Introduction

The Edible Insects Market covers farming, processing, packaging, distribution, and product manufacturing of insects used for human consumption. The primary insects in the sector include crickets, mealworms, black soldier fly larvae (BSFL), grasshoppers, ants, silkworm pupae, and beetle varieties. These insects are commercialized as whole roasted insects, protein powders, oils, snacks, energy bars, pasta, bakery ingredients, pet food additives, culinary garnishes, functional ingredients, and alternative nutrition formulations.

The market has global importance due to its role in addressing long-term food production limits, protein demand increase, land and water constraints, greenhouse gas reduction goals, and supply diversification. Insects convert organic feed to protein efficiently, emit fewer greenhouse gases compared to cattle or poultry, require less land, and can be farmed in modular vertical environments. These advantages align with sustainability plans, national protein self-sufficiency discussions, agricultural modernization, and investment in climate-adaptive food systems.

Learn how the Edible Insects Market is evolving—insights, trends, and opportunities await. Download report: https://www.databridgemarketresearch.com/reports/global-edible-insects-market

The Evolution

Human consumption of insects, known as entomophagy, has existed for thousands of years. Traditional dietary systems incorporated insects due to availability, nutrition density, cultural acceptance, and medicinal benefit beliefs. Commercial industrial evolution followed measurable milestones:

Pre-industrial era: Insects eaten in Asia, Africa, Latin America, and parts of the Middle East in local, seasonal, or tribal diets.

1930s–1960s: Mechanized grinding systems and dehydration methods enabled early use of insect powders in small research food labs.

1970s–1990s: Universities study feed conversion, amino acid quality, and insect ecology. Farming remains localized and small scale.

2000–2014: Sustainable food discourse enters U.N., FAO, and climate policy narratives highlighting insects as future protein sources.

2015–2019: Commercial insect farms scale in Europe and North America. Retail snacks enter supermarket aisles. Powdered cricket protein becomes a key B2B ingredient for bars and bakery blends.

2020–2023: Growth expands driven by pandemic-era supply diversification, e-commerce kits, investor capital, high-protein diets, shelf-stable snack demand, survival food adoption, and fitness nutrition.

2024–2025: Innovations focus on:

Automated microfarming modules

AI-optimized feed cycles

Frass (insect fertilizer) valorization

3D extrusion incorporating insect powder

Aseptic, contamination-controlled processing

Oil extraction technologies for omega-rich formulations

Cold chain optimization for insect-based fresh food SKUs

Demand shifted from novelty consumption to macro-nutritional metrics such as protein per serving, sugar-free claims, micronutrient labeling, gut-friendly phrasing, omega 3-6-9 oil deliverables, clean-ingredient formulations, allergen control labeling, halal certification discussions, export-grade pathogen safety, and flavor standardization.

Market Trends

1. Consumer Adoption Trends

Alternative Protein Migration: Consumers test non-traditional protein sources due to rising meat cost and sustainability discussions.

Functional Nutrition Preference: Buyers choose insects processed into powders that integrate invisibly into daily food.

Clean Label Emphasis: Food brands reformulate products using minimal-ingredient declarations.

Localization Trend: Countries encourage domestic production to reduce import dependency.

Culinary Modernization: Restaurants adopt roasted insects as premium garnishes or tasting menu elements.

Youth and Fitness Demographics: Higher acceptance among consumers aged 18–40, gym communities, athletes, and urban nutrition-focused buyers.

2. Technological and Product Format Trends

Protein Powder Standardization: Cricket and mealworm powders gain dominance for stable formulation.

Extrusion-Based Snacks: Pasta, chips, puff snacks, noodles, and baked snacks using 5–20% insect protein integration.

Oil Extraction: BSFL oil and cricket oil used for softgels and omega-focused nutraceutical blends.

Farming Efficiency Tech: AI feed optimization, IoT climate control, vertical stacking farms, and modular containers.

Waste-to-Protein Systems: Black soldier fly larvae used to convert agricultural waste, food waste residues, or brewery by-products into protein and frass fertilizer.

3. Regional Adoption Patterns

Europe: Strong regulatory progress, commercialization of mealworm-based products, government-linked sustainability pilots, and retail acceptance.

North America: High QSR presence, start-up farm acceleration, fitness-focused product launches, branded protein bars, flavored powders, and snacks.

Asia-Pacific: Largest insect consumption by population scale; major traditional adoption with rapid processing commercialization.

Latin America: Traditional entomophagy + emerging packaged snacks and powders for retail export.

