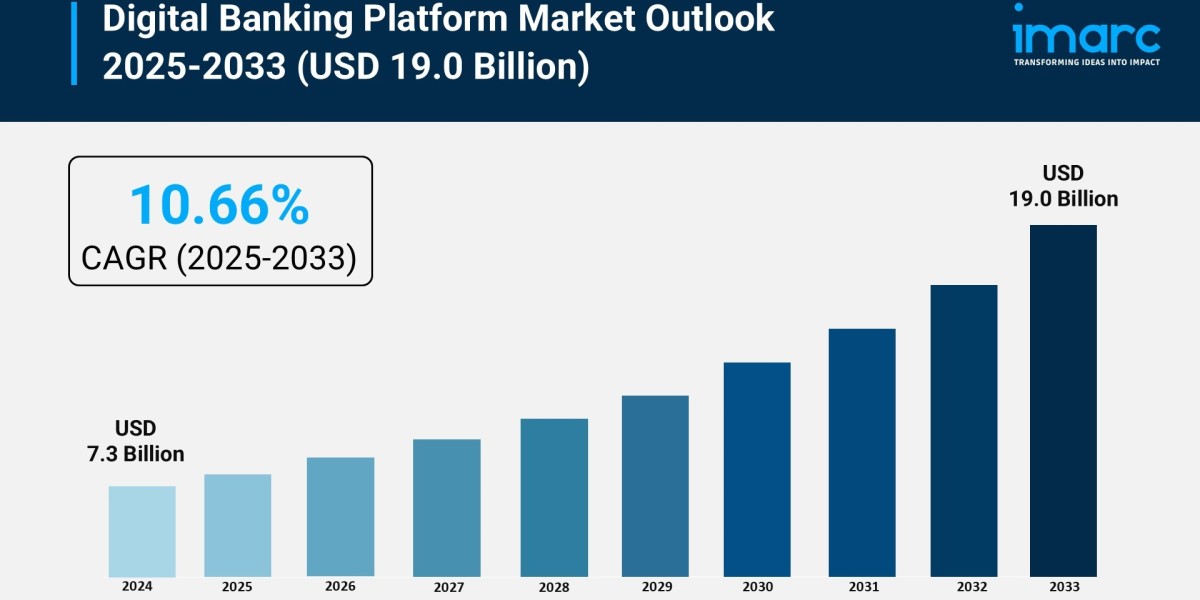

Market Overview:

The digital banking platform market is experiencing rapid growth, driven by rising demand for personalized banking experiences, expansion of financial inclusion initiatives, and advancements in cloud-based technologies. According to IMARC Group's latest research publication, "Digital Banking Platform Market Report by Component (Solutions, Services), Type (Retail Banking, Corporate Banking), Deployment Mode (On-premises, Cloud-based), Banking Mode (Online Banking, Mobile Banking), and Region 2025-2033", the global digital banking platform market size reached USD 7.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.0 Billion by 2033, exhibiting a growth rate (CAGR) of 10.66% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Download a sample PDF of this report: https://www.imarcgroup.com/digital-banking-platform-market/requestsample

Growth Factors in the Digital Banking Platform Market

- Rising Demand for Personalized Banking Experiences

The growth of personalized banking services is a major factor driving demand for digital banking services. Today, bank customers expect to receive personalized financial advice, make individualized product selections, and enjoy a seamless, looped user experience. Digital banking platforms utilize customer data and artificial intelligence (AI) to detect user behavior and to deliver hyper-personalized services. For instance, Chime is a U.S.-based neobank that uses AI to provide real-time spending insights, and automated savings tools that resonate with younger users. This personalization and customization develop customer loyalty while also attracting new users - resulting in traditional banking institutions investing in digital banking platforms to remain competitive. Defaulting onto customer expectations, platforms that prioritize personalization will continue to expand the banking market.

- Expansion of Financial Inclusion Initiatives

Digital banking platforms are pivotal in promoting financial inclusion, particularly in underserved regions. By offering low-cost, accessible banking services through mobile apps, these platforms reach unbanked and underbanked populations. For example, M-Pesa in Kenya has transformed financial access by enabling mobile-based transactions for millions without traditional bank accounts. Governments and financial institutions worldwide are supporting such initiatives to bridge economic gaps, boosting the adoption of digital banking solutions. This focus on inclusivity not only expands the customer base for digital platforms but also aligns with global sustainable development goals, fueling market growth.

