The global animal wound care market size was estimated at USD 1.08 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.92% over the forecast period. The market is primarily driven by factors, such as the rising adoption of companion animals, increasing demand for veterinary surgeries, and growing animal injury cases. For instance, according to the U.S. Department of Transportation, over 1 million animals die each year due to road accidents, with several million animals getting injured. Moreover, the increasing number of veterinary visits and rising adoption of pet insurance are boosting industry growth.

Trupanion, a pet insurance company, observed 1.3 million pet insurance enrollments as of June 2022. It observed 32% growth in the second quarter of 2021. The COVID-19 pandemic affected millions of people and businesses around the world. It financially impacted as well as put other implications on most of the veterinary fields, including the animal wound care market. The postponement and cancellation of elective surgeries in animals due to nationwide lockdowns resulted in a decline in postoperative wound cases, thus impacting the industry's growth. Furthermore, on March 2020, the Federation of Veterinarians of Europe (FVE) stated that many small- and medium-sized veterinary businesses were facing a period of financial difficulty in the initial stage of the pandemic.

Gather more insights about the market drivers, restrains and growth of the Global Animal Wound Care Market

Detailed Segmentation:

Product Insights

In 2022, the surgical wound care products segment dominated the industry and accounted for the maximum share of more than 40.40% of the overall revenue. Sutures, staplers, tissue adhesives, sealants, and glues are examples of products used in surgical wound care. Skin staplers have become increasingly common due to their benefits including ease of use, shorter surgical times, and simplicity of removal. In various veterinary procedures, including cardiovascular, orthopedic, & neurological procedures, suture cassettes & surgical sutures are used to temporarily assist wound healing. Some of the major companies that provide these devices are Surgical Holdings, DRE Veterinary, and Medtronic.

Animal Type Insights

In 2022, the companion animal segment dominated the global industry and accounted for the maximum share of more than63.85% of the overall revenue. Rising pet healthcare costs, especially in developed regions, are among the key factors driving the growth of this segment. According to a report by American Pet Products Association (APPA), pet owners spent around USD 34.3 billion on veterinary care in 2021 in the U.S. Another key factor propelling the segment growth is the rising demand for minimally invasive surgeries. Modern procedures provide various benefits including smaller incisions and fewer stitches, which encourage pet owners to choose cutting-edge, minimally invasive technologies.

End-use Insights

The veterinary hospitals and clinics segment dominated the industry in 2022 and accounted for the maximum share of more than 40.00% of the overall revenue owing to faster diagnosis and easy availability of & access to treatments in vet hospitals & clinics. Moreover, these settings offer a wide range of treatments as well as improved wound care procedures, which is a high-impact rendering driver for the segment. Another key factor driving the segment growth is various government animal welfare groups issuing guidelines for safety practices and regulations to be adopted in veterinary hospitals & clinics.

