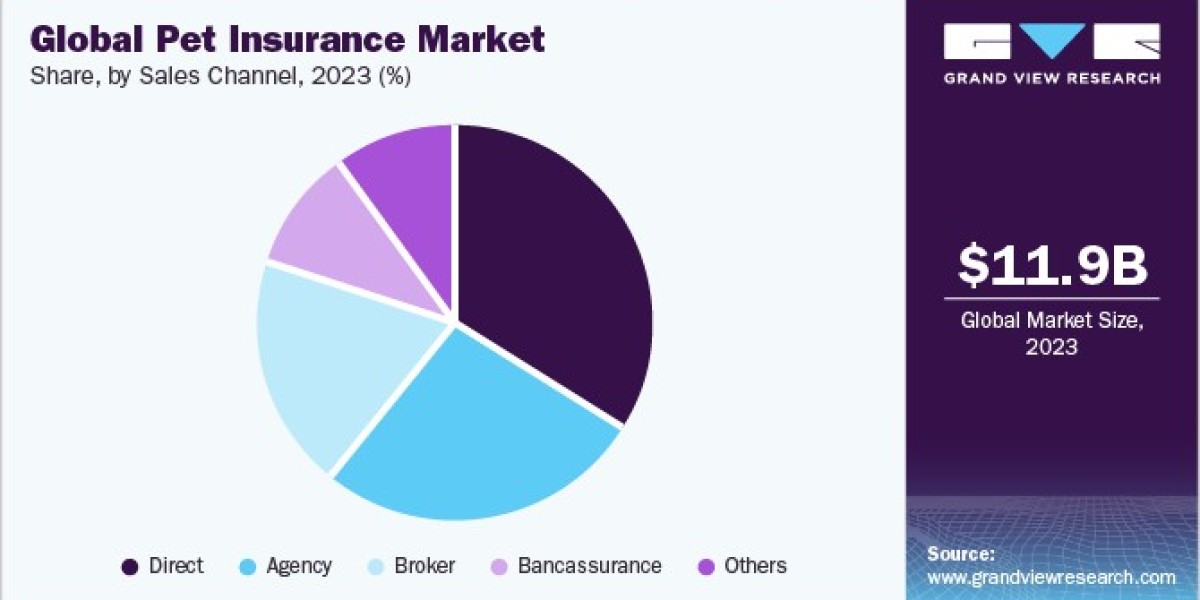

The global pet insurance market, valued at a substantial $11.87 billion in 2023, is poised for significant growth, projected to expand at a compound annual growth rate of 14.15% from 2024 to 2030. Several key factors are driving this market expansion.

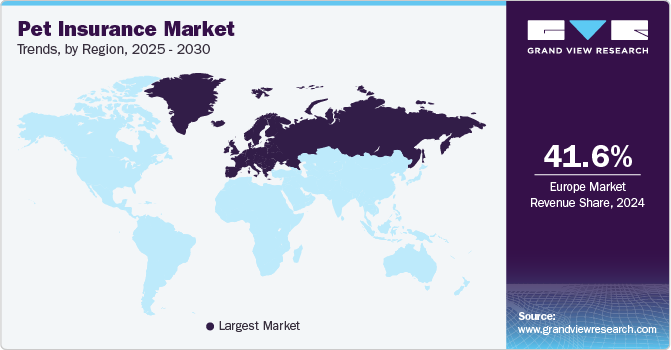

Firstly, the increasing number of pets worldwide, coupled with the growing trend of pet adoption, is a major contributor. As more people choose to have pets, the demand for pet insurance to protect their furry companions against unexpected medical expenses is rising. Secondly, the adoption of pet insurance in previously underpenetrated markets is also fueling growth. As awareness of pet insurance benefits increases, more pet owners in these regions are opting for coverage.

Thirdly, the escalating costs of veterinary care are another significant driver. With advancements in medical technology and treatments, the expenses associated with treating pet illnesses and injuries have risen. Pet insurance offers a financial safety net, helping pet owners manage these costs. Additionally, initiatives by key companies in the pet insurance industry, such as product innovation and expanded coverage options, are contributing to market growth.

Furthermore, the humanization of pets, treating them as family members, is influencing the market. As pet owners become more invested in their pets' well-being, they are more likely to seek out insurance to protect them from unforeseen medical needs. The latest data from the 2023 State of the Industry report by NAPHIA underscores this trend, revealing a significant increase in the number of insured pets in North America.

Gather more insights about the market drivers, restrains and growth of the Pet Insurance Market

Moreover, the rising incidence of diseases in cats and dogs is a major concern for pet owners, leading to increased demand for pet insurance. Serious medical conditions like accidental injuries and cancer can incur substantial expenses, making insurance a valuable tool for mitigating these financial burdens. The growing need for specialized veterinary healthcare facilities, with advanced equipment and expertise, is also driving the adoption of pet insurance. These facilities often require significant investments, leading to higher treatment costs.

Finally, the increasing disposable income of pet owners, particularly in developing economies, is making pet insurance more affordable and accessible. As people have more discretionary income, they are more likely to invest in their pets' health and well-being, including insurance coverage.

Coverage Type Segmentation Insights

By coverage type, the accident and illness segment dominated the pet insurance market in 2023, accounting for a substantial 84.94% of the total market share. This segment's prominence is expected to continue, with the fastest CAGR projected for the coming years. Several factors contribute to this growth, including the significant costs associated with veterinary care, the increasing number of companion animals, and a rising awareness of the benefits of pet insurance.

Accident and illness policies, often provided by pet insurance companies, offer comprehensive coverage for a wide range of conditions, including acute and chronic diseases, medications, diagnostic tests, and more. Given the extensive protection they provide to pet owners, this segment is poised for continued rapid expansion.

In contrast, the "others" segment, which includes liability insurance policies and others, is anticipated to experience a higher uptake in European countries. This growth can be attributed to factors such as Germany's mandate for dog liability insurance for pet owners. Companies like Luko, operating in countries like France, Germany, and Spain, offer dog liability insurance that covers pet owners against both physical and material damages caused by their pets. These policies often provide substantial coverage, extending up to 30 million euros, further encouraging pet owners to adopt such insurance.

Order a free sample PDF of the Pet Insurance Market Intelligence Study, published by Grand View Research.