Market Overview:

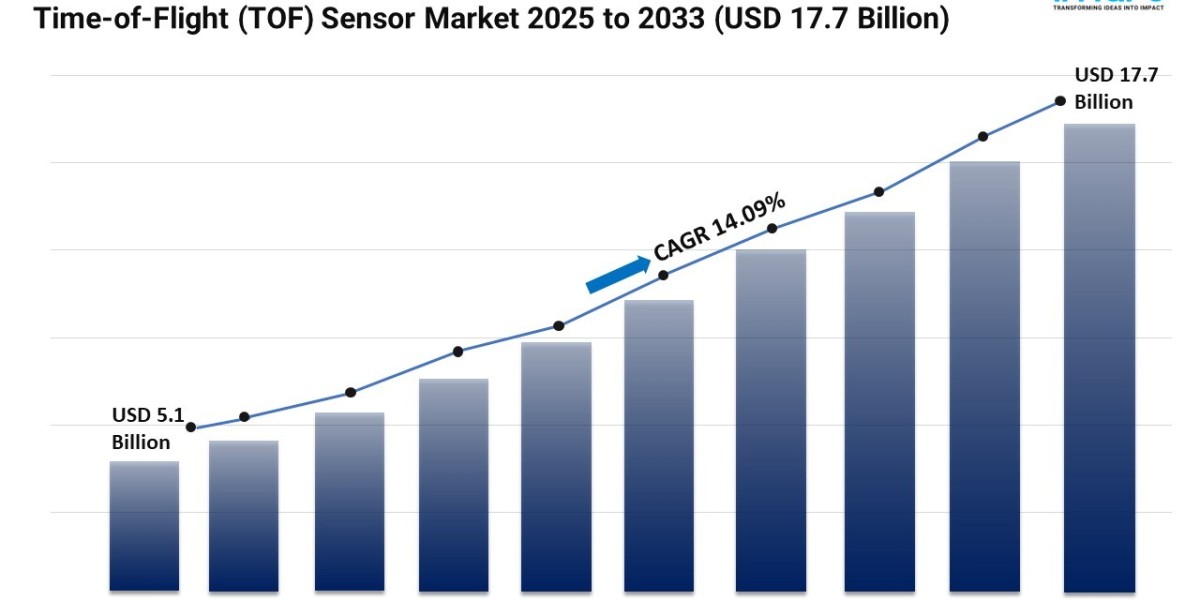

The Time-of-Flight (TOF) Sensor Market is experiencing significant expansion, driven by The Rising Integration in Consumer Electronics, Growing Adoption in Automotive Safety Systems, and Increasing Demand for Industrial Automation. According to IMARC Group's latest research publication, "Time-of-Flight (TOF) Sensor Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The global time-of-flight (ToF) sensor market size was valued at USD 5.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 18.1 Billion by 2034, exhibiting a CAGR of 13.39% from 2026-2034.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/time-of-flight-sensor-market/requestsample

Our Report Includes:

- Market Dynamics

- Market Trends and Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Time-of-Flight (TOF) Sensor Industry:

- The Rising Integration in Consumer Electronics

The adoption of Time-of-Flight (ToF) sensors in consumer electronics is accelerating as brands seek to enhance camera performance and interactive device features. Smartphones, tablets, and laptops now integrate ToF modules for advanced depth sensing that enables 3D imaging, secure facial authentication, and intuitive gesture control. These sensors significantly improve autofocus speed, low-light performance, and spatial accuracy, aligning with rising consumer expectations for high-quality imaging and AR-enabled applications. As digital content creation surges and immersive experiences gain popularity, manufacturers are embedding ToF technology in their flagship and mid-range products. With the continued expansion of global smartphone penetration and demand for smarter devices, ToF sensor integration in consumer electronics is expected to become a standard design feature in the coming years.

- Growing Adoption in Automotive Safety Systems

The automotive industry is quickly integrating ToF sensors as part of advanced safety, automation, and driver-monitoring systems. These sensors enhance core ADAS functions such as collision detection, lane-change assistance, and adaptive cruise control by providing highly accurate depth perception in real time. Inside the cabin, ToF sensors enable driver drowsiness monitoring, gesture-based infotainment control, and precise occupant detection to support airbag optimization. As EVs and autonomous vehicles proliferate, automakers require compact, robust, and weather-resilient sensors capable of delivering consistent performance. With mobility ecosystems shifting toward fully connected, intelligent vehicles, ToF sensors are becoming essential for achieving reliable situational awareness and improved passenger safety.

