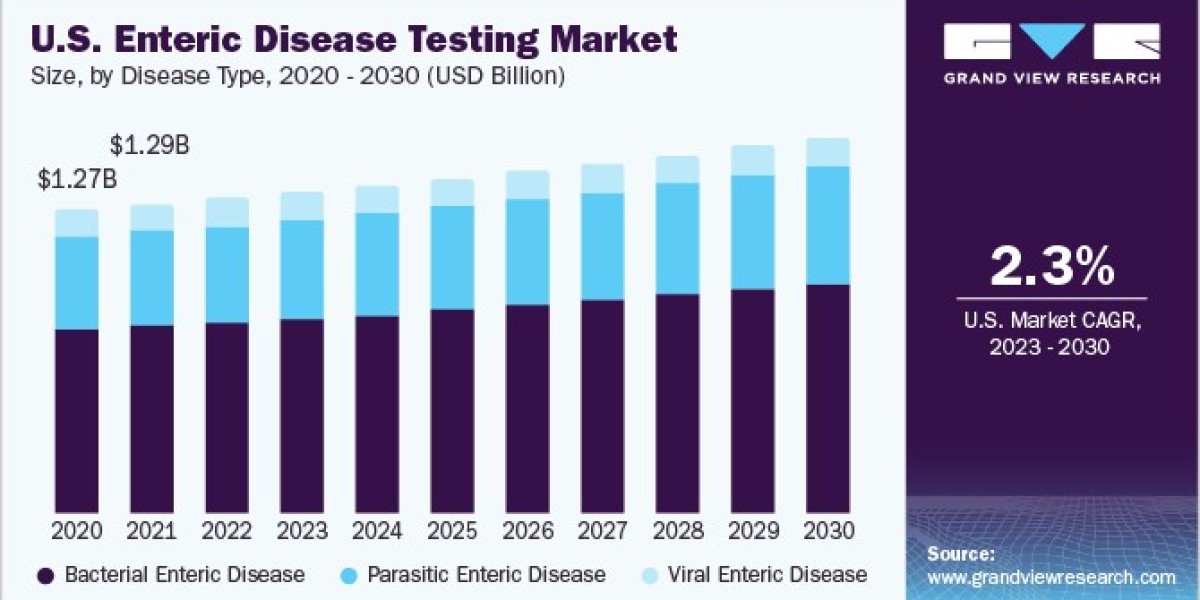

The global enteric disease testing market was valued at USD 3.81 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 2.7% from 2023 to 2030. Key factors driving this market include advancements in testing technologies and increased government funding, particularly in emerging economies. These developments are expected to enhance the accessibility and efficiency of enteric disease diagnostics. Additionally, the rising global demand for early diagnostic solutions plays a critical role in boosting the market's growth, as early detection helps in better management and treatment of enteric diseases.

However, the COVID-19 pandemic had a notable impact on the enteric disease testing market. As the pandemic heightened awareness of viral and bacterial infections, people became more cautious about their food choices, favoring home-cooked and hygienic options to lower their risk of infection. This behavioral shift led to a decrease in the incidence of enteric diseases during 2020 and 2021, which, in turn, reduced the demand for enteric disease testing. Moreover, the pandemic placed a significant focus on COVID-19 testing, which took priority over other infectious disease testing, further limiting the demand for enteric disease diagnostics. As a result, the market experienced a temporary slowdown during this period. Despite these challenges, the market is expected to recover and grow steadily as demand for comprehensive infectious disease testing increases in the post-pandemic era.

