The global protein ingredients market size is expected to reach USD 122.17 billion by 2030, registering a CAGR of 5.8% according to a new report by Grand View Research, Inc. The market is expected to witness significant growth over the forecast period owing to increasing consumer awareness regarding maintaining a healthy diet and leading an active lifestyle. In addition, the growing popularity of adopting a high protein diet as a part of weight reduction is expected to propel the demand for protein ingredients.

Increasing innovations by various manufacturers in terms of manufacturing proteins that contain a wide range of amino acids and specific functions, including energy balance, weight loss, muscle repair, and satiety, are expected to create immense growth potential for the market over the forecast period. Moreover, ascending demand for protein ingredients among women owing to the prevalence of the ‘strong not skinny’ trend as well as the rising popularity of resistance training among women are factors likely to fuel the market growth.

There has been an increase in the demand for supplements and natural prevention, a rise in the consumption of snack-based meal replacements, and growth in the consumer demand for greater ingredient traceability and authenticity. Moreover, rising demand for higher protein density in mainstream diet and growing multiple nutritional segments addressing various consumer needs on the basis of different life stages, gender, health issues, performance demands, regional diets, and regulatory framework are some of the other major trends being observed in the market.

Gather more insights about the market drivers, restrains and growth of the Protein Ingredients Market

Detailed Segmentation:

Product Insights

Based on product type, the animal/dairy protein segment is projected to account for a revenue share of 78.94% in 2022. The animal protein segment in the market is primarily driven by the demand for high-quality protein from various sectors such as food and beverage, animal feed, and personal care industries. Animal protein is considered a complete protein source as it contains all the essential amino acids required by the human body, making it a popular choice among consumers looking to maintain a healthy lifestyle.

Application Insights

Based on application, the food & beverage segment dominated the market with a revenue share of 39.21% in 2022 and is expected to retain its dominance during the forecast period. Whey protein ingredients are an economical source of protein and are therefore extensively used in the bakery and confectionery industry. Furthermore, advancements in process design and technology have improved the quality of whey products that are highly refined, including demineralized whey, WPIs, and WPCs. The advancements have resulted in the increased incorporation of protein ingredients in various functional food products to make them nutrient-rich.

Regional Insights

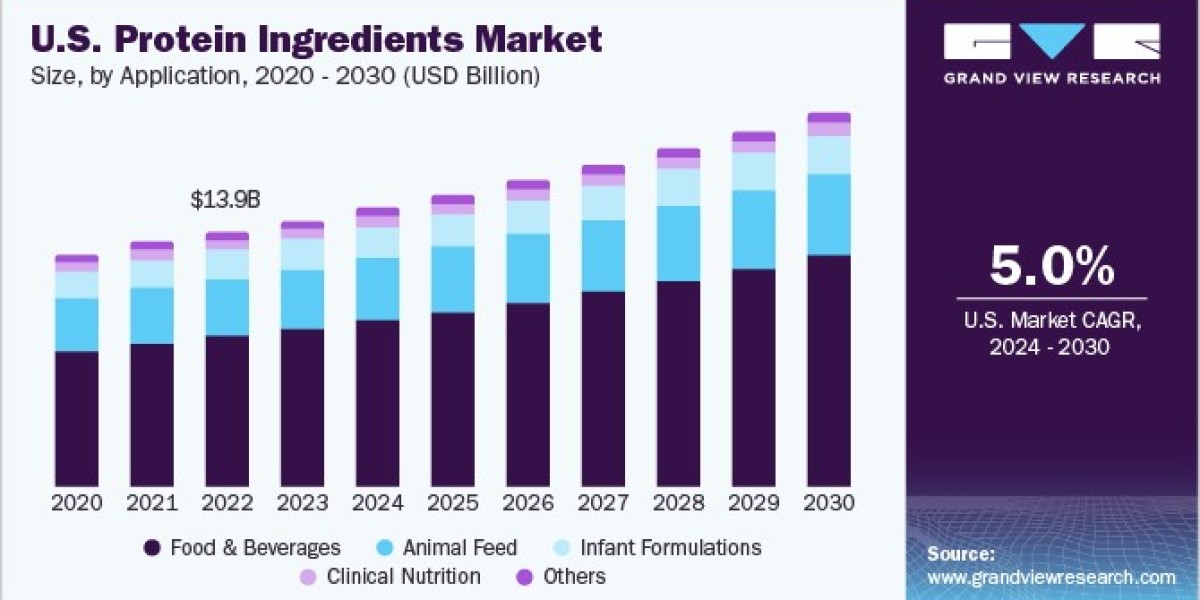

North America dominated the market and accounted for more than 33.56% share of the global revenue in 2022. The growing demand for protein ingredients is a result of the increasing consumption of snacks, cold cereals, and energy bars. The introduction of new products, such as Enfamil Human Milk Fortifier Liquid High Protein, by companies including Mead Johnson and Cargill, Inc. to cater to the consumer needs for cholesterol-free and low saturated fat beverages is expected to augment the product demand further.

