Buying a van is a big step — whether you’re starting a new business, upgrading your fleet, or simply need more space for family trips. For many buyers, securing finance can be the most stressful part. That’s where guaranteed van finance comes in: a solution designed to simplify approval and get you on the road faster. In this post, we’ll explore what guaranteed van finance means, who benefits most, and practical tips to make the most of this option.

What Is Guaranteed Van Finance?

Guaranteed van finance is a lending option that aims to secure approval for loan or lease agreements with higher certainty than standard finance routes. Instead of relying solely on traditional credit checks, lenders offering guaranteed van finance may consider other factors like employment status, the van’s value, or a co-signer. The result is a smoother approval process for applicants who might otherwise be declined by conventional lenders.

- Key feature: Increased approval likelihood

- Common forms: Hire purchase (HP), personal contract purchase (PCP), and lease agreements

- Typical beneficiaries: Self-employed individuals, new business owners, and people with imperfect credit histories

Who Should Consider Guaranteed Van Finance?

Not every buyer needs guaranteed van finance, but it’s particularly helpful for those in the following situations:

- Limited or poor credit history: If your credit score isn’t strong, guaranteed van finance can offer a route to approval that traditional lenders might not provide.

- Recent business startups: New businesses often lack long trading histories. Lenders may look at business plans or projected cash flow instead.

- Irregular income: Freelancers and contractors with variable income can benefit when lenders consider overall affordability rather than fixed paystubs.

- Urgent needs: When time is of the essence and you need a van quickly to start earning, guaranteed options can reduce waiting times.

Benefits of Choosing Guaranteed Van Finance

Practical benefits of choosing guaranteed van finance:

- Higher approval chances: Lenders offering this product structure their approvals to be inclusive.

- Speed: Faster decisions mean you can collect your van and start working sooner.

- Flexibility: Options like HP or leasing let you pick terms that suit your cash flow.

- Budget predictability: Many packages include fixed monthly payments, making financial planning simpler.

How to Apply: Step-by-Step Tips

To make your guaranteed van finance application successful, follow these targeted steps:

- Gather documentation: Even if the product is ‘guaranteed,’ lenders still ask for ID, proof of residence, and evidence of income or business activity.

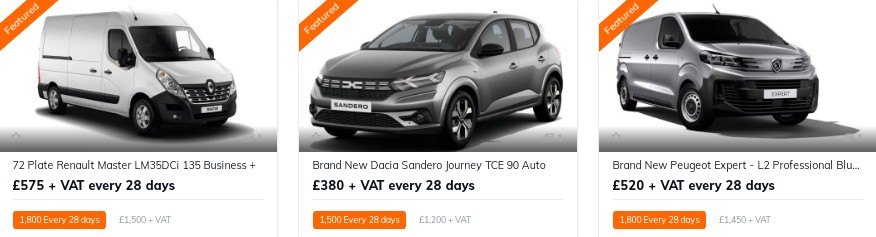

- Choose the right van: Finance is often tied to the vehicle value. A well-maintained, popular model may secure better terms.

- Compare offers: Different lenders have different criteria and fees. Compare APRs, deposit requirements, and term lengths.

- Consider a deposit: A reasonable deposit reduces loan-to-value ratio and can improve monthly payment terms.

- Read the terms: Pay attention to mileage limits, maintenance clauses, and early repayment penalties if you choose leasing or PCP.

Avoiding Common Pitfalls

Even with guaranteed van finance, buyers should be cautious:

- Don’t ignore the fine print: Some “guaranteed” deals may have stricter conditions or higher interest rates.

- Avoid over-borrowing: Choose a monthly payment you can sustain, even during slower months.

- Check for hidden fees: Administration costs or excess mileage charges can sneak up on you.

- Maintain the vehicle: Leased vehicles often require returns in good condition to avoid extra charges.

Final Thoughts: Is Guaranteed Van Finance Right for You?

Guaranteed van finance can be a practical, accessible route to owning or leasing a van, especially if traditional finance options have been closed to you. By increasing approval chances and offering flexible structures, it empowers self-employed individuals, startups, and those with imperfect credit to get back on the road and grow their opportunities.

If you’re considering this route, do your homework: compare multiple lenders, understand the terms, and choose a solution that fits your budget and business goals. With the right approach, guaranteed van finance can turn the stress of buying a van into a smooth, confidence-building experience.

- Next step: Get quotes from at least three lenders and ask for a clear breakdown of fees, APR, and term conditions to find the best guaranteed van finance deal for your needs.