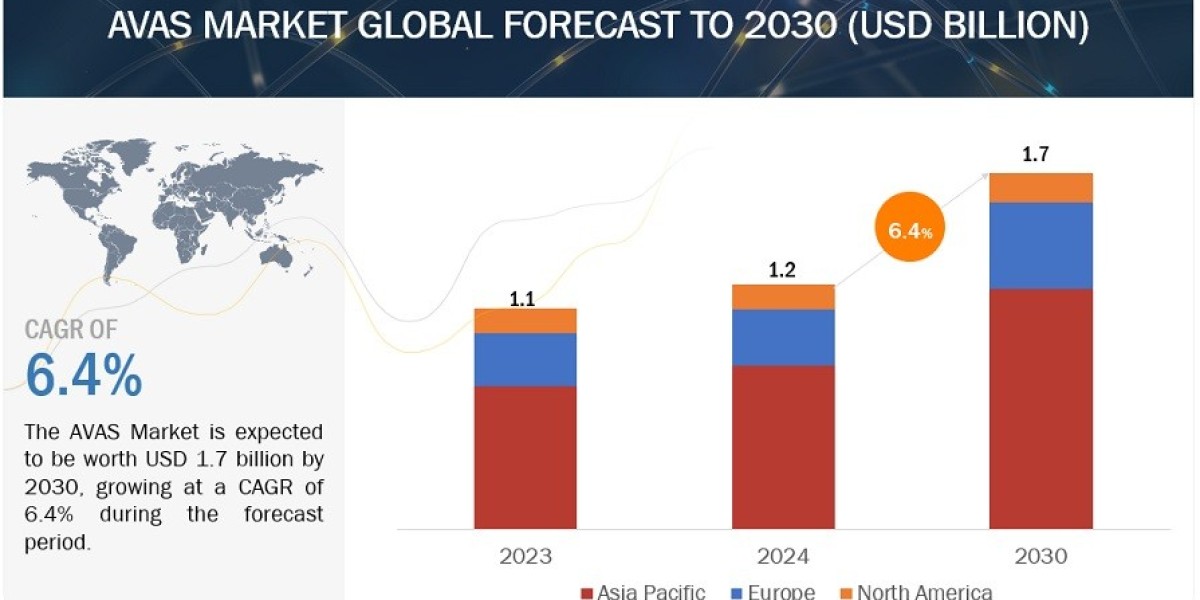

The global AVAS market size is projected to grow from USD 1.2 billion in 2024 to USD 1.7 billion by 2030, at a CAGR of 6.4%. The AVAS market growth is driven by the increasing adoption of electric vehicles and hybrid electric vehicles, which, while beneficial for reducing emissions, are often too quiet at low speeds, posing a risk to pedestrians, especially those who are visually impaired. Regulatory mandates across various regions, such as the European Union and the United States, require the installation of AVAS in these vehicles to enhance pedestrian safety. Additionally, technological advancements and innovations in sound design and integration are propelling market growth, enabling manufacturers to offer more sophisticated and customizable alert systems. Public awareness of the need for improved road safety, coupled with government incentives for EV adoption, also plays a crucial role in driving the AVAS market size. Further, the increasing urbanization and the consequent rise in vehicular traffic necessitate effective solutions like AVAS to prevent accidents and ensure safer mobility for all road users.

The separated AVAS segment is estimated to hold a significant share in the AVAS market share during the forecast period. In the separated segment, AVAS units are installed as distinct components, often externally mounted on the vehicle. This separation allows for greater versatility in placement, ensuring optimal sound dispersion and effectiveness across different vehicle types and models. Manufacturers can strategically position the AVAS units to maximize their auditory impact, enhancing pedestrian awareness and safety. Moreover, the ease of access associated with separated systems simplifies maintenance and replacement, which can be particularly advantageous for fleet operators and large-scale transportation services. Some EVs have an optional position of speakers at the rear end of the vehicle, which emits a sound to alert commuters when the vehicle is reversing.

