The global supply chain analytics (SCA) market was estimated at USD 6.12 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 17.8% from 2023 to 2030. The increasing demand for SCA solutions is largely driven by heightened awareness of their benefits, which include improved forecasting accuracy, enhanced supply chain optimization, reduced waste, and the meaningful integration of business data. Additionally, the rising number of small and medium enterprises (SMEs) and their increased investment in analytics to strengthen their market positions and compete effectively are expected to further propel market growth over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Global Supply Chain Analytics Market

Segmentation Analysis:

Solution Insights

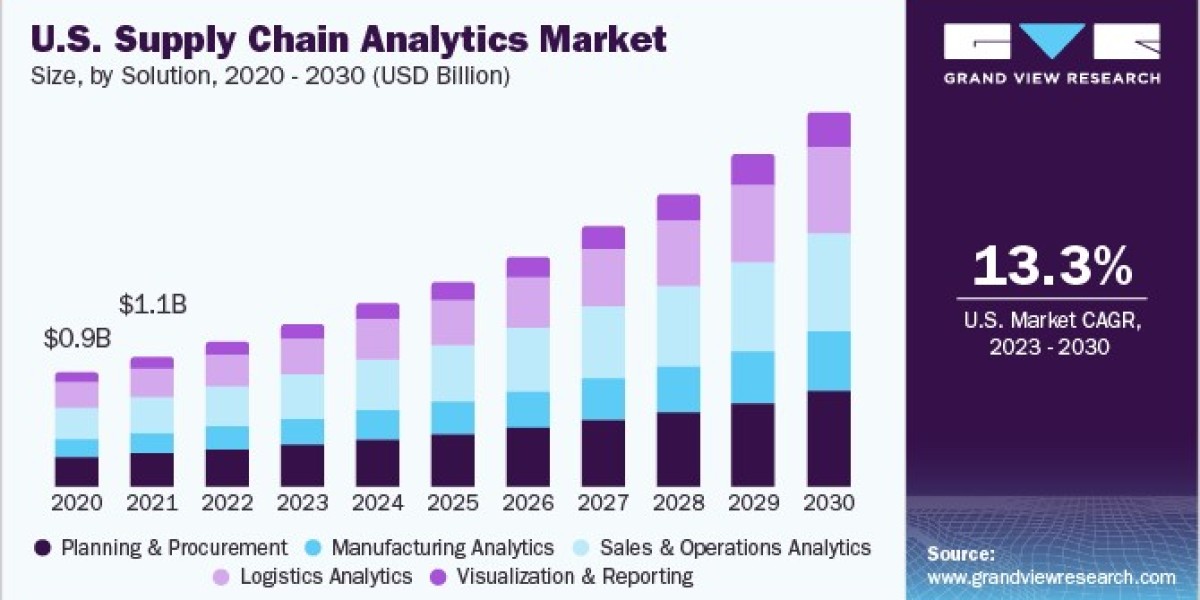

In terms of solutions, the sales and operations analytics segment held the largest market share, exceeding 28% in 2022. The need for optimizing resource utilization and reducing costs were key factors driving this segment's growth. Clients benefit from flexible and customizable SCA solutions that can adapt to changing requirements while remaining cost-effective, contributing to the segment's projected growth.

Logistics analytics solutions are essential for linking transportation networks with market demand forecasts and identifying product supply locations. The integration of big data within SCA enhances supply chain and logistics operations, effectively addressing customer needs and boosting satisfaction and loyalty. This trend is expected to drive growth in the logistics analytics segment over the forecast period.

The planning and procurement segment is also expected to experience significant growth, as demand forecasting in supply chain planning analytics encompasses factors like freight costs, production levels, distribution, and budgeting, which help users efficiently manage logistics operations.

Service Insights

Regarding services, the professional service segment accounted for over 60% of the market share in 2022. These services are crucial for ensuring that new systems integrate seamlessly with existing departmental systems, thereby minimizing data loss or theft. The growing demand for professional services focused on data analysis and protection, as well as expertise in emerging technologies, is contributing to this segment's growth. However, the supply chain sector often lacks skilled professionals capable of identifying and analyzing trends that inform marketing decisions.

The support and maintenance segment is expected to register the fastest CAGR over the forecast period. Third-party support can lead to cost savings while providing access to skilled professionals. Addressing the technical complexities of software, maintaining and repairing systems, facilitating data transfers, and regularly updating software are all critical factors for the successful implementation of SCA solutions. Neglecting these areas could hinder productivity, making the demand for support and maintenance services crucial in the coming years.

Deployment Insights

In terms of deployment, the cloud segment dominated the market with over 62% share in 2022. The proliferation of technology has driven the widespread adoption of IoT devices, increasing the reliance of original equipment manufacturers (OEMs) on cloud-based platforms. Cloud deployment enhances flexibility and allows for extensive customization of products and services for organizations. The industry is particularly favoring big data analytics solutions for their advantages in data security and risk assessment. Improved mobility and user-friendliness of cloud services have further accelerated the adoption of supply chain analytics solutions on cloud platforms.

Additionally, the preference for cloud-based deployment is expected to grow, especially among enterprises in developing economies in the Middle East, Africa (MEA), and Asia Pacific, where a lack of in-house IT expertise often leads businesses to opt for cloud solutions. The increasing availability of cloud-based SCA options is expected to drive demand among small and medium enterprises due to benefits like easier deployment, shorter implementation timelines, better utilization of IT resources, and enhanced flexibility and mobility.

Enterprise Size Insights

In terms of enterprise size, large enterprises accounted for over 59% of the market share in 2022. The demand for robust monitoring solutions and automation capabilities for resource allocation and strategic decision-making fueled growth in this segment. Conversely, the small and medium enterprises segment is projected to grow at the fastest rate of 19.2% over the forecast period. This growth can be attributed to the increasing number of SMEs in developing countries such as Mexico and India, along with their need for internal network architectures for data storage.

The rising adoption of IT infrastructure among SMEs to enable digital services across various business channels is expected to contribute to the growth of this segment. Additionally, government initiatives aimed at promoting digital campaigns for SMEs globally are likely to further stimulate growth.

End-use Insights

In terms of end-use, the manufacturing segment held the largest market share at over 23% in 2022. SCA solutions in manufacturing can enhance performance by providing real-time data access across the value chain and reflecting updates across various processes within the organization. The growing demand for products and the necessity to ensure their availability and timely delivery are driving the need for improved supply chain efficiency. For instance, in April 2023, Snowflake, a data cloud company, launched the Manufacturing Data Cloud, designed for the automotive, technology, and industrial sectors. This platform allows manufacturers to collaborate effectively with suppliers, partners, and customers, ultimately improving supply chain performance and supporting smart manufacturing initiatives.

The Manufacturing Data Cloud equips manufacturers with tools to work collaboratively and securely with their partners, suppliers, and customers, enhancing agility and visibility throughout the value chain. In today's digital industrial landscape, businesses can leverage this platform to strengthen supply chain performance, implement smart manufacturing projects, and establish a solid data foundation for their operations.

As e-commerce continues to expand and businesses strive to provide seamless delivery experiences, efficient supply chain planning has become increasingly critical. The rapid growth of the e-commerce sector, combined with the integration of big data and artificial intelligence into SCA, is anticipated to be a key driver of global demand for effective supply networks, particularly benefitting the retail and consumer goods segments during the forecast period.

Order a free sample PDF of the Supply Chain Analytics Market Intelligence Study, published by Grand View Research.