Introduction

The Middle East and Africa (MEA) Lithium Ion Battery Market covers the demand, production, import activity, assembly, system integration, recycling, and deployment of rechargeable lithium ion batteries used in mobility systems, industrial energy storage, consumer devices, telecom infrastructure, grid balancing, renewable energy backup units, and specialized power systems. Lithium ion batteries (Li-ion) are lightweight, high-energy-density power units capable of fast charging, low self-discharge, stable cycle life, and compact modular integration. They are available in cylindrical, pouch, and prismatic formats, with chemistries including LFP (lithium iron phosphate), NMC (nickel manganese cobalt), LMO (lithium manganese oxide), and emerging solid-enhanced blends.

The MEA region is strategically important due to rapid electrification demand, renewable energy expansion, 5G telecom investment, urban EV infrastructure planning, harsh-climate performance requirements, micro-grid deployment, and long logistics corridors that need reliable off-grid power. Li-ion systems support national clean-energy programs, solar backup for rural electrification, mining vehicle electrification, port equipment decarbonization, last-mile logistics fleets, power banking units, smart metering grids, telecom towers, and emergency power paths.

Learn how the Middle East and Africa (MEA) Lithium Ion Battery Market is evolving—insights, trends, and opportunities await. Download report: https://www.databridgemarketresearch.com/reports/middle-east-and-africa-lithium-ion-battery-market

The Evolution

Global Li-ion Foundation (1970s–2012)

Lithium ion batteries emerged through foundational electrochemistry research in the 1970s. Sony commercialized the first mass-market Li-ion cell in 1991, enabling lightweight rechargeable power. For two decades, adoption centered on consumer electronics, laptops, and early industrial devices.

Electrification Trigger (2013–2017)

The global EV industry and energy storage systems (ESS) scaled Li-ion production dramatically. NMC cells dominated high-performance mobility. LFP cells rose in cost-competitive energy storage due to safety and thermal stability.

MEA Early Market Stage (2016–2020)

The MEA region’s Li-ion adoption first scaled through telecom tower backup systems, solar home systems, and UPS replacements. Battery imports from Asia supplied most regional demand. Harsh temperature sensitivity pushed interest in thermal-stable chemistries.

Modern MEA Transformation Cycle (2021–2025)

National energy diversification plans accelerated electrification. EV charging corridors in GCC nations expanded battery-dependent mobility programs. Africa’s solar-storage uptake increased rapidly for rural electrification, micro-grids, and commercial backup. Logistics companies piloted electric fleets. Oil and gas operators began electrifying low-emission operations vehicles and port equipment. Recycling conversations gained policy support.

Key Innovations in MEA

High-temperature-resilient LFP packs

Modular ESS cabinets for solar farms

Telecom battery hybridization (diesel-offset tower backup packs)

Fast-charge enabled NMC modules for urban EV clusters

BMS (battery management system) localization with multi-sensor telemetry

Anti-thermal-runaway protection packs

Mining vehicle electrification-grade Li-ion modules

Early solid-enhanced and solid-state hybrids in pilot form

Battery banking kiosks for low-grid regions

Global innovation set the stage. MEA demand now drives its own ecosystem pressures, logistics framing, and policy alignment cycles.

Market Trends

1. EV Infrastructure-Linked Battery Demand

GCC countries (Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, and Oman) show increasing EV deployment targets. Automotive distributors, taxi fleets, bus pilots, logistics vans, and charging-corridor-linked fleets directly influence demand for NMC and LFP battery packs.

2. Renewable Energy Storage Uplift

Africa leads solar-storage adoption. Large solar farms, commercial backup packs, mini-grids, and home solar systems increasingly integrate LFP-dominated battery cabinets due to safety, cycling durability, and heat tolerance. Energy diversification programs across MEA are battery-dependent.

3. Telecom Tower Li-ion Replacement Cycle

Lead-acid tower backup batteries are steadily replaced by Li-ion packs that reduce service weight, maintenance, theft risk, and transport difficulty. Countries including South Africa, Nigeria, Kenya, Ghana, Ethiopia, Rwanda, Tanzania, Angola, Senegal, and UAE telecom infrastructure adopt Li-ion UPS towers.

4. Consumer Power Banking Growth

High smartphone penetration increases demand for portable charging, wearables, wireless accessories, and compact battery banking packs.

