Planning a funeral is one of life’s most challenging tasks, both emotionally and financially. From selecting a burial or cremation option to arranging services and covering costs, families often face overwhelming decisions during a difficult time. Understanding funeral services, costs, and insurance options can provide peace of mind and ensure your loved ones are protected from unexpected expenses.

This article explores the essentials of funeral services, common costs, and how funeral or burial insurance can help families manage financial obligations.

Understanding Funeral Services

Funeral services encompass all activities related to honoring a person’s life after death. These services can vary widely based on cultural, religious, and personal preferences but typically include:

Preparation and embalming: Preparing the body for viewing or burial.

Casket or urn selection: Choosing the container for burial or cremation.

Ceremonial arrangements: Memorial services, viewings, or religious rituals.

Transportation: Moving the deceased and guests, including hearses or limousines.

Administrative and legal services: Death certificates, permits, and other paperwork.

By planning ahead and understanding these components, families can make informed choices that align with their values and budget.

For a detailed look at what goes into funeral costs, see this comprehensive guide: Funeral Costs Breakdown.

Types of Funeral Services

Funeral services generally fall into a few main categories:

1. Traditional Burial

Traditional burials involve embalming the body, placing it in a casket, and conducting a service at a funeral home or religious site. The body is then buried in a cemetery plot. This option provides a conventional and often ceremonial farewell.

2. Cremation

Cremation has grown in popularity due to its flexibility and affordability. Families may choose to hold a memorial service either before or after cremation. Cremated remains can be kept in an urn, scattered, or buried in a cemetery plot.

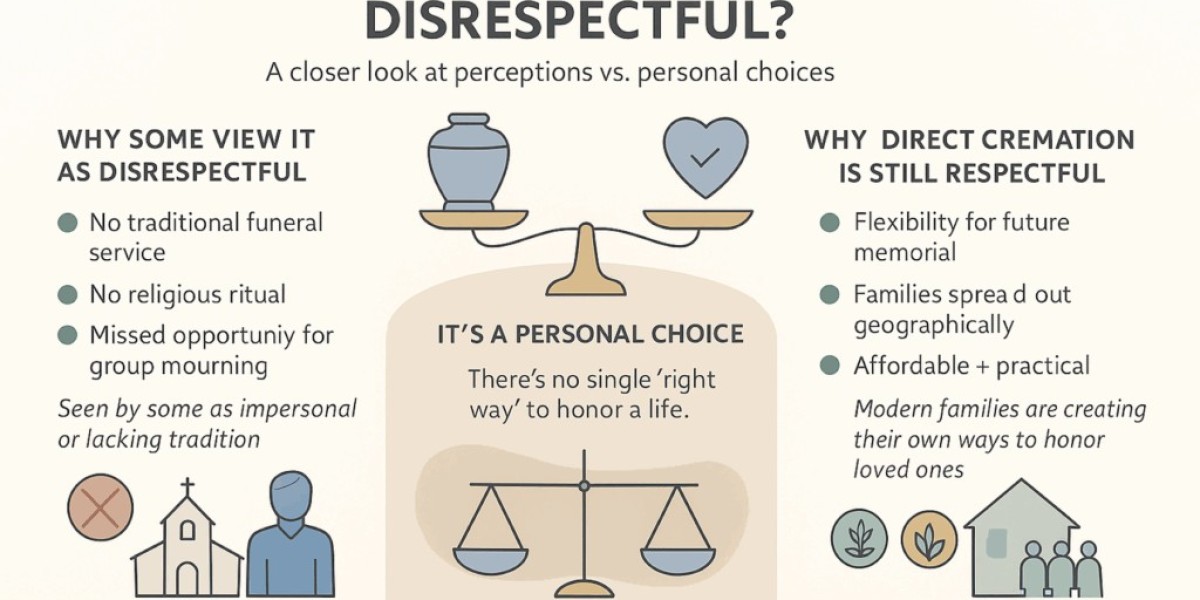

3. Direct Burial or Direct Cremation

These options skip ceremonies or viewings and focus on cost-efficiency. Direct services are increasingly chosen by families seeking a simple, respectful alternative. Coverage for these services can often be handled through specialized insurance plans.

Cost Considerations for Funeral Services

Funeral costs vary significantly based on the type of service, location, and personal choices. Common expenses include:

Casket or urn costs – Prices range widely depending on material and design.

Funeral home fees – Preparation, staff, and facility usage are billed separately.

Cemetery charges – Burial plots, grave opening and closing fees, and perpetual care.

Memorial service expenses – Flowers, printed programs, and catering for gatherings.

Transportation – Hearses, limousines, and sometimes flights for transporting the deceased.

On average, funeral expenses can range from a few thousand to over ten thousand dollars, depending on choices and location. Proper planning helps prevent financial strain during an emotionally difficult time.

For more guidance on the financial aspects of funerals and cost management strategies.

The Role of Funeral and Burial Insurance

Funeral and burial insurance are specialized insurance policies designed to cover funeral-related expenses. Unlike traditional life insurance, these policies focus on small to medium-sized death benefits specifically allocated for final expenses.

Benefits of Funeral and Burial Insurance

Financial Relief for Loved Ones – Ensures that family members are not burdened with unexpected costs.

Pre-planning Flexibility – Policyholders can select coverage amounts to match anticipated expenses.

Simple Qualification – Many plans do not require extensive medical exams.

Direct Payouts – Benefits are typically paid directly to beneficiaries or funeral homes.

Funeral insurance is especially valuable for seniors, individuals with pre-existing conditions, or those who want to ease the financial burden on their families.

Learn more about how burial insurance can protect your family’s finances: Burial Insurance Options.

Planning a Funeral in Advance

Advance planning provides multiple benefits:

Financial Planning – Helps allocate funds ahead of time and avoid surprise expenses.

Personalized Services – Ensures that your wishes regarding ceremonies, burial type, or cremation are respected.

Stress Reduction – Provides peace of mind to both the individual and family members.

Pre-planning can be done through funeral homes, online platforms, or with the support of insurance policies like burial or final expense insurance. Early planning also allows for comparing providers and costs to ensure the most appropriate services.

Tips for Managing Funeral Expenses

Compare Options – Consider multiple funeral homes and service providers for price and services.

Decide on Burial vs. Cremation – Cremation often reduces costs and provides flexibility.

Consider Direct Services – Direct burial or cremation can be cost-effective without compromising respect.

Use Insurance Wisely – Align your funeral or burial insurance with anticipated expenses.

Document Wishes Clearly – Ensure family members know your preferences to avoid confusion and emotional stress.

Why Planning Matters

Funerals are about honoring life while managing practical necessities. Planning in advance and understanding costs, service types, and insurance options allows families to focus on remembrance and healing rather than finances.

By combining knowledge of funeral services with tools like burial insurance, families can ensure a smooth and respectful process. Coverage can be tailored to meet both financial and ceremonial preferences, making the planning process easier and more predictable.

Conclusion

Funeral services involve significant emotional and financial considerations. By understanding the types of services, associated costs, and the role of insurance, families can make informed decisions that provide peace of mind and financial security.

Whether you are planning ahead for yourself or supporting a loved one, funeral and burial insurance can cover essential expenses and help avoid unnecessary financial strain. For guidance on typical funeral costs and how insurance can provide protection, explore these resources: Funeral Costs Breakdown and Burial Insurance Options.