Browse through Grand View Research's Nutraceuticals & Functional Foods Industry Research Reports.

• The global fermented ingredients market size was valued at USD 35.3 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.1% from 2024 to 2030.

• The global milk protein market size was estimated at USD 6.63 billion in 2023 and is projected to grow at a CAGR of 3.2% from 2024 to 2030.

Key Companies & Market Share Insights

The protein ingredients market is fragmented and is expected to witness moderate to high competition among the companies owing to the presence of numerous players. The changing consumer preferences towards functional foods and sports nutrition products are projected to push manufacturers to incorporate protein ingredients from sources such as dairy, soy, pea, eggs, and insects.

Some prominent players in the global protein ingredients market include:

• DuPont

• Rousselot

• ADM

• Burcon

• Tessenderlo Group

• Kewpie Corporation

• Roquette Freres

• The Scoular Company

• CHS, Inc.

• Mead Johnson & Company, LLC

• CropEnergies AG

• Fonterra Co-Operative Group

• Bunge Limited

• Cargill, Incorporated

• MGP

• Ingredion

• Kerry Inc.

• Givaudan

• Axiom Foods

• Tate & Lyle

• Puris

Protein Ingredients Market Segmentation

Grand View Research has segmented the protein ingredients market based on product, application, and region:

Protein Ingredients Product Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

• Plant Proteins

o Cereals

o Wheat

o Wheat Protein Concentrates

o Wheat Protein Isolates

o Textured Wheat Protein

o Hydrolyzed Wheat Protein

o HMEC/HMMA Wheat Protein

o Rice

o Rice Protein Isolates

o Rice Protein Concentrates

o Hydrolyzed Rice Protein

o Others

o Oats

o Oat Protein Concentrates

o Oat Protein Isolates

o Hydrolyzed Oat Protein

o Others

o Legumes

o Soy

o Soy Protein Concentrates

o Soy Protein Isolates

o Textured Soy Protein

o Hydrolyzed Soy Protein

o HMEC/HMMA Soy Protein

o Pea

o Pea Protein Concentrates

o Pea Protein Isolates

o Textured Pea Protein

o Hydrolyzed Pea Protein

o HMEC/HMMA Pea Protein

o Lupine

o Chickpea

o Others

o Roots

o Potato

o Potato Protein Concentrate

o Potato Protein Isolate

o Maca

o Others

o Ancient Grains

o Ancient Wheat

o Quinoa

o Sorghum

o Amaranth

o Chia

o Millet

o Others

o Nuts & Seeds

o Canola

o Canola Protein Isolates

o Hydrolyzed Canola Protein

o Others

o Almond

o Flaxseeds

o Others

o Animal/Dairy Proteins

o Egg Protein

o Milk Protein Concentrates/Isolates

o Whey Protein Concentrates

o Whey Protein Hydrolysates

o Whey Protein Isolates

o Gelatin

o Casein/Caseinates

o Collagen Peptides

o Microbe-based Protein

o Algae

o Bacteria

o Yeast

o Fungi

o Insect Protein

o Coleoptera

o Lepidoptera

o Hymenoptera

o Orthoptera

o Hemiptera

o Diptera

o Others

Order a free sample PDF of the Protein Ingredients Market Intelligence Study, published by Grand View Research.

Recent Developments

• At Vitafoods held in April 2023, Darling Ingredients’ health brand Rousselot showcased its collagen peptides solution PEPTAN® for holistic well-being benefits. The premium protein-based ingredient provides multiple science-backed health benefits with nifty formulation properties.

• In June 2023, Roquette unveiled the new food innovation center, in Lestrem, France. This center will include a sensory analysis laboratory, a demonstration kitchen, and collaborative labs for pilot-scale testing of various plant-based ingredients.

• In May 2023, Burcon NutraScience Corporation, a global manufacturer of plant-based proteins for the F&B industry, announced its strategic initiative called Burcon 2.0. The Burcon 2.0 strategy will offer pilot-scale plant protein processing as a service.

• In April 2023, Burcon announced its plans to acquire Merit Functional Foods (Merit). Earlier in January 2023, Burcon was granted a patent for pea protein, which protected and maintained its pea protein licensee, Merit, with marketplace differentiation.

• In February 2023, Roquette entered a collaborative project with Eurial, Agri Obtentions, Greencell, the Université Lumière Lyon 2, and INRAE to develop AlinOVeg, which French plant-based (fava bean and peas) protein extraction and product development. Furthermore, in January 2023 Roquette invested in DAIZ Inc. to develop disruptive solutions in the healthy plant protein foods sector.

• In January 2022, Rousselot announced the expansion of its porcine collagen production capacity at the Ghent facility.