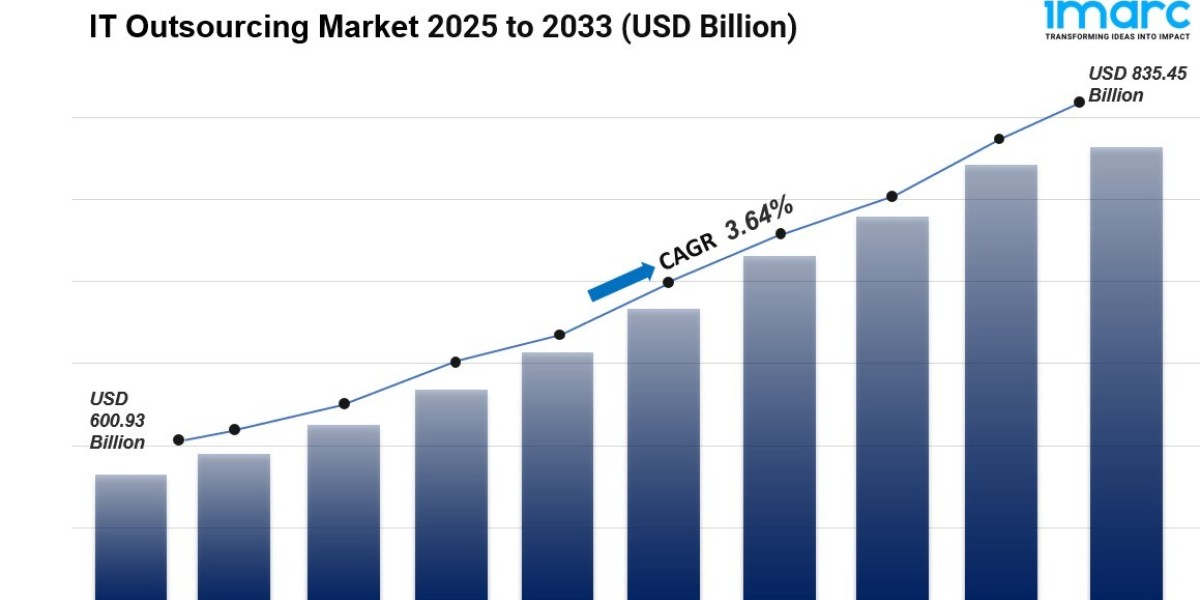

The global IT Outsourcing Market was valued at USD 600.93 Billion in 2024 and is projected to reach USD 835.45 Billion by 2033. It is expected to grow at a CAGR of 3.64% during the forecast period 2025-2033. Market growth is driven by cost-effective solutions, rapid technology advancements such as AI, cloud computing, and big data analytics, and the increasing need for scalable and flexible IT infrastructure.

The global IT outsourcing market continues to expand as organizations increasingly prioritize cost efficiency, scalability, and access to specialized expertise. IT Outsourcing Market size indicate a strong shift toward cloud-based service models, automation, and digital transformation initiatives across industries. Companies are outsourcing functions such as application development, cybersecurity, infrastructure management, and data analytics to enhance operational agility. The rise of AI-driven tools and managed services is further reshaping vendor capabilities and service delivery models. Additionally, nearshoring and hybrid outsourcing approaches are growing as businesses seek greater flexibility, faster turnaround, and improved collaboration. Overall, the market is poised for steady growth driven by technological innovation and strategic digital investments.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

IT Outsourcing Market Key Takeaways

- Current Market Size: USD 600.93 Billion in 2024

- CAGR: 3.64% during 2025-2033

- Forecast Period: 2025-2033

- North America holds the largest market share with 33.8% in 2024.

- Increasing pressure to minimize expenses and enhance profitability drives market expansion.

- Adoption of advanced technologies such as AI and cloud computing pushes demand for outsourcing.

- The BFSI sector leads market share by end user in 2024, driven by cybersecurity and FinTech innovations.

- The SaaS model leads the market by service model due to cost-effectiveness and scalability.