5. Commercial Fleet Pilots

Retail logistics, port equipment, airport ground fleets, refrigerated vans moving vaccines/biologics, micro-delivery networks, industrial forklifts, mining vehicles, cement-quarry trucks, cold-chain equipment, and long-corridor logistics pilots integrate lithium packs that reduce diesel dependence.

6. Manufacturing Localization Interest

MEA governments support industrial capacity buildouts. Assembly plants, pack manufacturing, and regional alliances are emerging in Saudi Arabia, UAE, Egypt, Morocco, Nigeria, and South Africa.

7. Recycling Policy Momentum

Battery recycling frameworks are gaining policy attention because MEA faces long transport corridors and import-heavy supply chains. Local recycling reduces freight costs and raw material leakage.

8. Climate-Resilient Chemistry Preference

High ambient temperature, desert dust, humidity extremes, and long storage times increase shift toward LFP, coated packs, and thermal-durable BMS systems.

Challenges

Import-Heavy Supply Chains: Most battery cells arrive from Asia, creating freight cost, delivery timing risk, and currency exposure.

Heat Stress Risk: Ambient temperature commonly exceeds 40°C in many MEA countries, stressing high-energy battery chemistry that is not thermally managed.

Grid Instability: Many African countries face intermittent power. Battery ESS must remain overspec-engineered for uptime, increasing system cost.

Skilled Technical Workforce Gap: BMS design, pack engineering, and thermal hardware require specialized engineers.

Raw Material Access Limitations: MEA countries have low local lithium refining capacity.

Recycling Infrastructure Deficit: Limited industrial recycling plants increase battery waste export dependence.

Regulatory Diversity: Safety compliance, customs classification, transport codes, port clearance approvals, and battery import standards vary widely.

Theft and Counterfeit Risks: Telecom towers and rural solar battery units face battery theft risk and counterfeit supply barriers.

Water-Cooling Compliance for ESS Camps: Excessive cooling water use in some installations creates EHS auditing pressure.

Key risks include thermal events, delayed battery imports, freight bottlenecks, currency pricing stress, disposal liabilities, grid underperformance insurance risk, tower theft, counterfeit cells entering channels, insufficient module testing, and overspend on aging power replacement cycles.

Market Scope

Segmentation by Battery Format

Cylindrical Cells (small devices, power banks)

Pouch Cells (wearables, automotive modules)

Prismatic Cells (EV packs, ESS cabinets)

Segmentation by Chemistry

LFP (Lithium Iron Phosphate): Agriculture storage, EV fleet, solar ESS, telecom

NMC (Nickel Manganese Cobalt): High-performance EV packs

LMO (Lithium Manganese Oxide): Light mobility, industrial uses

Hybrid Chemistries: Solid-enhanced, high-temp variants in pilots

Segmentation by Application

Electric Vehicles (passenger, taxi, bus, logistics fleet)

Energy Storage Systems (ESS) (solar farms, micro-grid, UPS, industrial backup)

Telecom Tower Backup

Consumer Electronics (smartphones, power banks, wireless accessories, wearables)

Industrial Mobility and Equipment (forklifts, forklifts in ports, mining trucks, quarry vehicles, ground fleets)

Segmentation by End-User Industry

Automotive distributors and fleets, solar farm operators, mini-grid electrification agents, grid-backup infrastructure providers, telecom tower companies, e-commerce logistics, port and airport ground systems, cold-chain storage networks in healthcare, cement and aggregates quarrying, mining companies, wireless accessory manufacturers, wearable device distributors, off-grid electricity agents, emergency power contractors, and battery recycling operators.

Regional Coverage

MEA is inclusive of:

Middle East:

Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman, Iraq, Jordan, and others prioritize EV infrastructure-linked battery packs, grid backup ESS, port equipment electrification, and facility UPS replacements.

Africa:

South Africa, Nigeria, Kenya, Egypt, Morocco, Ghana, Ethiopia, Rwanda, Tanzania, Angola, Senegal, Tunisia, and others scale fastest through renewable ESS, mini-grids, tower backup, industrial mobility electrification, and consumer electronics uptake.

Region-to-Global Contrast

North America leads global R&D, 800G chip integration, and hyperscale EV/ESS.

