"The universal IoT Insurance Market report offers an in-depth overview of product specification, technology, product type and production analysis considering major factors such as revenue, cost, and gross margin. This report is an analytical assessment of the prime challenges that will arrive in the market in terms of sales, export/import, or revenue. This business report is mainly delivered in the format of PDF and spreadsheets where PPT can also be provided depending upon client’s request. For market segmentation study, a market of potential customers is divided into groups or segments based on different characteristics such as end user and geographical region.

The world class IoT Insurance Market report considers various factors that have great effect on the growth of business which includes historic data, present market trends, environment, technological innovation, upcoming technologies and the technical progress in the IoT Insurance Market industry. It is a professional and detailed report that highlights primary and secondary drivers, market share, leading segments and geographical analysis. The statistics are signified in graphical and tabular format for a clear understanding on facts and figures. IoT Insurance Market document is a synopsis about how is the market status right now and how will it be in the forecast years for IoT Insurance Market industry.

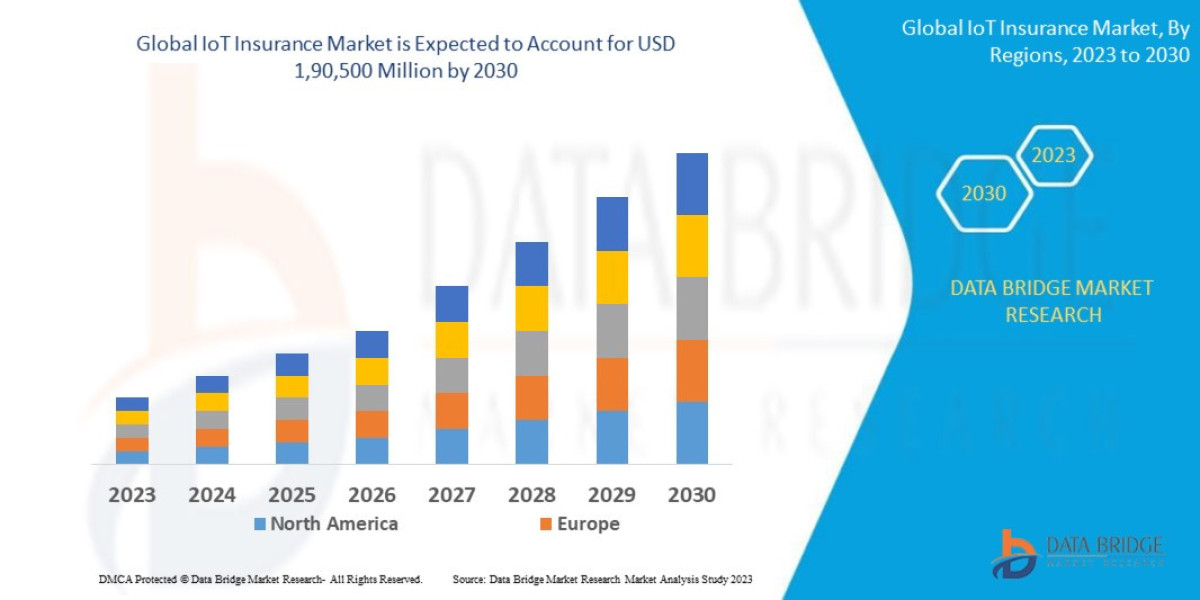

Data Bridge Market Research analyses that the global IoT insurance market which was USD 27,500 million in 2022, is expected to reach USD 1,90,500 million by 2030, and is expected to undergo a CAGR of 34.8% during the forecast period 2023-2030.

Explore Further Details about This Research IoT Insurance Market Report https://www.databridgemarketresearch.com/reports/global-iot-insurance-market

IoT Insurance Market Scope and Segmentation

REPORT METRIC | DETAILS |

Forecast Period | 2023 to 2030 |

Base Year | 2022 |

Historic Years | 2021 ( Customisable to 2015-2020) |

Quantitative Units | Revenue in USD Million, Volumes in Units, Pricing in USD |

Segments Covered | By Type (Health Insurance, Property and Causality Insurance, Agricultural Insurance, Life Insurance, Others), End-User (Automotive and Transport, Travel, Healthcare, Home and Commercial Buildings, Business, Agriculture, Consumer Electronics) |

Countries Covered | (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) |

Market Players Covered | Accenture plc (US), Allerin (US), Capgemini SE (US), Cognizant (US), Concirrus (US), Intel Corporation (US), International Business Machines Corporation (US), Microsoft Corporation (US), Sas Institute Inc. (US), Telit (US), Verisk Analytics Inc. (US) and Wipro Limited (US) |

Market Opportunities |

The introduction of Industry 4.0 is predicted to have a beneficial impact |

Market Definition

The global Internet of Things (IoT) insurance market refers to the market that encompasses insurance products and services specifically tailored for IoT devices and technologies. IoT refers to the network of interconnected physical devices, vehicles, buildings, and other objects embedded with sensors, software, and connectivity, enabling them to collect and exchange data.

Global IoT Insurance Market

Drivers

- Risk Management and Loss Prevention

IoT insurance offers enhanced risk assessment and loss prevention capabilities. By utilizing real-time data from IoT devices, insurers can better understand and assess risks, allowing for more accurate underwriting and pricing. IoT-enabled risk mitigation measures, such as remote monitoring and predictive analytics, help prevent losses and reduce claim frequencies.

- Personalized Insurance Solutions

IoT insurance enables insurers to offer personalized coverage and pricing based on individual data and behavior. For instance, in auto insurance, usage-based policies can be tailored to an individual's driving habits, resulting in fairer premiums. Personalized insurance solutions drive customer satisfaction and retention.

Opportunity

- Market Expansion and Penetration

The global IoT insurance market offers opportunities for insurers to expand their customer base and penetrate new markets. As IoT adoption continues to grow across industries and regions, insurers can target specific sectors such as healthcare, agriculture, and manufacturing, where IoT devices are extensively used, and offer tailored insurance solutions.

Answers That the Report Acknowledges:

- IoT Insurance Market size and growth rate during forecast period

- Key factors driving the IoT Insurance Market market

- Key IoT Insurance Market trends cracking up the growth of the Biscuits Market market

- Challenges to market growth

- Key vendors of IoT Insurance Market

- Detailed SWOT analysis

- Opportunities and threats faces by the existing vendors in Global IoT Insurance Market Trending factors influencing the market in the geographical regions

- Strategic initiatives focusing the leading vendors

- PEST analysis of the IoT Insurance Market in the five major regions

Why choose Data Bridge Market Research?

- Modern technologies, such as artificial intelligence, to provide updated industry growth.

- DBMR team provides clients with the top notch IoT Insurance Market research report.

- Interaction with research scientists and development heads to understand the nature of the IoT Insurance Market more precisely.

- 24/7 availability of services.

- Data collection from implementation vendors, service providers, and raw material suppliers to provide a clear perspective with Forecast period.

DBMR team uses very fair means to gather information that is scrutinized at every stage while structuring an influential IoT Insurance Market size

Browse Related Reports:

About Data Bridge Market Research:

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email – [email protected]

"