The global infection control market was valued at USD 214.0 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. This growth is primarily driven by the rising number of surgical and clinical procedures that necessitate stringent infection prevention measures. The increasing preference for infection control solutions is largely attributed to the favorable clinical outcomes associated with their use. Additionally, the COVID-19 pandemic has positively influenced market growth, as the demand for sterilization and disinfection has surged in hospitals, clinics, and among pharmaceutical and medical device companies.

During the pandemic, the production of sanitizer products saw a remarkable 60% increase in the U.S. alone, highlighting the substantial growth potential for infection control products in the future. Furthermore, the trend of outsourcing sterilization services and the introduction of advanced sterilization solutions are contributing to the market's expansion. A significant driver of growth is the increasing number of government initiatives aimed at ensuring robust infection prevention measures. Governments worldwide are increasingly involved in issuing guidelines to promote awareness and effective prevention strategies, which is expected to support market growth throughout the forecast period. For instance, the World Health Organization (WHO) has provided guidelines to prevent and control pandemic- and epidemic-prone acute respiratory diseases in healthcare settings, covering essential practices such as hand hygiene, the use of personal protective equipment (PPE), and disinfection and sterilization protocols.

Gather more insights about the market drivers, restrains and growth of the Infection Control Market

Type Insights

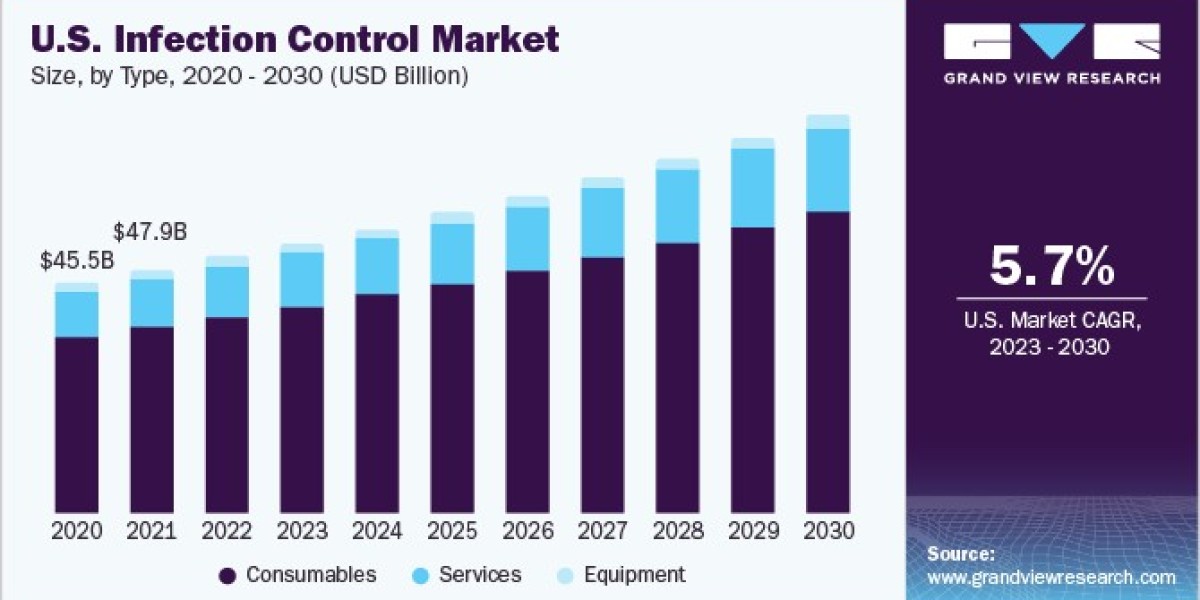

The global infection control market is segmented into three main categories: equipment, services, and consumables. In 2022, the consumables segment dominated the market, capturing the largest revenue share. This dominant position is largely due to the frequent use and short life cycle of consumable products, which are integral to disinfection, sterilization, and other infection control procedures. Consumables include items such as personal protective equipment (PPE), which held a significant share of the market as of 2022.

The equipment segment is further divided into disinfectors and sterilization equipment. Disinfectors are classified into washers, flushes, and endoscope reprocessors. The sterilization equipment category includes heat sterilization equipment, low-temperature sterilization equipment, radiation sterilization equipment, filtration sterilization equipment, and liquid sterilization equipment. Additionally, the consumables segment encompasses infectious waste disposal, disinfectants, sterilization consumables, and PPE, among others.

Various healthcare organizations are actively promoting awareness about the benefits of personal protective equipment, which is anticipated to contribute significantly to the market's growth. For example, W&H Company is enhancing its hygiene portfolio by introducing the LEXA PLUS CLASS B sterilizer, a technologically advanced device designed to streamline reprocessing and enhance infection prevention in dental practices.

Among the different segments, the services category is expected to experience the fastest CAGR during the forecast period. This rapid growth can be attributed to the increasing inclination of market players to reduce overall healthcare costs while capitalizing on the advantages that come with outsourcing. These advantages include cost savings, enhanced service efficiency, improved productivity, and a heightened focus on core developmental areas that are critical to a company's profitability and growth. Organizations also aim to promote the adoption of infection control services by issuing guidelines and recommendations regarding selection, risk assessment, rational usage, and disposal, all aimed at reducing the risk of transmitting respiratory pathogens within healthcare facilities. The services segment includes contract sterilization and infectious waste disposal, with the contract sterilization category further divided into methods such as ethylene oxide sterilization, e-beam sterilization, gamma sterilization, and other techniques.

Overall, the infection control market is positioned for substantial growth, driven by a combination of increasing healthcare needs, government initiatives, and advancements in technology and services.

Order a free sample PDF of the Infection Control Market Intelligence Study, published by Grand View Research.