Europe leads green financing, carbon KPIs, cooling compliance, and automotive electrification.

Asia-Pacific dominates cell manufacturing and export supply.

MEA drives demand on dual pillars of climate-resilient storage and EV corridor scaling.

Market Size and Factors Driving Growth (≈450 words)

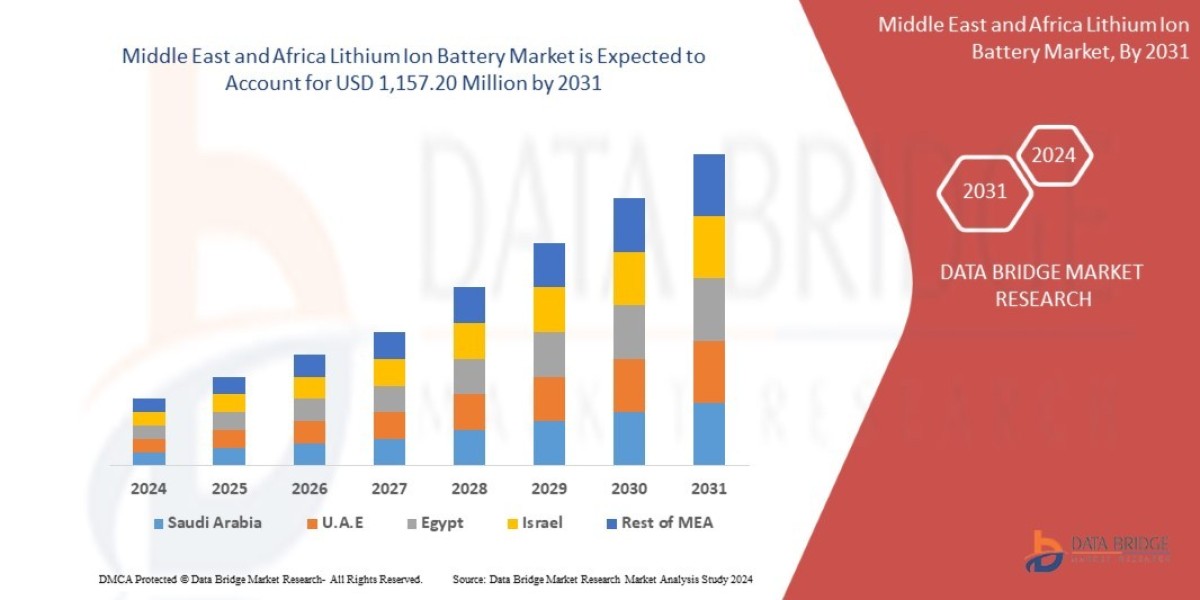

Middle East and Africa lithium ion battery market size was valued at USD 2.36 billion in 2024 and is projected to reach USD 6.98 billion by 2032, with a CAGR of 14.7% during the forecast period of 2025 to 2032.

Core Drivers

1. Transport Electrification Targets

Saudi Arabia and the UAE lead regional battery-led EV deployment roadmaps. National transport decarbonization targets elevate adoption in taxis, ride-hail fleets, delivery vans, port ground fleets, bus pilots, corporate commuter buses, refrigerated healthcare logistics, construction fleet pilots, ground mobility equipment, and passenger EV onboarding programs.

2. Renewable Power and Micro-Grid Expansion

Africa registers the fastest solar electrification uptake. Lithium battery cabinets stabilize intermittent grids, support rural electrification mini-grids, buffer solar farms, replace diesel-based tower backup, and scale seasonal energy availability for agriculture storage, UPS standby, commerce continuity, and low-grid rural electricity integrity.

3. Telecom Infrastructure Modernization

MEA’s telecom sector replaces lead-acid tower backup batteries with lithium packs that reduce transport weight, maintenance cost, mid-chain insurance failure liabilities, remote operator staffing costs, theft exposure, and manual tower handling inefficiencies. Li-ion ensures longer cycle durability under thermal extremes.

4. Climate Resilience Requirement

The MEA environment commonly includes desert heat, dust storms, long storage durations, and high humidity coastlines. LFP lithium chemistries show strong preference due to thermal predictability, minimal fire risk, longer cycles, reduced stolen-asset likelihood, and compact storage that reduces land footprint for energy backup.

