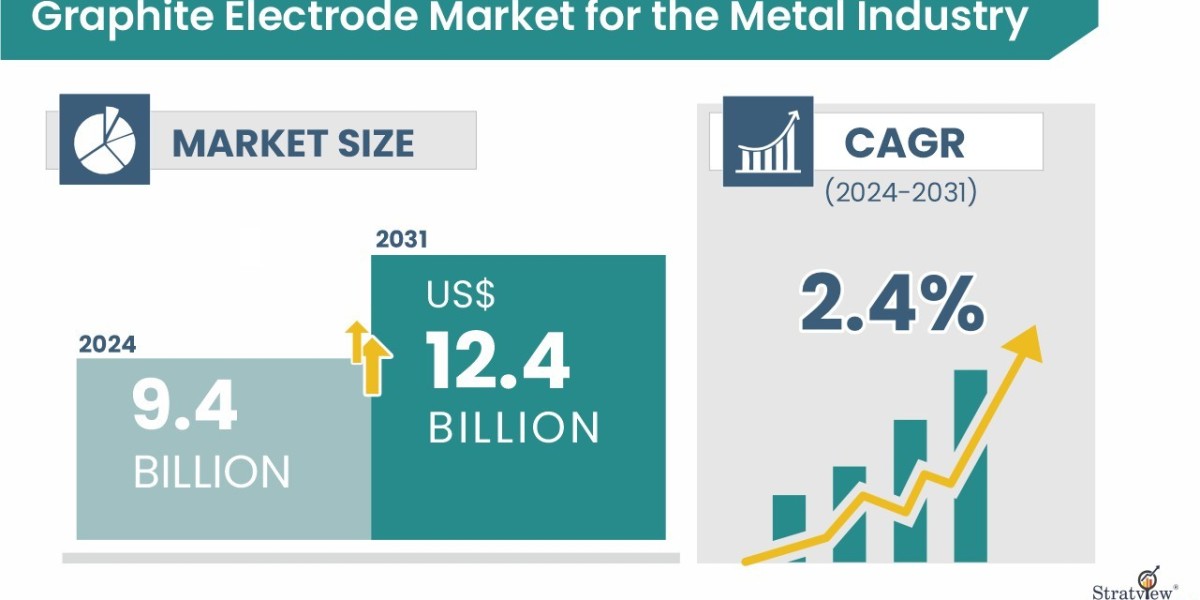

Graphite electrodes are indispensable in the metal industry, particularly in electric arc furnaces (EAFs) used for steel production. With the global push toward recycling and energy-efficient steelmaking, EAF capacity is expanding rapidly, driving demand for graphite electrodes. Beyond steel, they are also critical in producing ferroalloys, aluminum, and other non-ferrous metals. Stratview Research projects that the graphite electrode market for the metal industry was USD 9.4 billion in 2024 and is likely to grow at a CAGR of 2.4% during 2024-2031 to reach USD 12.4 billion in 2031, powered by electrification, recycling, and regional capacity expansion.

Download the sample report here:

Market Drivers

- EAF steelmaking growth: As scrap recycling and green steel initiatives expand, EAF-based steel production is rising, which directly drives graphite electrode demand.

- Industrialization in emerging markets: Growth in infrastructure and automotive industries in Asia-Pacific, the Middle East, and Latin America supports electrode consumption.

- Energy efficiency and sustainability: EAF technology is more environmentally friendly compared to blast furnaces, aligning with global decarbonization goals.

- Ferroalloy and aluminum production: Graphite electrodes are essential in smelting processes, further broadening market scope.

- Supply-demand dynamics: The limited availability of needle coke, a critical raw material, impacts prices but underscores the strategic importance of electrodes.

Trends

- Shift toward ultra-high power (UHP) electrodes: UHP grades are in increasing demand due to their ability to withstand high currents and temperatures in modern furnaces.

- Regional expansion of EAF capacity: China, India, and the U.S. are adding new EAF plants to meet sustainable steel production goals.

- Raw material challenges: Needle coke supply fluctuations create pricing volatility, pushing companies to explore synthetic alternatives.

- Circular economy: Recycling of spent electrodes and optimization of electrode consumption rates are emerging strategies.

- Strategic partnerships: Electrode manufacturers are entering long-term contracts with steelmakers to secure supply chains.

Conclusion

The graphite electrode market for the metal industry is set for steady growth through 2030, propelled by green steel production, infrastructure demand, and non-ferrous applications. Companies that innovate in UHP electrodes, recycling, and sustainable sourcing will remain competitive in this evolving market.