The global in vitro diagnostics market size is expected to reach USD 101.58 billion by 2030, according to a new report by Grand View Research, Inc. It is estimated to register a CAGR of 4.4% over the forecast period driven by the increasing geriatric population, COVID-19 pandemic, and technological advancements in diagnostics that are supporting its adoption. Technological advancements in terms of portability, accuracy, and cost-effectiveness are projected to be one of the high-impact rendering drivers. Technological advancements were further accelerated by the launch of COVID-19 IVD diagnostics and enhanced the adoption of instruments and consumables for technologies, such as PCR. Competitors in the market are increasingly adopting agreement and partnership strategies to maintain a constant flow of business for manufacturers & diagnostics for users.

These agreements are also a result of the harsh price containment strategies for government laboratories, which lowers the price in government settings. For instance, in April 2021, the Italian subsidiary of Seegene, Inc. received a USD 108.25 million tenders for public procurement for the supply of extraction reagents, as well as 7.15 million SARS-CoV-2 diagnostic tests. However, it increases the multiparty nature and complexity of the supply chain. The high prevalence of cancer and Cardiovascular Diseases (CVDs) globally is anticipated to drive diagnostic innovation to facilitate early diagnosis and meet the constantly evolving needs of consumers. Novel technologies, such as plasmonic PCR, are anticipated to commercially enter the market during the forecast period, influencing the business of existing products adversely.

Gather more insights about the market drivers, restrains and growth of the In Vitro Diagnostics Market

Detailed Segmentation:

Market Characteristics

Market growth stage is medium, and the pace of the market growth is decelerating. Decreasing demand for COVID-19 tests is hampering the growth. The market is characterized by a high degree of innovation owing to the increasing introduction of novel molecular diagnostics and immunoassay tests for multiple disease indications. Moreover, increasing demand for patient-centric tests is encouraging market players to develop technologically advanced products.

Product Insights

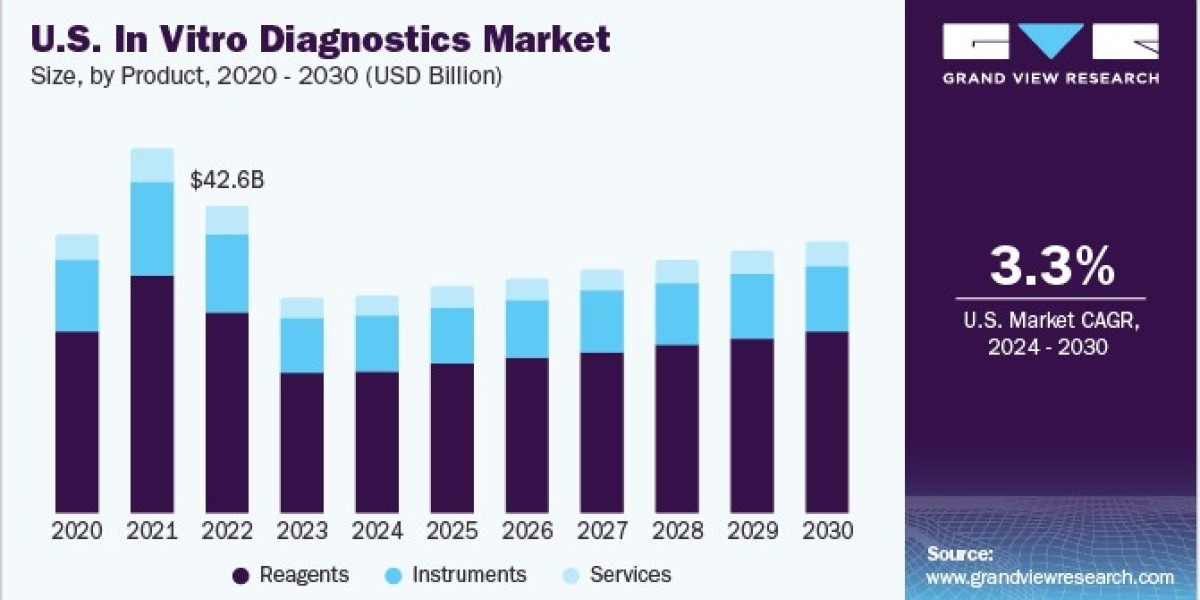

The reagents segment held the largest share of 65.88% of the overall revenue in 2023. The segment is expected to retain its dominance growing at the fastest CAGR from 2024 to 2030 owing to the extensive R&D initiatives undertaken by major players to develop novel reagents and test kits. For instance, in February 2023, BD received the market approval for the BD Onclarity HPV Assay to be used with the ThinPrep Pap Test in the U.S. The increasing R&D activities to enable faster cancer detection and precision medicine are allowing companies to focus on niche profitable areas in the IVD business. For instance, in March 2023, QIAGEN partnered with Servier to develop a companion diagnostic test for TIBSOVO, indicated for treating the blood cancer acute myeloid leukemia.

Technology Insights

The immunoassay segment accounted for the largest revenue share in 2023. Increasing incidence of chronic & communicable diseases and rising need for early diagnosis are among the key factors leading to an increase in demand for immunological methods, including different types of Enzyme-Linked Immunosorbent Assays (ELISAs). Moreover, key players are focused on R&D pertaining to development of new immunological diagnostic instruments and tests for IVD applications. For instance, in October 2023, Sysmex Corporation and Fujirebio Holdings, Inc. collaborated to enhance their R&D, production, clinical development, and marketing activities in immunoassay.