Middle East & Africa (MEA): Growing interest driven by food security discussions, livestock feed cost limits, climate constraints, circular agriculture initiatives, and halal certification interest. Domestic farming modules represent a scaling opportunity for institutional supply, defense nutrition, emergency food reserves, and climate-adaptive agriculture portfolios.

Challenges

1. Regulatory Barriers

Health claim phrasing varies widely by country.

Functional ingredient approvals for insect-based oils or powders remain uneven.

Labeling language related to protein equivalence, allergen phrasing, and farm safety requires stricter compliance.

Certification systems (organic status, halal, food-grade export pathogen validation) can be lengthy and costly for new companies.

2. Economic and Supply Barriers

Capital cost for climate-controlled farms remains high.

Feed pricing volatility impacts farming profitability.

Processing scale-up requires specialized pathogen-safe machinery, drying control, and contamination-controlled grinding systems.

Cold energy cost for fresh-service insects.

Packaging standardization remains fragmented in developing regions.

3. Market Risks

Consumer perception challenges reduce whole-insect retail adoption in some countries.

Product pricing remains higher than conventional proteins in many regions.

Potential allergen sensitivity (shellfish-similar protein pathways triggering cross-reactivity).

Farm contamination or pathogen outbreaks pose reputational risk if quality systems fail.

Freight limits on frozen or fresh insect ingredient exports.

4. Key Barriers to Growth

Limited large-scale manufacturing infrastructure in MEA reduces price competitiveness.

Retail distribution networks for frozen or blended basis solutions lack uniform storage.

Certification complexity for new ingredients slows commercialization.

Market Scope

1. Segmentation by Type

Crickets (Acheta domesticus, Gryllus bimaculatus)

Mealworms (Tenebrio molitor)

Black Soldier Fly Larvae (BSFL) (Hermetia illucens)

Grasshoppers and Locusts

Ants

Silkworm Pupae

Beetle Species and Others

2. Segmentation by Product Form

Whole roasted/dehydrated insects

Edible insect protein powders

Edible insect oils

Insect-integrated snacks (chips, pasta, noodles, cookies)

Insect-based energy bars and supplements

Pet food and livestock feed additives

Culinary/restaurant insects (premium roasted, seasoned, flavored)

Insect-derived frass fertilizer (indirect revenue but part of farming market scope)

3. Segmentation by Application

Direct human food consumption

Functional nutrition and supplements

Sports nutrition and recovery products

Bakery and processed food B2B ingredient supply

Emergency food and defense nutrition reserves

Child nutrition and micronutrient-rich bars

Sustainable protein blends

Gut health formulations

Beauty and nutraceutical uses (oil softgels, cosmetic powders)

4. End-User Industries

Retail packaged food and beverages

Quick Service Restaurants (QSR) and cafés

Gyms, sports clubs, and nutrition centers

Universities, hospitals, defense institutions

Ingredient manufacturers and food processing companies

E-commerce nutrition platforms and subscriptions

Pet food and animal feed manufacturers

Nutraceutical and supplement brands

5. Regional Market Coverage

North America: Grocery retail, protein bars, snacks, sports nutrition, start-up farms, B2B formulation.

Europe: Strong commercialization of mealworms, regulatory pilot adoption, retail acceptance.

Asia-Pacific: Market scale by population, largest consumer share, traditional adoption, processing acceleration.

Latin America: Cultural entomophagy, retail snacks, export opportunities, cricket powder adoption.

Middle East & Africa: Food security alignment, climate farming modules, livestock feed cost limits drive institutional and ingredient-side growth potential.