Gather more insights about the market drivers, restrains and growth of the Enteric Disease Testing Market

Disease Type Insights

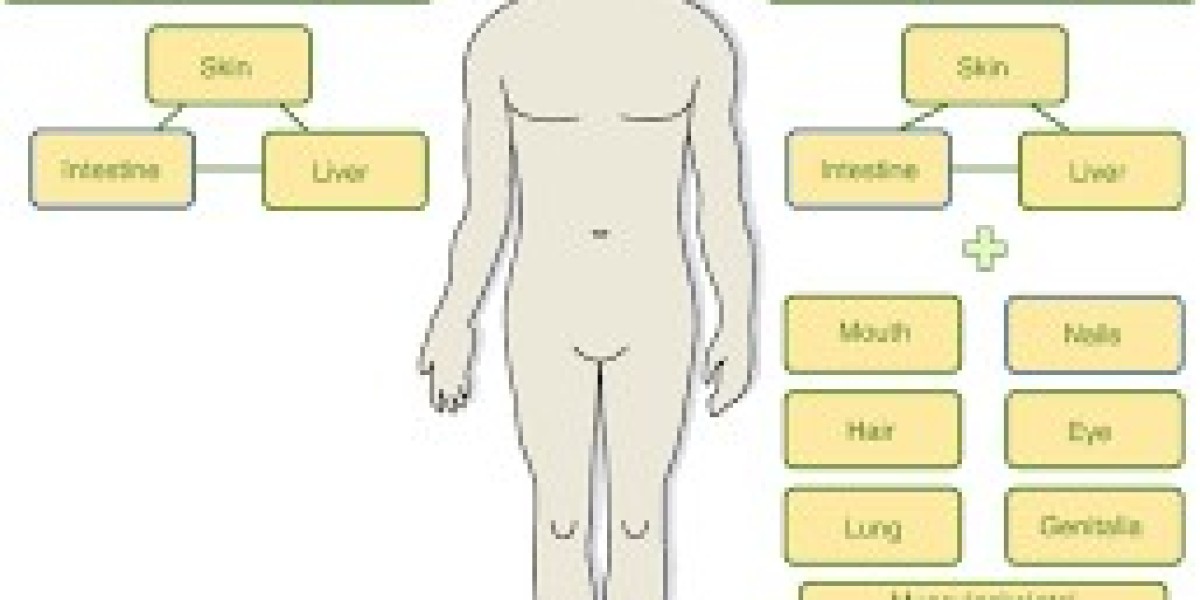

The enteric disease testing market is categorized based on disease type into three primary segments: bacterial, viral, and parasitic enteric diseases. Among these, the bacterial enteric diseases segment holds the dominant market position, capturing the largest revenue share and is projected to experience the fastest compound annual growth rate (CAGR) from 2023 to 2030. Various pathogenic bacteria are responsible for these diseases, including Clostridium difficile, Escherichia coli, Shigella, Salmonella, and Campylobacter. Notably, the National Institute of Health reports that C. difficile infections affect approximately half a million individuals in the United States each year, with around 29,000 of those diagnosed succumbing to the infection within a month. Additionally, E. coli is responsible for roughly 63,000 cases of hemorrhagic colitis annually in the U.S., underscoring the critical need for effective testing and diagnosis of bacterial enteric diseases.

The parasitic disease testing segment is also anticipated to experience significant growth, driven by the increasing incidence of parasitic infections and the emergence of new strains. The World Health Organization (WHO) has reported ongoing cholera outbreaks in at least 18 countries as of February 2023, with the mortality rates from these outbreaks reaching alarming levels. In 2021, the global cholera mortality rate was approximately 1.9%, and similar trends are expected to persist in 2022 and 2023, highlighting the urgent need for improved testing and preventive measures against such diseases.

According to the Child Health Epidemiology Research Group (CHERG), enteric pathogens like Salmonella spp., rotavirus, and Vibrio cholerae have resulted in higher mortality rates compared to other enteric pathogens. Consequently, the WHO committee has prioritized the development of new and improved vaccines targeting these pathogens. While some viruses, such as rotavirus, are widely distributed globally and infect about 90% of children under five years old, the incidence of these infections is often influenced by environmental factors, along with seasonal and geographical patterns related to hygiene, sanitation, and access to clean drinking water. This complex interplay of factors emphasizes the critical importance of developing effective diagnostic and preventive strategies for enteric diseases to reduce their burden on public health.

Order a free sample PDF of the Enteric Disease Testing Market Intelligence Study, published by Grand View Research.