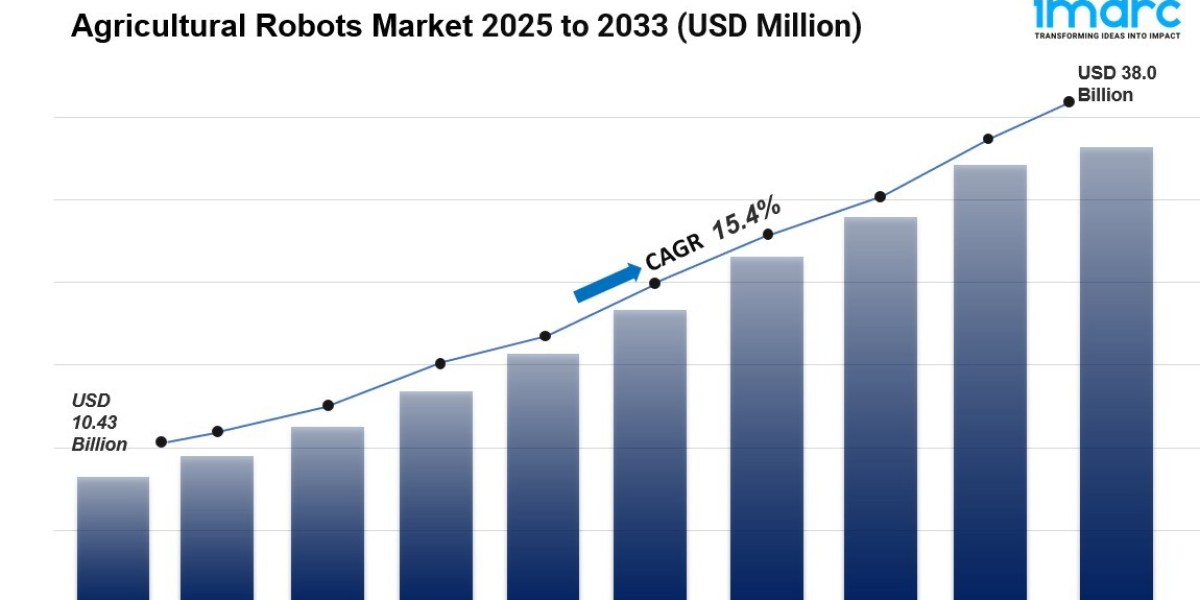

The global Agricultural Robots Market was valued at USD 10.43 Billion in 2024 and is projected to reach USD 38.0 Billion by 2033, growing at a CAGR of 15.4% during the forecast period of 2025-2033. The market is primarily driven by technological advancements, increased automation in agriculture, and significant investments in innovation worldwide. North America leads the market share due to its advanced technological infrastructure and adoption of automated farming solutions.

The Agricultural Robots Market Share is expanding rapidly as automation and digitalization transform modern farming practices. Agricultural robots—commonly known as agribots—are increasingly deployed to enhance productivity, reduce labor dependency, and improve precision in activities such as harvesting, planting, crop monitoring, irrigation, and livestock management. Rising labor shortages, the need for sustainable farming, and the adoption of smart agriculture technologies are key drivers accelerating market growth. Advancements in AI, machine vision, and autonomous navigation are enabling the development of more efficient and reliable robotic solutions. As major players introduce next-generation robots and farmers invest in precision tools, the agricultural robots market is set to witness strong adoption across large farms, greenhouses, and specialty crop cultivation over the coming years.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Agricultural Robots Market Key Takeaways

- Current Market Size: USD 10.43 Billion in 2024

- CAGR: 15.4% from 2025 to 2033

- Forecast Period: 2025-2033

- North America dominated with a 35.2% market share in 2024, driven by advanced technology and labor shortages.

- Automated harvesting systems made up 43.7% of the market in 2024, being the largest product type segment.

- Field farming accounted for 39.2% share by application, driven by efficiency improvements and eco-friendly farming.

