring deep expertise and economies of scale, allowing them to handle AR tasks more efficiently. This means your clients can focus on their core business activities, while you focus on strategic accounting responsibilities.

Leveraging Advanced Technology

Accounts receivable outsourcing providers invest heavily in cutting-edge technologies to overcome the challenges of data sharing and integration across platforms. These tools streamline processes, enhance accuracy, and provide real-time insights into your client’s financial status.From automation to advanced reporting platforms, service providers use these technologies to reduce labor costs and improve efficiency. Automation minimizes manual intervention, reducing errors and processing times. When choosing a service provider, prioritize those with robust technology capabilities to empower your clients with timely, accurate financial data.

Enhanced Flexibility

Business cycles are rarely consistent; seasonal peaks and fluctuations in sales cycles can lead to varying AR workloads. Managing these spikes internally requires maintaining a flexible workforce, which can be costly and time-consuming.Outsourcing solves this issue by providing scalable solutions. During periods of increased activity, service providers can handle the extra workload without requiring you to hire or train additional staff. This flexibility ensures uninterrupted service quality while keeping costs under control.

Focus on Core Activities

For many accounting practices, AR management is a non-core task. By outsourcing this function, you free up valuable time and resources to concentrate on activities that drive growth and profitability. This strategic shift allows your internal teams to focus on high-value tasks like advisory and consulting services, leaving routine AR tasks to experts.Improved Accuracy

Despite advancements in technology, manual intervention in AR processes can still lead to errors. Outsourcing mitigates this risk by leveraging the expertise of professionals who are adept at using the latest accounting software. These providers bring a high level of accuracy to AR management, reducing discrepancies and ensuring compliance with financial regulations.Additionally, outsourcing eliminates the learning curve associated with training new staff on advanced tools, allowing your clients to benefit from seamless, error-free processes.

Conclusion

Accounts receivable outsourcing offers a strategic solution to the complexities of modern AR management. By partnering with professional service providers, accounting practices can deliver superior results for their clients while optimizing their own operations.

At Corient UK, we specialize in providing tailored AR outsourcing services to accounting practices across the United Kingdom. Our experienced team combines deep expertise with advanced technology to streamline AR processes, enhance accuracy, and reduce costs. From bookkeeping and payroll outsourcing to audit and VAT services, we offer a comprehensive suite of solutions designed to transform your practice.

Ready to elevate your AR management? Visit our contact page and fill out the form to discuss your requirements. Our team will connect with you promptly to explore how we can support your success.