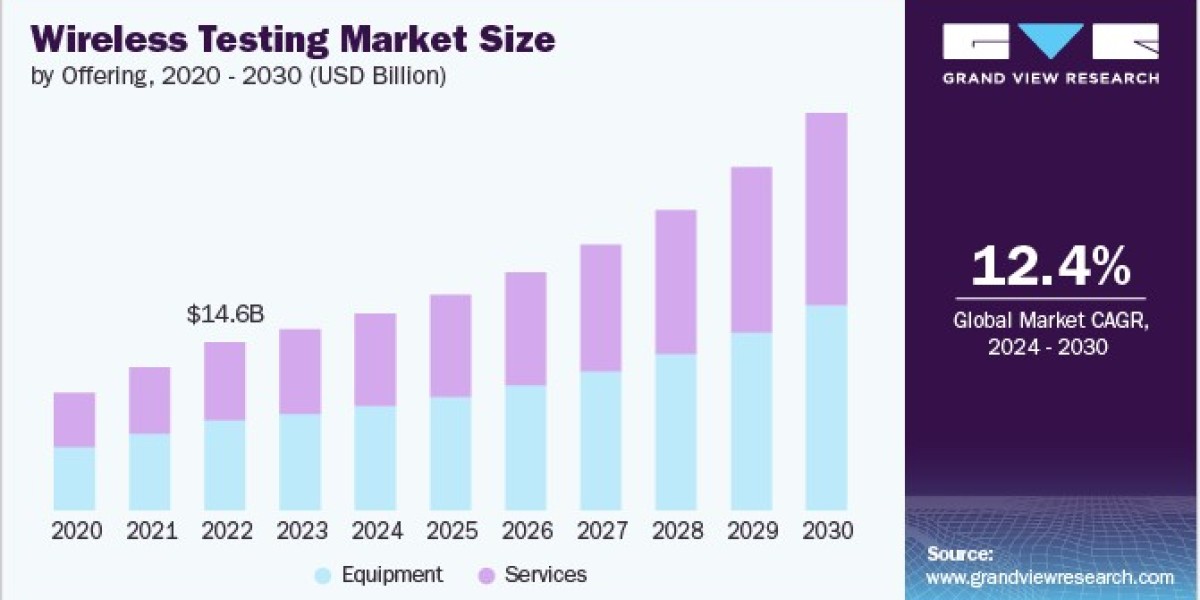

The global wireless testing market size was estimated at USD 14.55 billion in 2023 and is expected to grow at a CAGR of 12.4% from 2024 to 2030. The wireless testing market is experiencing robust growth, driven by a confluence of technological advancements and expanding applications across diverse industries. As wireless connectivity becomes increasingly ubiquitous, the demand for reliable, efficient, and secure wireless systems has surged, necessitating more sophisticated and comprehensive testing solutions.

The rapid proliferation of wireless devices underpins this market expansion, the evolution of wireless standards such as 5G, and the integration of wireless technologies into critical infrastructure and everyday applications. From smartphones and IoT devices to industrial automation and smart city initiatives, the pervasive nature of wireless technology has created a complex ecosystem that requires rigorous testing to ensure functionality, interoperability, and compliance with evolving regulatory standards. As organizations and industries continue to leverage wireless capabilities to drive innovation and improve operational efficiency, the wireless testing market is poised for continued growth, playing a crucial role in maintaining the integrity and performance of our increasingly connected world.

Gather more insights about the market drivers, restrains and growth of the Global Wireless Testing Market

Another major factor contributing to the expansion of the wireless testing market is the increasing complexity of wireless technologies and the growing emphasis on quality and reliability across diverse industries. As wireless systems become more intricate and are integrated into critical applications like autonomous vehicles, healthcare devices, and industrial automation, the need for thorough and accurate testing becomes paramount. This complexity is evident in the rising number of wireless protocols and frequency bands that devices must support. For instance, a modern smartphone typically incorporates multiple wireless technologies such as 5G, Wi-Fi 6, Bluetooth 5.0, NFC, and GPS, each requiring specific testing procedures.

This growth is further fueled by stringent regulatory requirements in sectors such as automotive, aerospace, and telecommunications, which mandate rigorous testing protocols to ensure product safety and performance. For example, in the automotive industry, the implementation of wireless systems for vehicle-to-everything (V2X) communication necessitates compliance with standards like DSRC (Dedicated Short-Range Communications) and C-V2X (Cellular Vehicle-to-Everything). Similarly, in aerospace, the DO-160 standard sets strict requirements for avionics equipment, including wireless systems.

The telecommunications sector faces ongoing challenges with the rollout of 5G networks, requiring extensive testing for spectrum efficiency, network slicing capabilities, and ultra-reliable low-latency communication (URLLC). The increasing adoption of wireless technologies in these high-stakes environments underscores the critical role of wireless testing in maintaining product integrity and public safety. Moreover, the emergence of Industry 4.0 and smart manufacturing concepts has led to a surge in industrial IoT devices, each requiring robust wireless testing to ensure seamless operation in challenging factory environments.

Regional Insights

North America wireless testing market accounted for the largest revenue share in the global wireless testing market in 2023 and is expected to retain its dominance from 2024-2030. The region is at the forefront of wireless technology adoption and innovation, particularly in 5G deployment and IoT integration. This leadership position necessitates advanced testing solutions to ensure the reliability and performance of cutting-edge wireless systems. The presence of major telecommunications companies, technology giants, and wireless device manufacturers in North America drives significant investment in research and development, including testing infrastructure. The region's robust regulatory framework, enforced by bodies like the Federal Communications Commission (FCC), mandates rigorous testing for compliance and certification of wireless devices and systems.

Additionally, North America's strong focus on sectors such as automotive (with the development of connected and autonomous vehicles), aerospace, and defense contributes to the high demand for sophisticated wireless testing solutions. The region's advanced industrial sector, embracing Industry 4.0 concepts, further fuels the need for comprehensive wireless testing in manufacturing and automation applications. Moreover, the high consumer adoption rate of smart devices and home automation systems in North America creates a substantial market for consumer electronics testing.

Key Wireless Testing Company Insights

Some of the key companies operating in the market include Deere & Company, and GGS Group., among others.

- Bureau Veritas offers inspection, laboratory testing, and certification services. The company offers independent inspection services to verify the conformity, integrity, and safety of assets, equipment, and facilities, serving industries such as oil & gas, power generation, construction, transportation, and mining. Bureau Veritas also conducts thorough tests to evaluate product quality, safety, and compliance across diverse sectors, such as consumer goods, industrial equipment, materials, and electrical and electronic devices.

EXFO Inc.and Intertek Group plc are some of the emerging market companies in the target market.

- The Intertek Group plc delivers innovative and customized assurance, testing, inspection, and certification services to its valued customers. It helps its customers mitigate risks, optimize performance, and enhance overall operational efficiency through cutting-edge technologies and in-depth industry knowledge. The company’s service offerings cover various areas, including product testing, safety certifications, quality inspections, supply chain audits, sustainability assessments, regulatory compliance evaluations, and tailored solutions designed to meet specific industry requirements.

Key Wireless Testing Companies:

The following are the leading companies in the wireless testing market. These companies collectively hold the largest market share and dictate industry trends.

- GGS Group

- Bureau Veritas

- Intertek Group PLC

- DEKRA com

- Anritsun

- Alifecom Technology

- Keysight Technologies

- Rohde & Schwarz

- Viavi Solutions Inc

- TUV Nord Group

- EXFO Inc.

- Applus+

Order a free sample PDF of the Wireless Testing Market Intelligence Study, published by Grand View Research.