- Increasing Demand for Industrial Automation

Industries worldwide are deploying ToF sensors to improve automation accuracy, enhance operational safety, and optimize productivity. These sensors support non-contact distance measurement, 3D scene analysis, and object detection—capabilities critical for robotic arms, advanced inspection systems, and automated manufacturing lines. Their reliability in challenging environments with fluctuating lighting or extreme temperatures makes them indispensable for modern factory operations. In logistics and warehousing, ToF technology enables navigation of AGVs, real-time pallet tracking, and smart inventory systems. As Industry 4.0 and AI-enabled automation continue to advance, demand is rising for durable, high-speed ToF sensors that seamlessly integrate with industrial IoT platforms and digital-twin ecosystems.

Key Trends in the Time-of-Flight (ToF) Sensor Market

- Growth of AI-Enhanced 3D Perception Systems

AI integration is reshaping ToF capabilities by enabling more intelligent 3D scene interpretation. Machine learning models now analyze ToF depth data to improve object segmentation, body tracking, spatial mapping, and gesture recognition. This combination allows devices—ranging from drones to consumer wearables—to interpret surroundings with far greater accuracy. AI-enhanced ToF systems are becoming critical for autonomous navigation, smart home interactions, and immersive entertainment applications. As edge AI hardware becomes more efficient, on-device 3D perception powered by ToF is expected to expand rapidly.

- Miniaturization and On-Chip Integration for Compact Devices

Manufacturers are focusing on shrinking ToF modules and integrating them directly into SoC architectures to support compact consumer electronics and IoT devices. These innovations reduce power consumption, improve thermal efficiency, and enable slimmer designs without compromising sensing performance. On-chip integration also lowers manufacturing costs and simplifies system design for OEMs. This miniaturization trend is particularly important for AR glasses, wearables, smart doorbells, and compact robotics where space constraints are critical. As devices continue to evolve toward lightweight and portable formats, ultra-compact ToF solutions will play a major role in driving wider market adoption.

- Expanding Use in Smart Retail, Public Safety, and Automation Infrastructure

ToF sensors are increasingly being adopted in smart environments that require accurate, real-time spatial awareness. Retailers use ToF-based systems for automated checkout counters, customer flow analysis, and interactive digital signage. In public safety, the technology supports advanced surveillance, crowd-density monitoring, and perimeter detection. Smart buildings integrate ToF sensors for energy-efficient lighting, HVAC automation, and occupancy-based access control. These applications benefit from ToF’s ability to deliver depth information with high precision while maintaining low latency. As IoT-enabled infrastructure expands globally, ToF sensors are emerging as a key enabler of intelligent, automated environments across both commercial and civic sectors.

The time-of-flight (tof) sensor market forecast offers insights into future opportunities and challenges, drawing on historical data and predictive modeling.

Leading Companies Operating in the Global Time-of-Flight (TOF) Sensor Industry:

- Adafruit Industries

- ams-OSRAM AG

- Broadcom Inc.

- Infineon Technologies AG

- Keyence Corporation

- Omron Corporation

- Panasonic Corporation

- Sentric Controls Sdn Bhd

- Sharp Corporation

- Sony Semiconductor Solutions Corporation

- STMicroelectronics

- Texas Instruments Incorporated

Time-of-Flight (TOF) Sensor Market Report Segmentation:

Breakup by Type:

- RF-Modulated Light Sources with Phase Detectors

- Range-Gated Imagers

- Direct Time-of-Flight Imagers

Range-gated imagers dominate the market owing to their exceptional capacity to produce high-contrast images in low-light or intricate settings and their ability to distinguish signals from particular distances.

Breakup by Application:

- Augmented Reality and Virtual Reality

- LiDAR

- Machine Vision

- 3D Imaging and Scanning

- Robotics and Drone

3D imaging and scanning hold the biggest market share as they play a vital role in improving accuracy, speed, and depth perception in numerous devices and systems across consumer electronics, automotive, and industrial sectors.

Breakup by End User:

- Consumer Electronics

- Automotive

- Entertainment and Gaming

- Industrial

- Healthcare

- Others

Consumer electronics represent the largest segment, accounting for 23.5% of the market share, due to the increasing demand for sophisticated features such as facial recognition, AR, 3D imaging, and gesture-based controls.

Breakup by Region:

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- North America (United States, Canada)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific leads the market with 30.0% of the market share due to its robust electronics production foundation, extensive use of smart technologies, and ongoing improvements in semiconductor performance.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201-971-6302