The commercial vehicle segment is expected to grow rapidly in the AVAS market growth during the forecast period. This segment includes light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs). HCVs consist of heavy trucks and buses & coaches, which are produced in smaller volumes due to their specific use in industries like logistics, construction, and mining. In contrast, LCVs have evolved from basic utility vehicles to versatile vehicles used for both passenger and commercial purposes. The rising sales of electric buses, especially in China, have significantly contributed to the growth of the commercial vehicle segment.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=20863691

The growing trend of replacing fossil fuel-based public transport with electric buses is expected to boost the electric commercial vehicle market during the forecast period. Additionally, the expansion of e-commerce, logistics, and shared mobility services is also expected to drive the electric commercial vehicle market during this period. Electric vans are expected to grow significantly in Europe and Asia due to their extensive use in businesses. EV LCVs are expected to grow at a rapid rate in the coming years. With the increasing number of electric commercial vehicles, there is a higher possibility of accidents in the future. The probability of pedestrian accidents is high in public transport places, especially crowded ones. To avoid such scenarios in the future, European countries and the US have introduced regulations for AVAS installation in EVs. Moreover, increased emphasis on safety measures for EVs is expected to drive the AVAS market during the forecast period.

The FCEV segment is expected to grow rapidly in the AVAS market during the forecast period. FCEVs use fuel cells to generate electricity from oxygen and compressed hydrogen, making them completely emission-free as they only emit water or heat. These vehicles have been introduced in the US, particularly in California, and many prominent truck manufacturers have already developed fuel cell electric trucks. In January 2023, the Adani Group in India signed an agreement with Ashok Leyland and Ballard Power to launch a pilot project for a hydrogen fuel cell electric truck in India. Japan and Europe are also focusing on launching FCEVs, which will increase the adoption of AVAS systems in these regions. FCEVs offer high fuel efficiency and can travel around 300-400 miles on a full tank, with the best models exceeding 500 miles. Refueling takes only three to five minutes, making FCEVs ideal for fixed-route transportation. However, the infrastructure for hydrogen refueling and production is limited due to the high cost of fuel cell stacks and systems. Storing and transporting hydrogen is also challenging and adds to the cost. Despite these challenges, many governments are investing in hydrogen-powered vehicles and infrastructure. Notable FCEVs currently on the market include the Toyota Mirai and Hyundai Nexo.

Japan aims to set up 900 hydrogen refueling stations and 0.8 million fuel cell cars by 2030. In South Korea, the Ministry of Knowledge Economy is undertaking similar efforts to promote fuel cells in the country. Headquartered in Japan, JX Nippon, Toshiba, and Panasonic are the three largest market players in the Asia Pacific region. Passenger cars account for most of the FCEV market (followed by buses, trucks, and LCVs) outside China. Japan has the world’s highest number of hydrogen power stations, followed by Germany, the US, and France. The expansion of FCEVs across various regions is expected to increase the adoption of AVAS systems, further enhancing safety standards in the evolving landscape of emission-free transportation.

The Asia-Pacific region is expected to dominate the AVAS market during the forecast period, including countries such as China, South Korea, Japan, and India. This region has some of the world's fastest-growing economies, particularly China and India. Recognizing the potential growth of the EV market, governments in these economies have implemented various initiatives to attract major OEMs to produce EVs locally. The region faces significant pollution challenges, with 93 of the world's most polluted cities located here and a high energy demand. Many countries in the region are planning to reduce emissions in the coming years. China, a leader in e-mobility, had already achieved its target of over 20% EV sales by 2025 as early as 2022 and was expected to reach around 35% in 2023. South Korea, Japan, and India have also announced plans to transition to EVs in the near future, with India aiming for 30% of passenger car sales to be electric by 2030. South Korea and Japan are aspiring to be among the world's top five EV producers by 2030.

The rapid adoption of EVs necessitates safety measures to prevent accidents due to the lack of noise from electric and hybrid vehicles. Countries such as China, Japan, India, and South Korea are seen as potential markets for electric scooters equipped with pedestrian warning systems in the future. India is taking substantial steps to adopt EVs while still accommodating internal combustion engine (ICE) vehicles. For example, in March 2024, the Union Government approved a scheme to establish India as a manufacturing hub for advanced technology EVs, aiming to attract investments from leading global EV manufacturers. These factors are expected to boost EV sales in the Asia-Pacific region, thereby driving the AVAS market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=20863691