End-use Insights

The hospitals segment held the largest revenue share in 2023 owing to a rise in the rate of hospitalizations that require support from faster diagnostics. Moreover, the ongoing development of healthcare infrastructure and favorable initiatives taken by government bodies are anticipated to enhance the existing hospital facilities. Thus, the demand for hospital-based IVD tests is increasing. Most IVD devices are purchased by hospitals and used in significant volumes. In 2023, there are over 6,129 hospitals in the U.S. that require constant aid from IVD for critical decision-making, as IVD tests provide faster and more accurate results.

Test Location Insights

The others (lab-based tests) segment accounted for the largest revenue share in 2023. A large number of test analyses at one time and the higher accuracy of laboratory-based tests make them more reliable compared to PoC and home tests, giving segment a competitive edge over the other two segments. Moreover, the availability of tests that allow for sample collection at home and sending it to the laboratories for testing makes testing highly convenient for patients.

Application Insights

The infectious diseases segment dominated the market in 2023. The outbreak of the COVID-19 pandemic increased the segment share significantly in recent years. Moreover, key players are introducing novel testing products to improve access to high-quality, innovative laboratory services for patients & healthcare providers. For instance, in February 2023, BD received EUA from the U.S. FDA for a new molecular diagnostic combination test for SARS-CoV-2, Influenza A+B, and Respiratory Syncytial Virus (RSV). Such initiatives by key players to strengthen their presence are expected to drive market growth.

Regional Insights

North America dominated the market and accounted for a share of 42.28% in 2023. The region is estimated to retain its leading market position throughout the forecast period. The market in this region is collectively driven by factors, such as the rising incidence of chronic diseases, presence of strong players, increasing number of novel test launches, and supportive government funding. For instance, in January 2023, BD and CerTest Biotec received EUA from the U.S. FDA for a PCR test for Mpox virus detection in the U.S. Moreover, the increasing requirement for genetic testing for personalized health care, such as that for diabetes and cancer, is expected to drive market growth in North America.

Browse through Grand View Research's Clinical Diagnostics Industry Research Reports.

• The global hepatitis diagnostic market size was valued at USD 3.82 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2030.

• The global hematology diagnostics market size was valued at USD 7.54 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2030.

Key Companies & Market Share Insights

Some of the key players operating in the in vitro diagnostics market include F. Hoffmann-La Roche Ltd.; Abbott; Quest Diagnostics Inc.; and Danaher. Market players are adopting various strategies, such as new product launches, mergers & acquisitions, and partnerships, to strengthen their product portfolios and offer diverse technologically advanced & innovative products.

Key In Vitro Diagnostics (IVD) Companies:

• Abbott

• bioMérieux SA

• QuidelOrtho Corporation

• Siemens Healthineers AG

• Bio-Rad Laboratories, Inc.

• Qiagen

• Sysmex Corporation

• Charles River Laboratories

• Quest Diagnostics Incorporated

• Agilent Technologies, Inc.

• Danaher Corporation

• BD

• F. Hoffmann-La Roche Ltd.

In Vitro Diagnostics Market Segmentation

Grand View Research has segmented the global in vitro diagnostics (IVD) market report based on product, technology, application, end-use, test location, and region:

IVD Product Outlook (Revenue, USD Million, 2018 - 2030)

• Instruments

• Reagents

• Services

IVD Technology Outlook (Revenue, USD Million, 2018 - 2030)

• Immunoassay

o Instruments

o Reagents

o Services

• Hematology

o Instruments

o Reagents

o Services

• Clinical Chemistry

o Instruments

o Reagents

o Services

• Molecular Diagnostics

o Instruments

o Reagents

o Services

• Coagulation

o Instruments

o Reagents

o Services

• Microbiology

o Instruments

o Reagents

o Services

• Others

o Instruments

o Reagents

o Services

IVD Application Outlook (Revenue, USD Million, 2018 - 2030)

• Infectious Diseases

• Diabetes

• Oncology

• Cardiology

• Nephrology

• Autoimmune Diseases

• Drug Testing

• Others

IVD Test Location Outlook (Revenue, USD Million, 2018 - 2030)

• Point of Care

• Home care

• Others

IVD End-use Outlook (Revenue, USD Million, 2018 - 2030)

• Hospitals

• Laboratory

• Home care

• Others

IVD Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

or US

or Canada

• Europe

o UK

or Germany

or France

or Spain

or Italy

o Russia

o Denmark

or Sweden

or Norway

• Asia Pacific

or Japan

o China

o India

o South Korea

or Australia

or Thailand

or Singapore

• Latin America

or Brazil

or Mexico

or Argentina

• Middle East and Africa (MEA)

o South Africa

o Saudi Arabia

o UAE

or Kuwait

Order a free sample PDF of the In Vitro Diagnostics Market Intelligence Study, published by Grand View Research.

Recent Developments

• In December 2023 , ARUP Laboratories and Medicover collaborated to provide diagnostic and healthcare services in Europe. ARUP Laboratories has developed AAV5 DetectCDx in collaboration with BioMarin Pharmaceutical Inc. to select therapies for severe hemophilia A patients

• In November 2023 , Veracyte joined Illumina to develop molecular tests for decentralized IVD applications. Companies are focusing on the development of Prosigna breast cancer and Percepta nasal swab tests of Veracyte

• In October 2023 , Promega Corporation announced its plan to develop and commercialize companion diagnostics kits with GSK Plc to identify cancer patients with MSI-H solid tumors

• In February 2023 , Unilabs announced investing over USD 200 million in Siemens Healthineers' technology and acquiring more than 400 laboratory analyzers to strengthen its laboratory infrastructure

• In February 2023 , F. Hoffmann-La Roche Ltd. collaborated with Janssen Biotech Inc. to develop companion diagnostics for targeted therapies. Companion diagnostic technologies include digital pathology, NGS, PCR, immunoassays, and immunohistochemistry