5. Urban Digitization Density

Mobile banking, digital retail, streaming adoption, AI-enabled telecom routing, e-commerce expansion, smart-metering for grids, airport ground robotics, digital security SOC frameworks, wearables, consumer power banking, wireless accessories, automotive corridor planning, and industrial electrification uplift battery uptake.

6. Warehouse and Port-Side Telemetry Expansion

Import-stored lithium racks and ESS cabinets increasingly integrate humidity monitoring sensors, BMS telemetry, dock-monitored railcars, port silo temperature KPIs, cold-chain compliance for healthcare transport packs, facility charging analytics, and anti-thermal-runaway architecture. Telemetry reduces breakdown uncertainty for insurance validation.

7. Regional Assembly and Recycling Interest

MEA governments support industrial alliances that build pack assembly centers and recycling capacity in Saudi Arabia, UAE, Egypt, Morocco, Nigeria, and South Africa. Local recycling reduces freight dependence and raw material leakage.

8. Mining and Quarry Mobilization

Industrial fleets in phosphate rock, copper, cement feed minerals, coal, aggregates, limestone, overburden removal vehicles, tunneling contractors, and quarries electrify ground mobility systems using lithium-based packs replacing diesel inputs for predictable uptime and cost reduction.

9. Cost Trajectory Improvements

Lithium cell pricing declines gradually due to mass capacity in Asia manufacturing. MEA adoption benefits from bulk pack procurements, fleet battery contracts, shared charging cabinets for mini-grids, tower backup swaps, packaging modularity, and tele-monitored ESS loops.

10. Technology Adoption Pathways

Dominant technologies in MEA transformation include:

Localized BMS software

Rack-level humidity and temperature telemetry

ANTI-thermal-runaway ESS cabinets

400G corridor switching for EV network routing

LFP heat-optimized packs for solar backup

Liquid-loop cooling for dense EV racks

Portable cylindrical pack for consumer power banking

MEA Market Opportunities

Utility-scale solar ESS lithium cabinets

Battery-dependent mining mobility fleets

EV fast-charge corridor networks

Telecom lithium tower swaps

Local pack assembly alliances

Anti-caking and anti-heat battery packaging

Sustainability-aligned financing for grid ESS

Micro-grid kiosks powered by lithium packs

Middle East and Africa Market Outlook

EV battery packs grow fastest in GCC urban corridors

ESS LFP cabinets dominate Africa solar farms

Tower UPS lithium swaps grow steadily

Recycling alliances expand by 2030

Local assembly plants uplift by 2028

FAQ

What is the MEA Lithium Ion Battery Market?

Which battery formats lead adoption in MEA?

What is the 2024 market valuation for MEA Li-ion batteries?

What is the forecast market value by 2035?

What CAGR growth is expected from 2025 to 2035?

Which chemistry type is preferred in high-temperature regions?

How is the automotive sector shaping MEA battery demand?

Which African countries lead solar battery ESS deployment?

How are telecom operators modernizing tower backup power?

What recycling challenges affect the MEA lithium market?

How does freight dependency shape MEA battery pricing?

What grid issues increase adoption of Li-ion ESS in Africa?

Which end-user industries drive battery modernization demand?

What role does LFP play in Africa solar storage systems?

How are GCC countries supporting EV battery ecosystems?

Which countries are pursuing local assembly capacity?

What BMS innovations are shaping lithium pack reliability?

How does climate resilience influence product preference?

Which risks influence large-volume lithium storage planning?

What opportunities exist for emerging stakeholders in MEA battery manufacturing?

Browse More Reports:

Global Microporous Breathable Packaging Films Market

Global Multiaxial Optical Position Sensor Market

Global Multi Touch Display Market

Global Multi Use Bioreactor Market

Global Network Function Virtualization Market

Global Non-mydriatic Handheld Fundus Camera Market

Global Non-Ultraviolet (UV) Dicing Tape Market

Global Nutrigenomics Testing Market

Global Oil Extraction Equipment Market

Global Oliguria Market

Global Original Equipment Manufacturer (O.E.M.) Insulation Market

Global Packaging Bioadhesives Market

Global Packaging Divider Market

Global Polyaryletherketone (PAEK) Market

Global Pancytopenia Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]