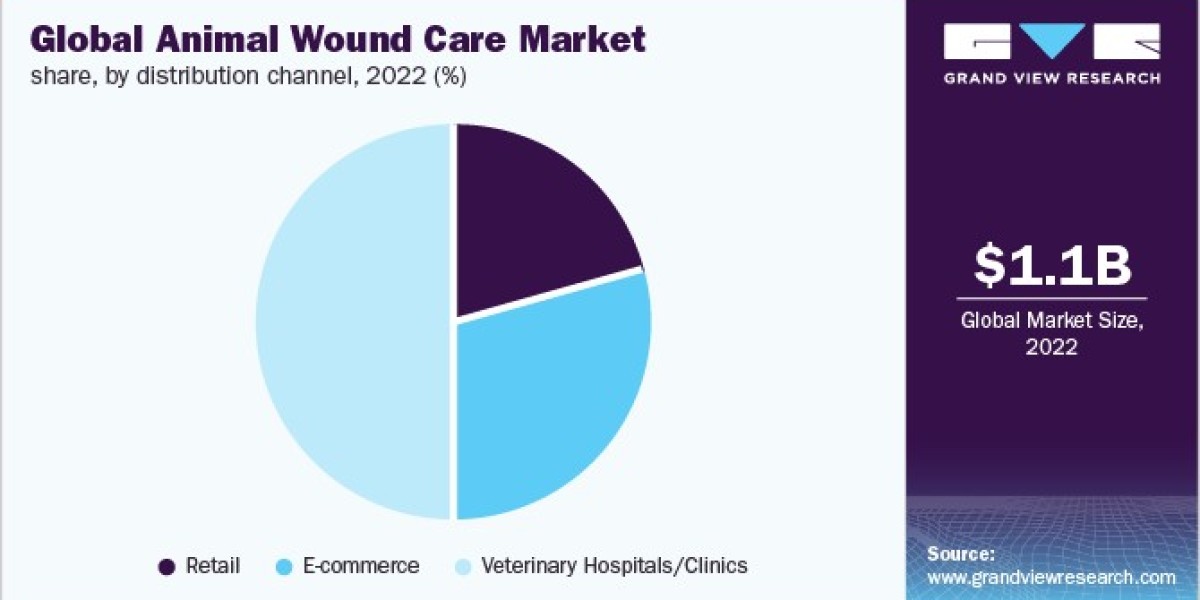

Distribution Channel Insights

Due to high accessibility and affordability, the veterinary hospitals and clinics segment dominated the global industry in 2022 and accounted for the highest share of more than 45.00% of the overall revenue. Veterinary hospitals are the primary healthcare facility, with their main objective to provide urgent medical treatment to patients. Veterinarians are committed to providing patients with better primary care services for a speedy recovery. The staff at clinics advises pet owners regarding pet food and the benefits of medicine in addition to providing veterinarian treatment. This enables more efficient animal wound care management and control. The e-commerce segment is expected to register the fastest growth rate during the forecast period.

Regional Insights

The North America region dominated the global industry in 2022 and accounted for the maximum share of more than 32.30% of the overall revenue. An increase in efforts undertaken by major players to advance their product portfolios by guaranteeing high-quality standards is expected to fuel regional market growth. However, during the COVID-19 pandemic, many government authorities recommended avoiding elective surgeries in animals, which resulted in a decline in postoperative wound cases. For instance, the CDC recommended veterinarians and veterinary staff attend only to emergency visits and procedures during the initial stages of the COVID-19 pandemic.

Browse through Grand View Research's Animal Health Industry Research Reports.

• The global animal wound care market size was estimated at USD 1.08 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.92% over the forecast period.

• The global pet herbal supplements market size was estimated at USD 895.0 million in 2023 and is estimated to grow at a CAGR of 10.6% from 2024 to 2030.

Some of the prominent players in the global animal wound care market include:

• B. Braun Melsungen AG

• Medtronic

• 3M

• Johnson & Johnson (Ethicon)

• Virbac

• Advancis Veterinary Ltd.

• INNOVACYN, Inc.

• Vernacare (Robinson Healthcare)

• NEOGEN Corp.

• KeriCure, Inc.

Animal Wound Care Market Segmentation

Grand View Research has segmented the global animal wound care market on the basis of product, animal type, end-use, distribution channel, and region:

Animal Wound Care Product Outlook (Revenue, USD Million, 2018 - 2030)

• Surgical Wound Care Products

o Sutures & Staplers

o Tissue Adhesive

• Advanced Wound Care Products

o Foam Dressings

o Hydrocolloid Dressing

o Film Dressing

o Hydrogel Dressing

o Others

• Traditional Wound Care Products

o Tapes

o Bandages

o Dressing

o Absorbents

o Others

• Therapy Devices

Animal Wound Care Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

• Companion Animals

o Dogs

o Cats

o Horses

o Others

• Livestock Animals

Animal Wound Care End-use Outlook (Revenue, USD Million, 2018 - 2030)

• Veterinary Hospitals/Clinics

• Homecare

• Research Institutes

Animal Wound Care Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

• Retail

• E-commerce

• Veterinary Hospitals/Clinics

Animal Wound Care Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o U.K.

o Germany

o France

o Italy

o Spain

• Asia Pacific

o China

o Japan

o India

• Latin America

o Brazil

o Mexico

o Argentina

• MEA

o South Africa

o Saudi Arabia

Order a free sample PDF of the Animal Wound Care Market Intelligence Study, published by Grand View Research.