The global commercial refrigeration equipment market size was valued at USD 40.82 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. The rapid expansion of the hospitality and tourism sector and the growing preference among end-consumers for takeaway meals are expected to drive market growth over the forecast period. In addition, increasing regulatory implications resulting in the adoption of lower global warming potential (GWP) commercial refrigerants coupled with ongoing technological breakthroughs will also provide growth prospects for the market.

A considerable rise in the international food trade has also boosted the demand for commercial refrigeration systems for frozen foods, processed foods, and seafood required for to storage and transportation. The continual innovations and rapid improvements in technologies, including liquid-vapor compression and ammonia absorption systems, are driving the product demand further. Various leading manufacturers are focusing on R&D activities to enhance the design and temperature control of their products to gain a competitive edge in the industry. The increasing need to control and monitor the environment of a commercial kitchen is expected to provide ample growth opportunities for the refrigeration industry over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Commercial Refrigeration Equipment Market

Product Insights

The refrigerators and freezers segment accounted for the largest revenue share of more than 22.0% in 2022. This can be attributed to the worldwide expansion of the travel and tourism industry, leading to the opening of various food joints and restaurants. The segment also covers blast chillers that are mainly used for prompt freezing or cooling of items at lower temperatures and stopping bacteria growth in the stored item. Besides, the wide adoption of chillers by healthcare professionals to store tissue samples of vaccines, controlled tests, and critical medicines is also contributing to the segment's growth.

System Type Insights

The self-contained segment held major revenue share of the global commercial refrigeration equipment market in 2022 on account of the rising product demand driven by easy and cost-effective installation and low maintenance and relocation costs of the appliances. As per the Environmental Protection Agency (EPA) statistics, in 2020, self-contained commercial refrigeration equipment produced around 26% of the overall HFC emissions globally. The stringent HFC emission norms are compelling the manufacturers to replace R-404A refrigerant with R-448A, minimizing the GWP of refrigeration equipment by around 70%.

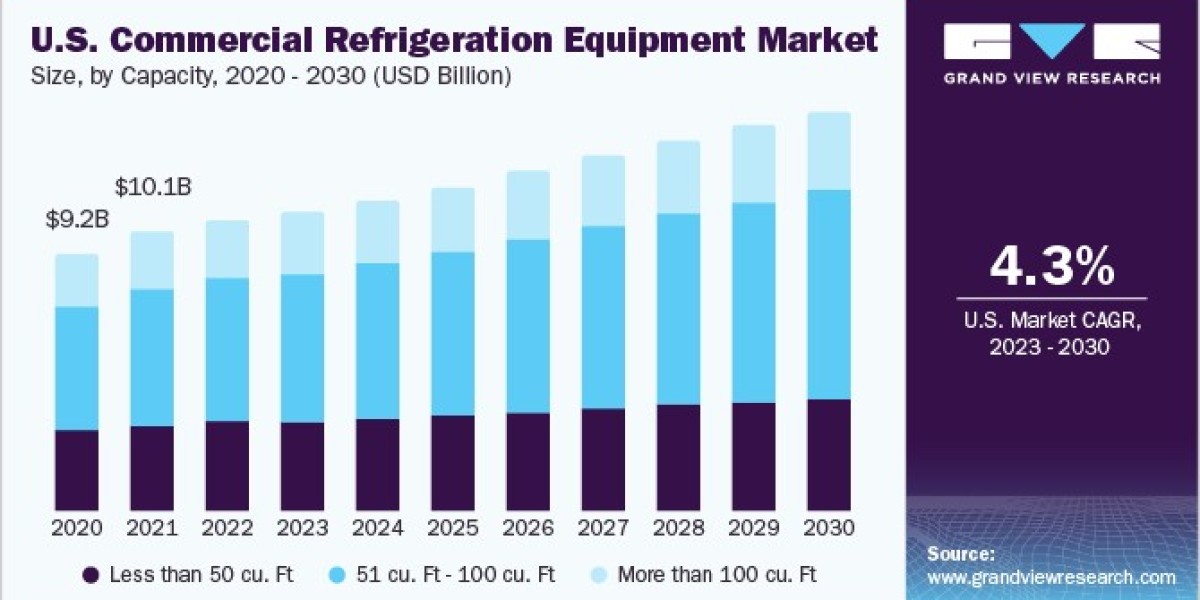

Capacity Insights

The 51 cu. Ft. to 100 cu. Ft. segment held the largest revenue share in 2022, owing to the rising number of specialty food stores, hypermarkets, and supermarkets across the globe. These retail chains have a wide range of products that require ample refrigeration, such as fresh produce, dairy, meat, and frozen foods. Their expansion is propelling the demand for commercial refrigerators in this capacity range to accommodate their growing inventory. Moreover, they are also required to comply with the regulations pertaining to food quality, which, in turn, leads to increased product demand.

