The blockchain technology market was valued at USD 7.36 billion in 2022 and is projected to soar to USD 3,273.83 billion by 2030, achieving an impressive compound annual growth rate (CAGR) of 84% over the forecast period. This rapid growth reflects blockchain’s potential to revolutionize both financial and non-financial industries, driving secure, fast, and cost-effective transactions.

In this article, we’ll explore the key drivers behind blockchain’s rise, real-world use cases, and the challenges businesses must overcome to unlock its full potential.

Know More: https://wemarketresearch.com/reports/blockchain-technology-market/770

Understanding Blockchain Technology

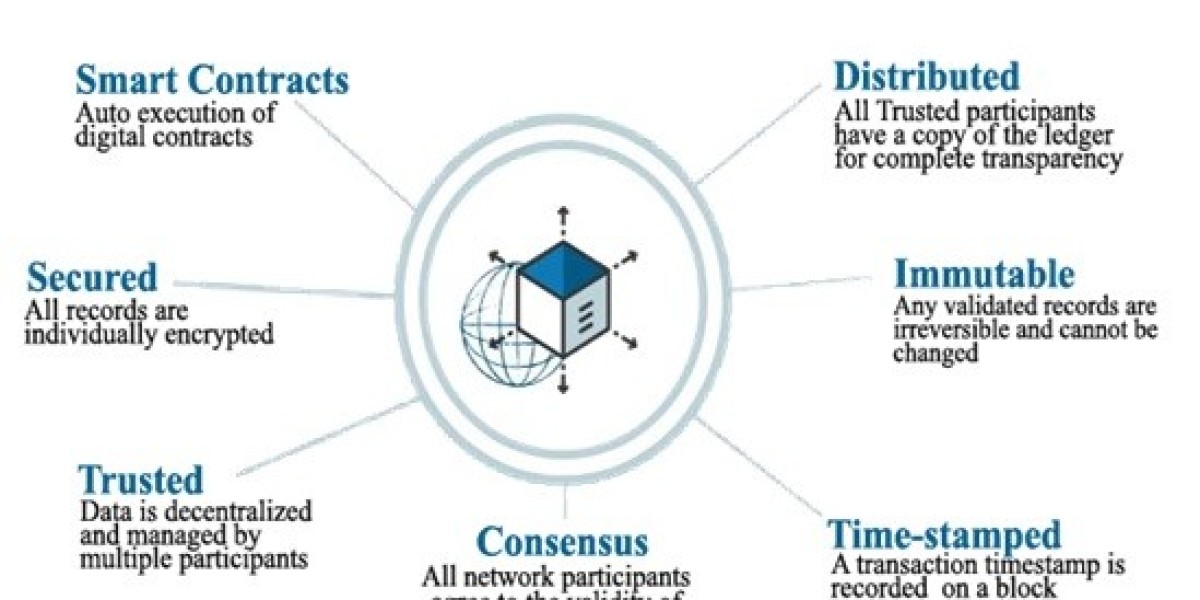

A blockchain is a distributed ledger composed of cryptographically linked blocks. Each block contains a timestamp, process data, and a cryptographic hash of the previous block, ensuring that transactions are transparent and tamper-proof. Blockchain eliminates intermediaries, allowing participants to transact directly across various industries, including:

- Financial services (mobile payments, factoring, cross-border transactions)

- Supply chain and logistics

- Healthcare data management

By enabling decentralized and peer-to-peer interactions, blockchain offers an innovative solution to the inefficiencies of traditional transaction systems.

Blockchain Use Cases Solving Real-World Challenges

While many blockchain projects struggle with adoption, successful implementations demonstrate the technology’s potential to address critical business challenges. Consider these three real-world examples:

- Supply Chain Transparency: Companies like IBM are using blockchain to trace products from origin to end customer, ensuring authenticity and reducing counterfeit risks.

- Decentralized Finance (DeFi): Platforms such as Ethereum enable financial transactions without banks, offering faster cross-border payments and lending services.

- Healthcare Data Management: Blockchain allows secure sharing of patient data among providers, enhancing care coordination while safeguarding privacy.

These use cases highlight blockchain’s ability to deliver measurable outcomes, from cutting costs to improving trust and efficiency.

Request Sample Copy: https://wemarketresearch.com/sample-request/blockchain-technology-market/770

Blockchain’s Evolving Capabilities: Web3 and Beyond

Blockchain has expanded beyond payments to become a fundamental component of Web3, the next iteration of the internet focused on decentralization. Newer technologies, such as Layer 2 zero-knowledge proofs, are being introduced to address the transparency-privacy paradox, though widespread adoption remains a challenge.

Smart contracts — self-executing programs on blockchain — are also revolutionizing business processes. By automating rules and transactions, smart contracts reduce human intervention and streamline operations in sectors like real estate and insurance.

Challenges in Blockchain Adoption

Despite its potential, blockchain adoption remains slow, primarily due to:

Design-Technology Alignment: Integrating blockchain solutions with existing business processes and agreements is complex. Organizations must align business goals with technical protocols to unlock blockchain’s benefits.

Fragmented Protocols: With more than 150 blockchain protocols in existence, businesses struggle to select the right technology. The lack of interoperability between platforms adds further complexity.

Most enterprises today opt for blockchain-inspired solutions — platforms that incorporate some blockchain features without full decentralization. These solutions offer simpler implementation and can evolve into more advanced decentralized applications (dApps) over time.

Key Blockchain Features for Success

According to Gartner, five essential characteristics define a complete blockchain solution:

Distribution: Data is shared across participants in the network.

Encryption: Ensures that information remains secure and tamper-proof.

Immutability: Transactions cannot be altered once recorded.

Tokenization: Digital assets can be assigned and tracked.

Decentralization: Power is distributed among participants through consensus algorithms.

While blockchain's core strengths lie in transparency and security, the technology must mature further to meet the demands of diverse industries. Companies adopting blockchain need to balance privacy, scalability, and performance to create viable solutions.

Conclusion: Embracing Blockchain for Future Growth

The blockchain market's extraordinary growth trajectory, from $7.36 billion in 2022 to $3,273.83 billion by 2030, underscores its transformative potential. As the technology matures and businesses find alignment between processes and protocols, blockchain will unlock new opportunities across industries.

Organizations looking to harness blockchain effectively must adopt a strategic approach — starting with simple use cases and evolving toward full-fledged blockchain solutions. With blockchain at the forefront of the Web3 revolution, companies that embrace innovation will be well-positioned to capitalize on this $3 trillion opportunity.

Quantitative Analysis:

Market size and forecast from 2023 to 2034

Market estimates and forecast for type segments up to 2034

Regional market size and forecast for type segments up to 2034

Market estimates and forecast for component segments up to 2034

Regional market size and forecast for component segments up to 2034

Market estimates and forecast for application segments up to 2034

Regional market size and forecast for application segments up to 2034

Market estimates and forecast for enterprise segments up to 2034

Regional market size and forecast for enterprise segments up to 2034

Market estimates and forecast for end-use segments up to 2034

Regional market size and forecast for end-use segments up to 2034

Company financial performance

Blockchain Technology Market Key Companies

IBM Corp. (U.S.)

Deloitte Touche Tohmatsu Ltd. (U.K.)

Chain, Inc. (U.S.)

Microsoft Corp. (U.S.)

The Linux Foundation (U.S.)

Global Arena Holding, Inc. (U.S.)

Ripple (U.S.)

Monax (U.S.)

BTL Group Ltd. (U.K.

Circle Internet Financial Ltd. (U.S.)

Digital Asset Holdings, LLC (U.S.)