- Hardware dominated the offering category, holding 71.7% market share in 2024, due to its critical role in robot operations.

- Rising demand for sustainable agriculture and precision farming technologies fosters market growth.

- The increasing shortage of skilled labor globally fuels adoption of autonomous agricultural robots.

Download a sample PDF of this report: https://www.imarcgroup.com/agricultural-robots-market/requestsample

Market Growth Factors

The biggest market driver is the shortage of labor supply. A survey of over 300 respondents showed that 76% of companies reported that labor shortages are increasing in multiple agricultural skilled occupations. The number of farm labor jobs is declining too. Farmers invest in autonomous robots that plant, weed, and harvest crops to produce more and cost less globally.

Because of rapidly advancing technologies such as robotics, automation, and artificial intelligence, agricultural robotics can identify crops and weeds with computer vision and machine learning, control weeds well, navigate in an advanced manner, and move through fields very accurately, since robots use sensors. Multispectral imaging and camera sensors provide real-time crop information, allowing agricultural robots to make more advanced decisions and become more efficient.

Additionally, growing environmental concerns and sustainability efforts have driven growth in the market as agriculture has historically overused fertilizers, pesticides, and water. Agricultural robots allow farmers to use some of these inputs more precisely as well, reducing runoff and waste. Robots which perform precision spraying can apply a required amount of pesticide to a specific region, and robotic irrigation can apply a required amount of water.

Market Segmentation

By Product Type:

- Unmanned Aerial Vehicles (UAVs)/Drones

- Milking Robots

- Automated Harvesting Systems

- Driverless Tractors

- Others

Automated harvesting systems, the largest segment at 43.7% in 2024, quickly and accurately gather crops such as fruits, vegetables, and grains, reducing labor and damage, while using AI and vision technologies for adaptability.

By Application:

- Field Farming

- Dairy Farm Management

- Animal Management

- Soil Management

- Crop Management

- Others

Field farming commands 39.2% market share in 2024. Robots handle planting, weeding, and harvesting while integrating AI and sensors to optimize water and fertilizer use, supporting high crop yields and sustainable farming.

By Offering:

- Hardware

- Software

- Services

Hardware dominates with 71.7% share in 2024, including drones, milking machines, automated harvesters, autonomous tractors, sensors, and robotic limbs. These are essential for performing specific agricultural tasks effectively.

Regional Insights

North America is the dominant region, holding over 35.2% market share in 2024. The region benefits from a highly advanced agricultural industry, sophisticated technology adoption, and significant labor shortages spurring the use of agricultural robots. It houses key manufacturers and research organizations driving innovation. For example, Niqo Robotics launched the AI-driven RoboThinner with 97% accuracy in lettuce thinning, significantly reducing labor needs.

Recent Developments & News

- November 2024: Fieldwork Robotics Ltd. partnered with Burro to launch the Fieldworker 1 robot, aimed at raspberry harvest labor shortage reduction through a flexible autonomous platform.

- July 2024: Agricobots project developed the VinyA ST-4030 vineyard spraying robot designed for steep and slippery terrain, enhancing viticulture safety and efficiency.

- March 2024: SIZA Robotics introduced TOOGO, a fully electric autonomous agricultural robot for vegetable and beet crops, commercial release planned for 2025.

- February 2024: A Kota teen developed the AI-powered AgRobot for soil health, crop conditions, water requirement assessments, and pest detection, earning the Pradhan Mantri Rashtriya Bal Puraskar.

Key Players

- Deere & Company

- Trimble Inc.

- Agco Corporation

- Lely Holding S.À.R.L

- AG Eagle LLC

- Agribotix LLC

- Agrobot

- Harvest Automation

- Naio Technologies

- Precision Hawk

- IBM

- Agjunction, Inc.

- DJI

- Boumatic Robotics, B.V.

- AG Leader Technology

- Topcon Positioning Systems, Inc.

- Autocopter Corp

- Auroras S.R.L.

- Grownetics Inc.

- Autonomous Tractor Corporation

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=1200&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302