The global flight simulator market size was valued at USD 5.18 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. The benefits offered by flight simulator devices include mission-critical training programs that ensure effective aircraft operation, low operational costs, and visual systems. These benefits offer near real-world experience and are anticipated to create new growth avenues for market growth over the next few years. Rising demand for better and more effective pilot training is anticipated to catapult growth. The growing importance of aircraft safety and the need for substantial training is anticipated to spur demand over the forecast period.

The need for flight handling and safety operations, such as situational awareness and skill competency, promotes industry growth. The industry is witnessing unprecedented R&D efforts in aerospace technology and technological advancements, resulting in the development of highly advanced flight simulators. These products offer high efficiency and can save fuel costs. Additionally, advancements in computing technology have significantly resulted in the incorporation of better visual and motion systems for enhanced fidelity and smoothness, which is also anticipated to drive the market flight simulators market over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Flight Simulator Market

Detailed Segmentation:

Product Insights

The FFS segment accounted for over 92.0% of the market share in 2022. FFS refers to high-technical flight simulators that offer high fidelity and reliability. FFS accurately stimulates the aircraft and the environment in which it operates. These devices create motion, sound, visuals, and all other aircraft operations to create a realistic training environment, which ensures thorough training for the pilots.

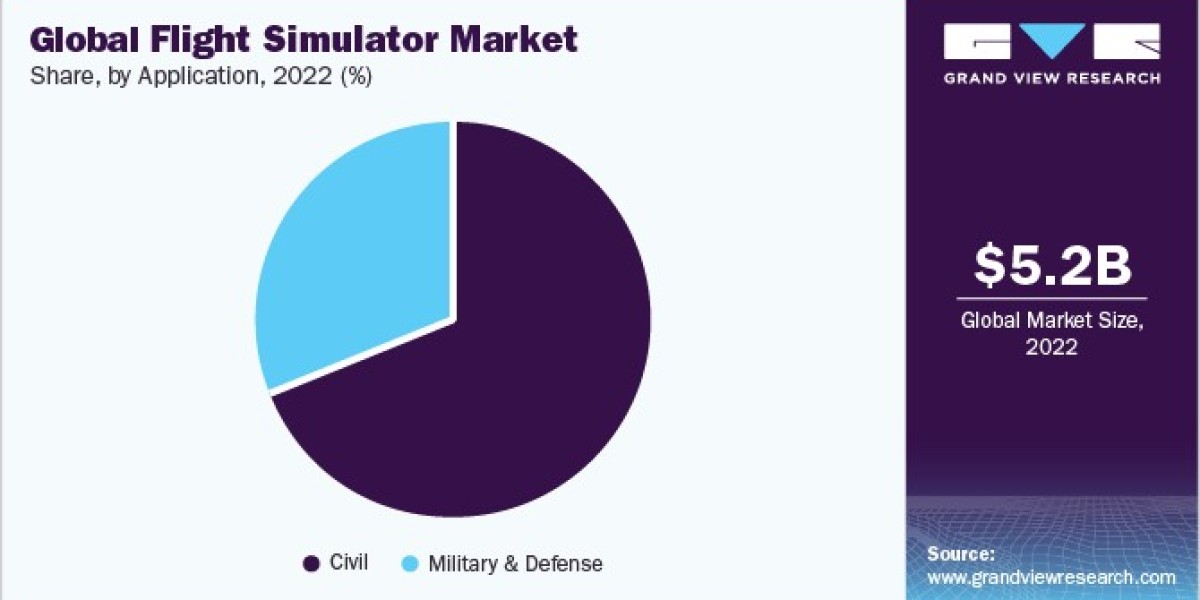

Application Insights

Based on application, the market for flight simulators has been segregated into military, Defense, and civil. The civil segment held the highest market share of 69.2% in 2022. Military and defense include simulators for training and mission rehearsals for armed forces. Further, live, virtual, and constructive training offered by flight simulators enables armed forces pilots to perform better in real-world tasks or missions, resulting in increased product installation.

Regional Insights

North America emerged as a key market for flight simulators, accounting for a significant global revenue share in 2022. This is attributable to early technology adoption by manufacturers and consumers. In addition, stringent regulations enforced by the Federal Aviation Administration (FAA) and Federal Aviation Regulations, including Sec. 61.64 for using flight simulators for training purposes, further spur regional growth. Further, advanced military and commercial infrastructure availability is also expected to bolster the market growth for flight simulators in this region.

Browse through Grand View Research's Automotive & Transportation Industry Research Reports.

• The global helicopter simulator market size was valued at USD 1.10 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.9% from 2024 to 2030.

• The global rear axle market size was valued at USD 54.7 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030.

Key Flight Simulator Companies:

• Leonardo S.p.A.

• Boeing

• CAE Inc.

• AIRBUS

• The DiSTI Corporation

• Fidelity Technologies Corporation

• Havelsan Air Electronic Industry

• Kratos Defense & Security Solutions, Inc.

• L3Harris Technologies, Inc.

• Lockheed Martin Corporation

• Meggitt PLC

• Collins Aerospace

• Saab AB

• Teledyne Brown Engineering

• Thales

• VirTra, Inc

Flight Simulators Market Segmentation

Grand View Research has segmented the global flight simulator market based on product, application and region:

Flight Simulator Product Outlook (Revenue, USD Million, 2018 - 2030)

• Full Flight Simulator (FFS)

• Fixed Flight Training Devices (FTD)

Flight Simulator Application Outlook (Revenue, USD Million, 2018 - 2030)

• Military & Defense

• Civil

Flight Simulator Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

• Asia Pacific

o China

o India

o Japan

o Australia

o South Korea

• Latin America

o Brazil

o Mexico

• Middle East and Africa

o United Arab Emirates (UAE)

o Saudi Arabia

o South Africa

Order a free sample PDF of the Flight Simulator Market Intelligence Study, published by Grand View Research.

Recent Developments

• In June 2023, the Microsoft Flight Simulator team announced the latest City Update II: France, a free addition that showcases the stunning landscapes of five cities: Angers, Amiens, Nîmes, Nantes, and Reims. As a special highlight for the Paris Air Show, this update also features the renowned Paris-Le Bourget Airport (LFPB) in both festival and standard configurations, adding to the immersive experience for players.

• In July 2022, L3Harris Technologies was chosen by Airbus to deliver a cutting-edge full-flight simulator for its Toulouse Training Center, specifically for the A320 family. The Reality7e simulator represents the pinnacle of L3Harris' advanced training technology, offering unparalleled fidelity and realism. Additionally, this partnership enabled early access to training devices, ensuring the industry's growing demand for training capacity.

• In July 2022, CAE introduced its latest innovation in pilot training, the CAE 700MXR Flight Simulator, at the Farnborough International Air Show 2022. This advanced simulator is designed for the emerging eVTOL market and offers a transformative training experience for navigating complex urban environments. The compact mini-motion platform and immersive 360⁰ field of view visuals provide highly realistic and physics-based simulations specifically tailored to single-pilot operations. With the CAE 700MXR Flight Simulator, CAE aims to revolutionize flight training and meet the unique demands of the evolving aviation industry.