Market Size and Factors Driving Growth

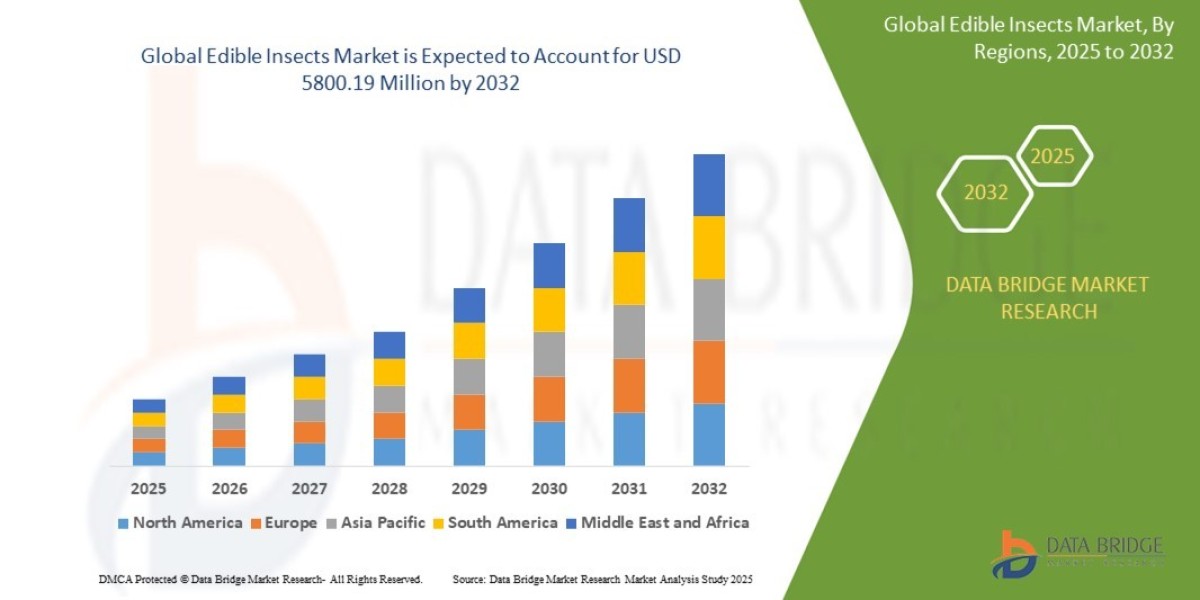

- The global edible insects market size was valued at USD 985.65 million in 2024 and is expected to reach USD 5800.19 million by 2032, at a CAGR of 24.80% during the forecast period

Key Drivers

1. Resource-Efficient Protein Production

Insects require less water and land than livestock protein.

High feed-to-protein conversion efficiency supports commercial scaling.

2. Population-Driven Protein Demand

Countries dependent on protein imports seek localized sustainable protein alternatives.

Urban demographics adopt high-protein beverages and meal bars incorporating insect protein.

3. Sustainability, Circular Agriculture, and Climate Pressure

Farming modules align with circular bioeconomy goals.

Use of agricultural waste residues for BSFL feed cycles adds economic value.

4. Functional Ingredient and Product Innovation

Powdered proteins scale faster than whole edible insects due to usability in manufacturing.

Oils provide omega nutrition deliverables targeting nutraceutical buyers.

5. Institutional Adoption Opportunities

Defense survival food reserves

Emergency rations

University and hospital nutrition bars

Gym bulk protein kiosks

Retail powdered formulations for bakeries and bars.

MEA Specific Opportunities

Local sourcing of waste feedstock for BSFL farms.

Rising halal certification demand for validated protein.

Institutional partnerships for emergency food reserves.

Expansion of climate-controlled farming container modules.

Domestic frozen insect base manufacturing for QSR and retail supply to improve pricing scales.

Higher potential for insect protein incorporation into fortified snacks and pet food due to cost sensitivity and supply limits in livestock feed.

FAQ

What is the current valuation of the global Edible Insects Market?

What CAGR is projected for the market until 2035?

Which insect segment holds the largest commercial share?

Why do processed insect powders scale faster than whole‐insect products?

What role does circular agriculture play in market growth?

How is AI and IoT improving insect farm output?

What are the main allergen risks associated with edible insect protein?

Which regions show the strongest consumer adoption patterns?

How important is halal certification for Middle East market expansion?

What institutional sectors contribute the highest demand growth?

How is BSFL oil used in nutraceutical and supplement products?

What are the economic barriers to scaling insect farms in developing regions?

Which snack categories show the highest acceptance for insect protein integration?

What risks affect retail pricing stability for edible insects?

How can MEA countries improve price competitiveness in the insect protein ecosystem?

What role does frass fertilizer play in farm‐linked revenue?

- Browse More Reports:

Global Fatty Liver Diseases Treatment Market

Global Flavimonas Oryzihabitans Infection Market

Global Gardner Syndrome Treatment Market

Global Healthcare Information Technology (IT) Consulting Services Market

Global Hydrazine Hydrate Market

Global Hypertrophic Cardiomyopathy Treatment Market

Global Intravenous Immunoglobulin Market

Global Kernicterus Treatment Market

Global Lung Stent Market

Global Maraburg Hemorrhagic Fever Market

Global Nail Psoriasis Treatment Market

Global Nucleating and Clarifying Agents Market

Global Off Highway Diesel Common Rail Injection System Market

Global Oxytocic Pharmaceutical Market

Global Personalized Cell Therapeutic MarketAbout Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]