- Advancements in Cloud-Based Technologies

Cloud technology is the revolutionizing of digital banking because it enables scalable, secure, and cost-effective platforms. By utilizing cloud-based solutions, banks can deploy new features faster, incorporate third-party services easier, and make the volume of transactions easier to handle. For example, in the UK, Starling Bank has yet to experience a hiccup in banking services due to the blurred lines of cloud and physical infrastructure. This flexible approach helps banks streamline their operational costs, and provide a better customer experience. Furthermore, cloud platforms help banks comply with strict data security regulations, which helps build consumer trust and confidence in areas where data safety is the primary concern. As banks continue to move to cloud environments, the demand for digital banking platforms that leverage these technologies continues to increase resulting in a positive driver for market growth.

Key Trends in the Digital Banking Platform Market

- Integration of Artificial Intelligence and Machine Learning

AI and machine learning (ML) are allowing digital banking platforms to improve efficiency and build engagement with consumers. Many of the tools that help to do this are powered by AI and machine learning, enabling chatbots, fraud detection systems, and predictive capability. For example, at Bank of America, a virtual assistant named Erica was launched which has AI behind it to offer customized financial advice to its millions of users. Fraud-detection systems that are powered by AI also eliminate some of the risks that are traditionally fronted by banks as some transactions can be flagged as suspicious in real time. As banks begin to face intense competition from both traditional and non-traditional financial services firms, they have invested heavily in AI with an aim to differentiate their platforms in an effort to stay competitive. This trend not only affects the operational efficiencies of banks, but also increases customer satisfaction, meaning that the integration of AI is fast becoming a staple of current and future digital banking platforms.

- Growth of Open Banking Ecosystems

Open banking is a transformative trend in the digital banking space, including the regulation in Europe for open banking in PSD2 regulatory framework. Open banking enables new third-party providers to access bank data (with customer consent) to develop new, innovative services. For example, UK-based Revolut is using open banking APIs to access bank transaction data, which allows users to access a single view of their finances, spanning many different account providers. Open banking enables greater collaboration between banks and fintechs and creates a more vibrant ecosystem of financial products. Open banking allows greater consumer choice and convenience, and banks can take advantage of open banking in order to adopt platforms that enable easy API integration, which shapes the new digital banking space.

- Emphasis on Sustainability and ESG Integration

Sustainability is becoming a key focus in digital banking, with platforms incorporating environmental, social, and governance (ESG) principles. Customers, especially millennials and Gen Z, prefer banks that align with their values, such as supporting green initiatives. For example, Aspiration, a U.S.-based digital bank, offers eco-friendly accounts that track carbon footprints and invest in sustainable projects. Digital platforms enable banks to transparently showcase their ESG commitments, attracting socially conscious consumers. This trend is prompting banks to integrate ESG metrics into their digital offerings, driving innovation and differentiation in a competitive market.

Leading Companies Operating in the Global Digital Banking Platform Industry:

- Appway AG (FNZ (UK) Ltd.)

- Fidelity Information Services (FIS)

- Finastra Limited

- Fiserv Inc.

- Infosys Limited

- nCino

- NCR Corporation

- Oracle Corporation

- SAP SE

- Sopra Steria

- Tata Consultancy Services Limited

- Temenos AG

- The Bank of New York Mellon Corporation

- Worldline

Digital Banking Platform Market Report Segmentation:

By Component:

- Solutions

- Services

Solutions represent the largest segment on account of their flexible and customizable offerings to financial institutions.

By Type:

- Retail Banking

- Corporate Banking

Retail banking holds the biggest market share, driven by the rising demand for convenient and personalized banking services.

By Deployment Mode:

- On-premises

- Cloud-based

On-premises account for the largest market share due to their ability to cater to the specific needs and preferences of financial institutions that prioritize maintaining control and security over their infrastructure and data.

By Banking Mode:

- Online Banking

- Mobile Banking

Online banking exhibits a clear dominance in the market as it enables financial institutions to offer a wide range of services to individuals through digital channels.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys a leading position in the digital banking platform market, which can be attributed to the thriving banking sector.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

![RTL+ Geo-Restriction: Best VPN Solutions [2024]](https://biiut.com/upload/photos/2025/11/6mESPJRQGs52WHWXBs9r_03_34afd1df8cf3fcc9eef31517bcf860c6_image.png)