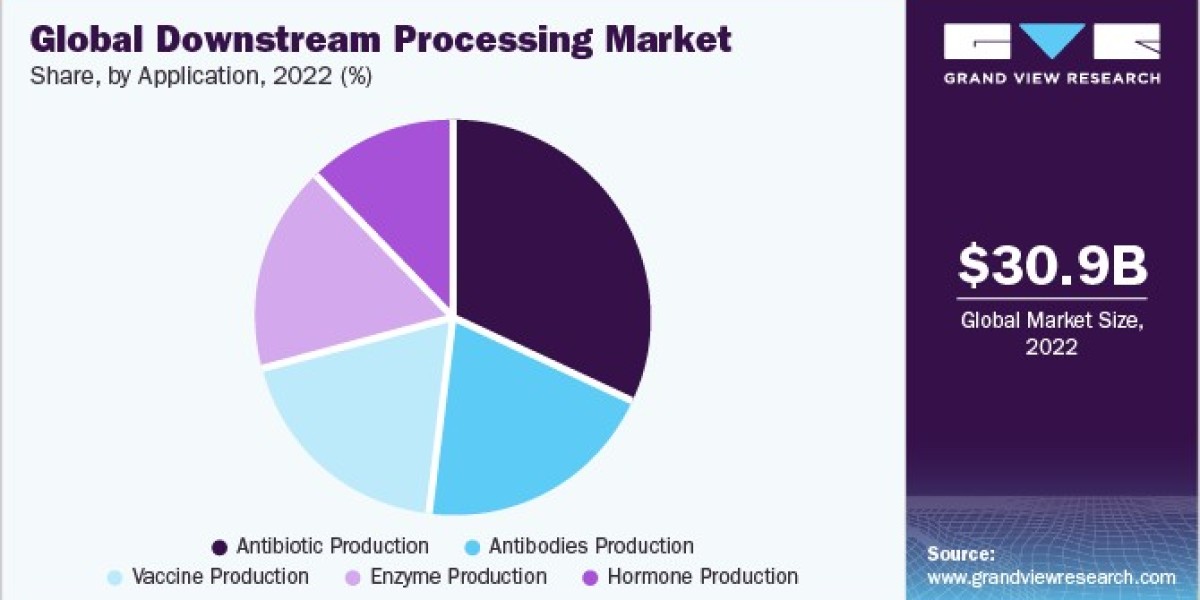

The global market for downstream processing, which involves the purification and isolation of biological products, was valued at approximately $30.96 billion in 2022. This market is projected to experience substantial growth, expanding at a compound annual growth rate of 14.84% from 2023 to 2030. A primary driver of this market expansion is the increased utilization of downstream processing techniques in the development of COVID-19 vaccines.

One notable development in the industry is the collaboration between Rentschler Biopharma and Vetter, formalized in March 2022 through the launch of Xpert Alliance. This partnership aims to enhance their joint efforts in providing effective solutions to customers' evolving needs in the challenging field of biopharmaceuticals. The visualization associated with this collaboration serves to emphasize its ongoing cooperation and successful track record in meeting customer demands.

Additionally, in April 2022, Bayer announced its intention to collaborate with Ginkgo Bioworks. The proposed agreement involves Ginkgo Bioworks acquiring Bayer's West Sacramento Biologics R&D facility and its internal discovery and lead optimization platform. This strategic move is expected to strengthen Bayer's leadership in biologics, provide access to crucial synthetic biology technologies, and maintain its position as a preferred partner for biologics research, development, and commercialization.

Gather more insights about the market drivers, restrains and growth of the Downstream Processing Market

Product Segmentation Insights

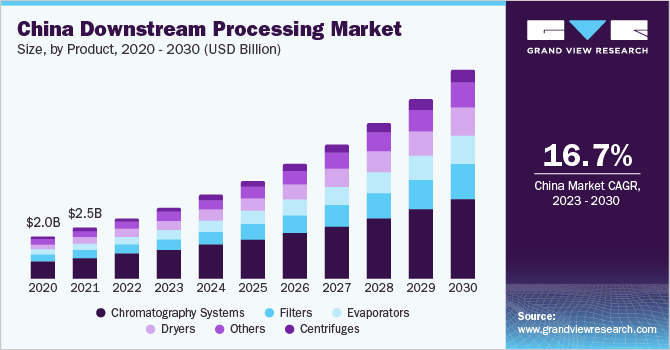

The chromatography systems segment, which is primarily used for separating and purifying biological molecules, was the dominant force in the downstream processing market, accounting for a substantial 41.29% of the total revenue in 2022. This segment's continued growth is driven by ongoing research and development efforts focused on enhancing its efficiency and speed. A notable example of this progress is the launch of the HyPeak chromatography system by Thermo Fisher Scientific in April 2021. This innovative system, designed specifically for bioprocessing, offers significant benefits in the development of therapeutic proteins and vaccines.

Moreover, the increasing number of deals and developments within the chromatography systems segment is further contributing to its growth. For instance, Sartorius Stedim Biotech acquired the chromatography equipment business from Novasep in January 2021. This acquisition is expected to enable Sartorius to develop novel chromatography systems that address efficiency issues and bottlenecks commonly encountered in downstream processing.

On the other hand, the filters segment is projected to experience the fastest growth rate, with a CAGR of 16.10% from 2023 to 2030. The rising utility of filters in viral inactivation is a primary driver behind this market expansion. A study conducted by researchers from Pennsylvania State University in September 2020 highlighted the effectiveness of BioEX hollow fiber and Planova 20N virus filters in removing viral-sized particles. Such research findings are expected to boost the adoption of filters in the downstream processing of biologics.

Order a free sample PDF of the Downstream Processing Market Intelligence Study, published by Grand View Research.