The global fiber optics market size is expected to reach USD 14.93 billion by 2030 and exhibit a CAGR of 6.9% from 2023 to 2030, according to Grand View Research Inc. The growth is attributed to the rising government funding in developing secure infrastructures to avoid massacres. Rising terrorism is also appealing to government authorities and defense services of different countries to take initiatives and stringent steps and curb such occurrences. This has led to the evolution and adoption of several technological methods such as body cams, wearables, and other responders that keep the security personnel connected, irrespective of the user’s location and user fiber optics for communications.

The concept of IoE (Internet of Everything) is attracting the security sector, worldwide, owing to the increasing awareness of the effectiveness and efficiency of the technology that aids in curbing national issues such as riots, massacres, killings, and other criminal offenses. The need for high-speed internet, capable of efficiently transmitting data is anticipated to grow with the increasing demand for IoE. The growing demand for high-bandwidth communication is fueling the fiber optic market growth. For instance, In March 2020, CommScope, an U.S-based Communication device company, installed 1.5 million feet of copper and 227 miles of fiber cabling in Allegiant Stadium, in Las Vegas. This fiber optic cabling provides high bandwidth connectivity to hundreds of thousands of smartphones and tablets and supports 4K video streaming.

Gather more insights about the market drivers, restrains and growth of the Fiber Optics Market

Detailed Segmentation:

Market Dynamics

Fiber optic systems can easily carry data, sound, and pictures over several kilometers to a few meters. Two industries with most significant applications are telecommunication and information technology. The development of fiber-rich infrastructure has greatly increased need for fiber optic cables. The telecommunication industry has been experiencing continuous advancements leading to a variety of upgrades and technological improvisations. Several innovations are being made across telecom industry, paving way for bandwidth-intensive communication. The growing demand for fiber optic cables can be accredited to rising bandwidth needs across carrier and enterprise networks. Broadband network topologies are being deployed at an exponentially rising rate as technology advances in telecom industry. Fiber to the home (FTTH), fiber to the building (FTTB), fiber to the cabinet (FTTC), and fiber to the premise (FTTP) are some of the well-known broadband networking architectures that call for extensive installation of fiber optic networks and consequently increase demand for fiber optic cables.

Type Insights

multi-mode fiber optic segment held largest revenue share of 53.6% in 2022 due to its low cost and widespread use in illumination and surgical lighting in the healthcare sector. Moreover, the multi-mode fiber optic is used in medical instruments and diagnostics, operating rooms, telemedicine, and medical imaging to achieve higher quality, efficiency, and resolution.

Multi-mode segment also provides a solution for communication, lighting, and sensing requirements in automotive applications. Moreover, multi-mode segment is increasingly being used as communication medium of choice for mission-critical applications due to its high bandwidth, and low cost.

Application Insights

Telecom segment dominated the market, with a revenue share of 41.7% in 2022. The growth prospects for fiber optics technology in telecom segment appear promising, owing to technology's increasing adoption in communication and data transmission services.

Fiber optics enables high-speed data transfer services in short and long-distance communications. The growing popularity of cloud-based applications, Video-on-Demand (VoD) services, and audio-video services drive up demand for fiber optic installations. Moreover, optical communications enabled the construction of telecommunications links over much greater distances and with much lower levels of transmission medium loss.