Download a sample PDF of this report: https://www.imarcgroup.com/it-outsourcing-market/requestsample

Market Growth Factors

The IT outsourcing market is primarily propelled by the growing need for cost-effective solutions aimed at reducing operational expenses across businesses globally. Organizations face increasing pressure to enhance profitability by minimizing internal IT overheads, which outsourcing solutions effectively address. The significant uptake of advanced technology such as artificial intelligence (AI), cloud computing, and big data analytics compels companies to depend on specialized external expertise. For example, 65% of organizations regularly use generative AI in at least one business function, and 72% have adopted AI overall, reflecting the urgency to keep pace with technological changes without in-house resource strain.

Access to specialized skills and cutting-edge technologies not typically available in-house greatly fuels the market growth. Recruiting and training for emerging tools and software is time-consuming and costly for organizations. Outsourcing allows companies to leverage skilled professionals who remain updated with the latest innovations—ensuring businesses stay competitive without the extensive costs of continuous training or equipment investment. This availability of specialized technical expertise drives enterprises towards third-party service providers.

Scalability and flexibility constitute another critical growth factor. Volatile market conditions require companies to adapt IT infrastructure promptly, whether scaling up due to increased workload or scaling down to manage costs effectively. Unlike traditional internal IT departments, outsourcing offers flexible, modular solutions that can rapidly adjust to business needs. This agility is especially advantageous for cyclical industries and those experiencing rapid growth. Additionally, the rising need to focus on core competencies leads many companies, especially SMEs and large enterprises, to delegate their IT functions to external specialists to improve operational efficiency and concentrate on strategic objectives.

Market Segmentation

Analysis by Service Model:

- Software as a Service (SaaS): The largest component in 2024, SaaS offers subscription-based pricing eliminating upfront hardware/software investments, ensuring cost-effectiveness, scalability, rapid deployment, and superior security compared to in-house IT.

- Platform as a Service (PaaS): Not elaborated specifically, but included as a key service model segment.

- Infrastructure as a Service (IaaS): Included as a fundamental IT outsourcing service delivery model.

Analysis by Organization Size:

- Small and Medium-sized Enterprises: A fast-growing segment driven by budget limitations, lack of in-house resources, and the complexity of technology environments. Outsourcing provides SMEs with cost-effective access to external ICT expertise, enabling growth without recruitment or training costs and offering scalability to meet demand increases.

- Large Enterprises: Characterized by operational complexity and digital transformation ambitions. Outsourcing allows offloading certain IT functions, focusing on strategic goals, mitigating risks related to data security and compliance, and facilitating access to emergent technology expertise without bearing training costs.

Analysis by End User:

- BFSI (Banking, Financial Services, and Insurance): The leading segment in 2024. Demand driven by cybersecurity needs, risk management, and compliance with regulations. FinTech innovations requiring specialized IT skills, such as blockchain and AI-driven analytics, also boost outsourcing demand.

- Healthcare: Not specifically detailed but included in end-users.

- Media and Telecommunications: Included as an end-user.

- Retail and E-commerce: Included as an end-user.

- Manufacturing: Included as an end-user.

- Others: Additional user sectors covered.

Regional Insights

North America dominates the IT outsourcing market with 33.8% market share in 2024. Its growth is bolstered by accelerated adoption of cloud technologies, digital transformation initiatives, and increasing demand for cost-effective, high-quality IT services. Companies in the region are outsourcing to focus on core activities, reduce costs, and mitigate cybersecurity risks through specialized providers. Growing remote work trends further enhance the necessity for robust outsourced IT infrastructure.

Recent Developments & News

- August 2024: Sonata Software was selected as a strategic IT outsourcing partner by a US-based premier healthcare and wellness company, focusing on cost efficiencies, engineering modernization, AI, and hyper-automation.

- February 2024: Accenture announced plans to acquire Insight Sourcing, a strategic sourcing and procurement services provider aimed at optimizing client costs.

- January 2024: DashDevs LLC acquired Ukrainian outsourcing company ITOMYCH STUDIO, enhancing fintech innovation and market presence.

- June 2023: Infosys secured a USD 454 million digital transformation deal with Denmark's Danske Bank, acquiring its India-based IT center.

Key Players

- Accenture plc

- Capgemini SE

- Dell Technologies Inc.

- DXC Technology Company

- Fujitsu Limited

- International Business Machines Corporation

- Nippon Telegraph and Telephone Corporation

- Specialist Computer Centres (SCC)

- Wipro Limited

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=5860&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302