Application Insights

The food & beverage retail segment is estimated to record a substantial CAGR from 2023 to 2030. The ongoing developments in cold channel logistics for transporting temperature-sensitive items are positively impacting segmental growth. Moreover, the demand for high-end temperature-controlled refrigerators for various transport vehicles for reliable distribution of beverages, liquor, fish, biopharmaceuticals, and other perishable products is also favoring the business growth. Besides, the growing inclination of capital-intensive customers in the food & beverage distribution industry toward the sectional refrigerated trailers will drive the segment’s growth in the upcoming years.

Regional Insights

North America accounted for a dominant revenue share of over 32% in 2022 in the global commercial refrigeration equipment market. The significant growth can be attributed to the mature retail industry and the availability of major supermarket chains, such as Walmart, Costco, Kroger, Publix, etc., in the region. Besides, the strong presence of various leading manufacturers of commercial refrigeration equipment coupled with the early adoption of smart equipment across the commercial kitchens is favoring the expansion of the regional market further.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

- The global hydroponics market size was valued at USD 5.00 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.4% from 2024 to 2030.

- The global smart home market size was valued at USD 79.16 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 27.07% from 2023 to 2030.

Key Companies profiled:

- AHT Cooling Systems GmbH

- Ali Group S.r.l. a Socio Unico

- Carrier

- Daikin Industries Ltd.

- Dover Corporation

- Electrolux AB

- Hussmann Corporation

- Illinois Tool Works Inc.

- Johnson Control

- Lennox International Inc.

- Panasonic Corporation

- Whirlpool Corporation

Commercial Refrigeration Equipment Market Segmentation

Grand View Research has segmented the global commercial refrigeration equipment market report based on the product, application, system type, refrigerant, capacity, distribution channel, and region

Commercial Refrigeration Equipment Product Outlook (Revenue, USD Million, 2018 - 2030)

- Transportation Refrigeration Equipment

- Trailers

- Trucks

- Shipping Containers

- Refrigerators & Freezers

- Walk-in-Refrigerators

- Reach-in Refrigerators

- Chest

- Beverage Refrigeration

- Display Showcases

- Ice Cream Cabinets

- Bakery/Deli Display

- Others

- Ice Merchandisers & Ice Vending Equipment

- Other Equipment

Commercial Refrigeration Equipment System Type Outlook (Revenue, USD Million, 2018 - 2030)

- Self-contained

- Remotely Operated

Commercial Refrigeration Equipment Capacity Outlook (Revenue, USD Million, 2018 - 2030)

- Less than 50 cu. Ft

- 50 to 100 cu. Ft

- More than 100 cu. Ft

Commercial Refrigeration Equipment Application Outlook (Revenue, USD Million, 2018 - 2030)

- Food Service

- Food & Beverage Retail

- Hypermarkets

- Supermarkets

- Convenience Store

- Specialty Food Store

- Others

- Hotels and Hospitality

- Pharmaceuticals

- Healthcare

- Biotechnology

- Chemicals

- Others

Commercial Refrigeration Equipment Refrigerant Outlook (Revenue, USD Million, 2018 - 2030)

- Synthetic Refrigerants (HFCs, HCFCs)

- Natural Refrigerants

- Carbon Dioxide (CO2)

- Ammonia (NH3)

- Others

Commercial Refrigeration Equipment Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- OEMs (Original Equipment Manufacturers)

- Distributors and Wholesalers

- Retailers

Commercial Refrigeration Equipment Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa (MEA)

- Saudi Arabia

- South Africa

Order a free sample PDF of the Commercial Refrigeration Equipment Market Intelligence Study, published by Grand View Research.

Recent Developments

- In January 2024, Hussmann Corporation, a retail refrigeration systems company, launched Evolve Technologies, a new offering focused on the development of technologies that facilitate the use of environmentally friendly refrigerants.

- In January 2022, Carrier Commercial Refrigeration installed its PowerCO2OL refrigeration system at a COVID-19 vaccine storage warehouse in Spain. This system uses carbon dioxide, a natural refrigerant, and serves as a sustainable and low global warming potential refrigerant to help preserve critical vaccines in Spain.