Regional Insights

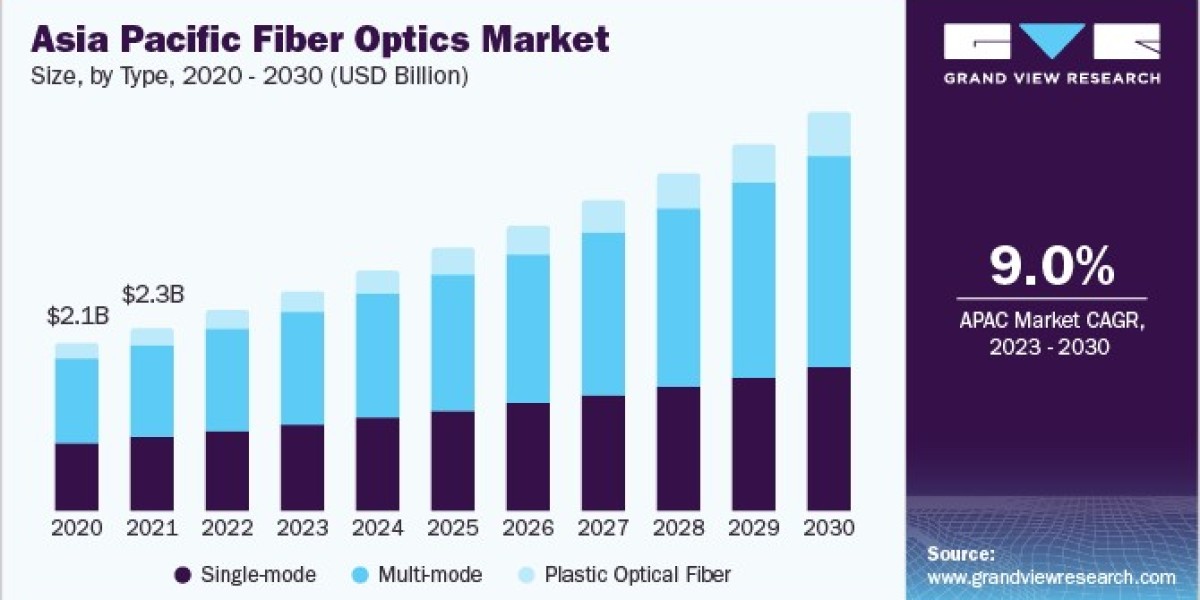

Asia Pacific region dominated global market at a revenue share of 28.8% in 2022. Increased technological advancements, widespread adoption in IT & telecommunications, administrative sectors, and development of fiber-integrated infrastructure are attributed to the growth.

In 2022, U.S. had around 91.9 million km of fiber optic cable laid throughout the country. Rising demand for Internet of Things (IoT) and connected devices along with growing deployment of broadband network platforms including Fiber to the Premise, Fiber to the Building, Fiber to the Home, and Fiber to the Cabinet also drives fiber optics' positive growth in this region.

Browse through Grand View Research's Semiconductors Industry Research Reports.

• The global microprocessor market size was estimated at USD 118.30 billion in 2023 and is projected to grow at a CAGR of 8.2% from 2024 to 2030.

• The global gallium nitride semiconductor devices market size was estimated at USD 2.56 billion in 2023 and is projected to grow at a CAGR of 26.4% from 2024 to 2030.

Key Companies & Market Share Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. Major focus is on developing new products and collaboration among key players. For instance, in December 2021, Amphenol Corporation, a U.S.-based Electronic connector manufacturing company, announced the acquisition of Halo Technology Limited, a manufacturer of fiber optic interconnects devices, for approximately $715 million. The initiative aims to enhance Amphenol Corporation's fiber optic offering to IT and data communications, mobile networks, and broadband customers by using Halos's high-technology products.

Some prominent players in global fiber optics market include:

• AFL

• Birla Furukawa Fiber Optics Limited

• Corning Incorporated

• Finolex Cables Limited

• Molex, LLC

• OFS Fitel, LLC

• Optical Cable Corporation (OCC)

• Prysmian Group

• Sterlite Technologies Limited

• Yangtze Optical Fiber and Cable Joint Stock Limited Company (YOFC)

Fiber Optics Market Segmentation

Grand View Research has segmented the global fiber optics market report based on type, application, and region:

Fiber Optics Type Outlook (Revenue, USD Million, 2017 - 2030)

• Single mode

• Multi-mode

• Plastic Optical Fiber (POF)

Fiber Optics Application Outlook (Revenue, USD Million, 2017 - 2030)

• Telecom

• Oil & Gas

• Military & Aerospace

• BFSI

• Medical

• Railway

• Others

Fiber Optics Regional Outlook (Revenue, USD Million, 2017 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o U.K.

o France

• Asia Pacific

o China

o Japan

o India

• South America

o Brazil

• Middle East and Africa

Order a free sample PDF of the Fiber Optics Market Intelligence Study, published by Grand View Research.

![NanoKlean Reviews [US, CA] Restores Shine And Luster!](https://biiut.com/upload/photos/2024/10/kfaiJiLzMVYZzjmMR2iB_07_331aa16e237bfbf1af8be2712b177527_image.png)