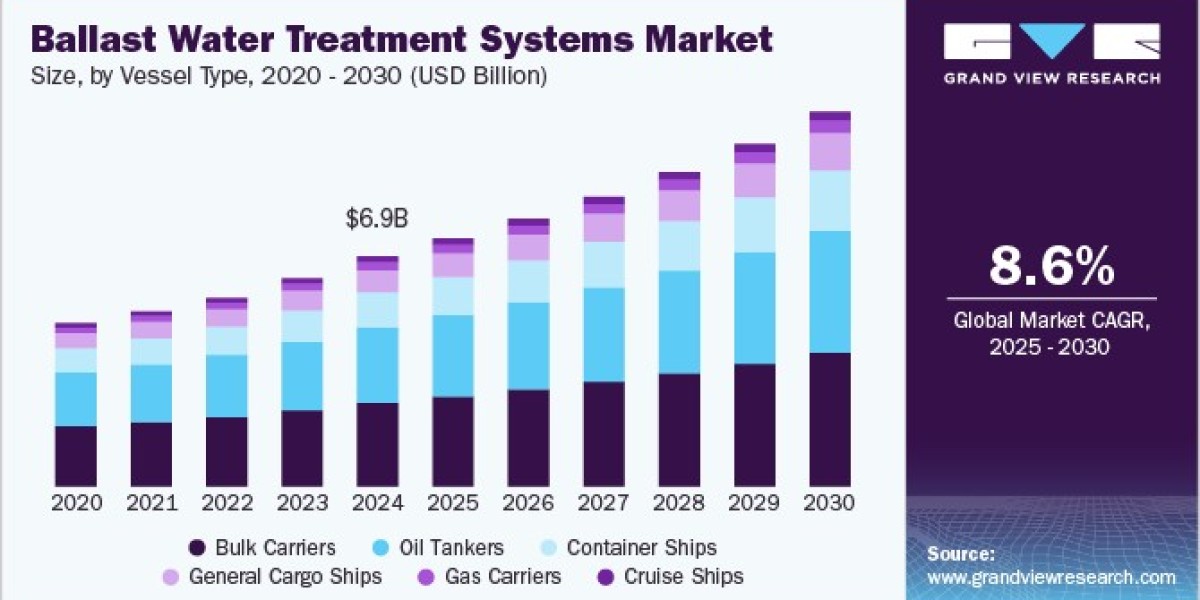

The global ballast water treatment systems market size is anticipated to reach USD 11.31 billion by 2030, growing at a CAGR of 8.6% during the forecast period, according to a new report by Grand View Research, Inc. The ballast water treatment systems industry’s growth is driven by the growing need to comply with international regulations, particularly the IMO’s Ballast Water Management Convention, which mandates the treatment of ballast water to prevent the spread of invasive species and protect marine ecosystems. As the global shipping industry continues to expand, the demand for efficient and reliable treatment systems rises, creating a significant market for advanced solutions. The push for environmental sustainability also drives investments in technologies that minimize the ecological impact of ballast water discharge.

Growth opportunities in the ballast water treatment systems industry are primarily driven by the need for vessel retrofitting to meet compliance standards, as many ships must install treatment systems to adhere to global regulations. Additionally, the increasing awareness of marine biodiversity preservation and stricter environmental policies across regions provide growth prospects for innovative, eco-friendly technologies. Emerging markets in Asia, Latin America, and Africa also present untapped opportunities for manufacturers to expand their reach.

Regulations such as the IMO’s Ballast Water Management Convention, which came into force in 2017, are a key driver for the market. These regulations mandate that all ships install ballast water treatment systems that meet specific standards for disinfection. Furthermore, various national regulations are being enacted to complement the global mandate, pushing shipowners to adopt compliant solutions or face penalties.

Get a preview of the latest developments in the Ballast Water Treatment Systems Market! Download your FREE sample PDF today and explore key data and trends

Top players in the market focus on technological innovation, cost-efficiency, and regulatory compliance. They invest in R&D to develop energy-efficient, eco-friendly systems and collaborate with shipbuilders for tailored solutions. Strategic partnerships with regulatory bodies and other market players, investments in sustainable technologies, and acquisitions help them maintain a competitive edge in the evolving market. For instance, in November 2024, ERMA FIRST ESK Engineering S.A. acquired Ecochlor, strengthening its position as a provider of ballast water treatment systems (BWTS) and decarbonization solutions. This acquisition expands ERMA FIRST GROUP's portfolio, making it one of the largest BWTS providers globally.

Ballast Water Treatment Systems Market Report Highlights

- Based on vessel type, the bulk carrier segment dominated the market in 2024 driven by the need for compliance with international regulations and the high frequency of international trade, where ballast water management is crucial to prevent the spread of invasive species.

- Based on capacity, the below 250 cubic meters per hour segment led the market in 2024. Systems with a capacity below 250 cubic meters per hour are driven by the needs for smaller vessels, offering cost-effective, efficient solutions for vessels with lower ballast water volumes while meeting regulatory standards.

- Based on system type, the filtration segment dominated the market in 2024 due to their effectiveness in removing suspended solids and microorganisms from ballast water, making them an essential component for meeting stringent environmental regulations while ensuring operational efficiency.

- Based on application, the stationary segment dominated the market in 2024. Stationary ballast water treatment systems are favored for larger vessels with higher treatment needs, offering reliable, long-term performance and ease of integration with the existing vessel infrastructure, especially in compliance with international standards.

- Based on region, the market in Asia Pacific dominated the market in 2024. The ballast water treatment systems industry in Asia Pacific is poised for substantial growth, driven by several key developments across major countries. The region's rich mineral resources, combined with a strategic emphasis on sustainability and technological advancement, are shaping a dynamic mining landscape.

- Companies operating in the market include Wärtsilä, ALFA LAVAL, Evac, Auramarine Ltd, Veolia Water Technologies, Coldharbour Marine Ltd., GenSys GmbH, Damen Shipyards Group, Hyde Marine Inc., MH Systems Inc., NEI Treatment Systems, and Optimarin AS.

- In April 2024, Optimarin AS acquired Hyde Marine's UV ballast water treatment business including its technologies, trademarks, and assets related to Hyde Marine and Hyde Guardian systems. This acquisition strengthens Optimarin’s position as a BWTS supplier, expanding its installed base and supporting customer needs for efficiency and compliance.

List of Key Players in the Ballast Water Treatment Systems market

- Wärtsilä

- ALFA LAVAL

- Evac

- Auramarine Ltd

- Veolia

- Coldharbour Marine Ltd.

- GenSys GmbH

- Damen Shipyards Group

- Hyde Marine Inc.

- MH Systems Inc.

- NEI Treatment Systems

- Optimarin AS

Gather more insights about the market drivers, restrains and growth of the Global Ballast Water Treatment Systems Market